I have officially made it to vacation! I’m typing this with an unobstructed view of the pacific ocean beyond my screen. I was finally able to take my foot off the gas in early October, right before my birthday. We started to prepare for a “soft landing” on our final “descent” into vacation by going out to Lake Meade the second week in October. It was glorious! We turned off our phones for three days. This was the first time in 15 years of going out to the lake that I didn’t bring a stack of books out to the lake with me.

I told my wife and her parents that I planned to just relax…like, really relax, in a way I haven’t done since I was in college. I ended up sleeping 12 hours a day between my nightly slumber and mid-day siestas. It was the perfect mid-month break before the much larger finish line waiting for the entire GYFG household at the end of October.

Upon returning from the lake, I blocked off the rest of my calendar in order to avoid a hectic schedule through the end of the month. I didn’t allow for any appointments beyond what I had already committed to. This allowed me the breathing room I needed to start the decompression process and to finish up all remaining loose ends for both my business and personal life.

During the last two months of October, I did have the pleasure of reading Morgan Housel’s new book, The Psychology of Money, and boy was it good. It is officially in my top five all-time favorite books (I highly recommend you buy and read this book).

Let’s dive into the details of this month’s financial report!

Financial Dashboard

Note: The income figure you see in the chart above for 2020 is our current projection for the calendar year, which is different than our TTM income figure that clocked in at $1.354M this month (down from $1.384M last month).

Net Worth:

Current Net Worth: $2,312,319 (up $641,998 or +38.4% for 2020)

Previous month: $2,208,859

Difference: +$103,459

Note: I’m still not holding a value for my business in my net worth. Depending on the multiple you use, that could add anywhere from $350,000 (1X) to $1,800,000 (5X) based on 70% ownership I’ve retained.

Net Worth Break Down:

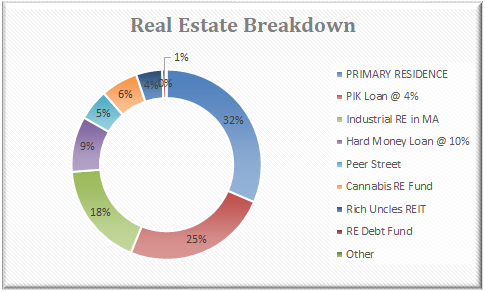

Real Estate (60%) – This category includes the equity in our primary residence, a hard money loan at a 10% interest rate, our investment in the Rich Uncles commercial REIT, and our hard money loans through the PeerStreet platform. This also includes a 4% PIK loan that will be converted to an equity position in 2022. We have officially reduced our concentration here by completing a cash-out refinance on our primary residence. In the charts below, you can see that our primary residence no longer makes up the largest chunk of the overall real estate allocation. More notably, our primary residence only makes up 13% of total net worth (down from 23% in September). I expect the concentration to continue its downward trend until we move into our new house in October of 2021.

Current Month

Net Cash (30%) – We are now sitting on almost $700,000 in cash after completing the $300,000 cash-out refinance. However, we have already identified approximately $235,000 that will be deployed between now and the end of the year.

– $100,000 will be added to our Industrial Real Estate investment in MA (no debt used and cash on cash returns at 25%+). This will allow us to defer taxes on an additional $100,000 in capital gains. Due to the pandemic the normal six-month window to re-deploy capital gains into an opportunity zone to defer taxes (which was up in August for us) was extended until December 31st of 2020.

– $50,000 will be invested in an 80 unit apartment complex in Chicago with a target cash on cash return of 10%. The property has done very well through the pandemic and has had a very minimal increase in delinquencies.

– $55,000 for a complete replacement of the HVAC system in our future house. This project will have be completed by the time this post goes live.

– $30,000 for the install of solar on our future house.

Note: Regarding the $55,000 for the HVAC and $30,000 for the solar system, I will be carrying those as an asset in our net worth calculation – in the form of equity we are building in our future home. We agreed on a price to purchase the property back in March and we believe that that price is now very conservative based on what the real estate market has done during The Great Lockdown.

Alternatives (7%) – This is a new catch-all category that captures our investments in the following: life settlements, a special purpose acquisition company (SPAC), and a private investment in the Robinhood trading platform.

Stocks (3%) – In September I opened up an account with Betterment and have set up a $500 $1,000 weekly investment (increased weekly amount as of November 1st). What I love about this robo-advisor is not only the very low management fee but also the automated tax-loss harvesting. I’ve been reading about other bloggers building up substantial “losses” that accumulate over time, all while avoiding the “wash sale” rule. I think this will be very handy in the years to come as a way to start accumulating a tax shield for realizing future gains all while not losing any exposure to the market. I encourage you all to take a look at the white paper on tax-loss harvesting that Betterment published to learn more.

Total Projected Income in 2020: We are currently on pace to earn $1,307,629. Keep in mind that ~$415,000 of that is from a realized gain from selling the stock I owned in my previous employer. My big goal right now as it has been in previous years is to create enough momentum that we can not only match this income level but surpass it in 2021 (not an easy task with a big $415,000 hole to fill – not to mention the fact that Mrs. GYFG is on track for her highest-earning year ever and plans to stop working sometime in the next 12-15 months depending on how long it takes us to get pregnant and deliver our second child).

Total Capital Deployed in 2020:

This month we only deployed $2,000 and it went into stocks via Betterment. As I mentioned above, the last two months of the year will see a sizable increase and finish the year strong for the most capital we have ever deployed in a single year – seems like I say this every year. We will be receiving $75,000 of our $150,000 hard money loan in the month of November, so that will offset the amounts I outlined above when I discussed where we had already earmarked $235,000 of our total cash position.

Net Worth Conversion Ratio

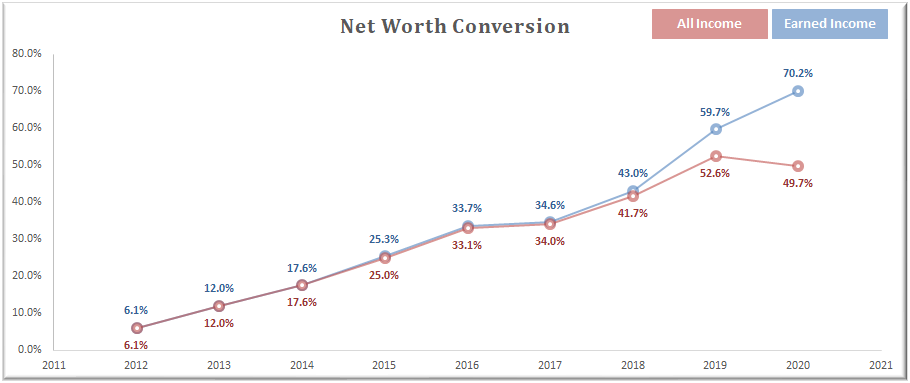

Definition: The Net Worth Conversion Ratio measures an earner’s ability to convert earned income into wealth (net worth). It excludes passive income since passive income is dependent on the earner’s decision of putting earned income to work or spending on consumption.

This is a new metric I will be updating and sharing monthly. Now that “the machine” is in full production, it is time to not only bring back the net worth conversion metric but to make it a star of the show. I once wrote that financial nirvana is reached once this metric exceeds 100%. When I first calculated this back in early 2016 the GYFG ratio clocked in at 25.3%. Since then we have significantly increased our savings rate and the gravitational pull of increasing both our savings rate and income helped us significantly improve the performance of this metric, which now clocks in at 71.6% (up from 70.2% last month).

You will notice that I have shared the metric based on ‘earned income’ and ‘all income’ but I’m most interested in the earned income calculation (per the definition above).

Last Month

This Month

The goal the past five years since adopting this metric was to focus on increasing our earned income while simultaneously saving at least 50% of our after-tax income in order to create excess capital for investing. I should note that I’ve excluded from the earned income calculation any income that’s derived passively from investments and more recently profit distributions from my business (I do include the W-2 income I earn as an employee of the business).

The end goal is to get to a point where net worth is 100% or greater than earned income – bonus points if you can accomplish the same thing based on all income sources. I expect our net worth conversion (blue line) to finish the year somewhere between 70% and 75%.

Business Spotlight – Cashflow is King

This month I want to focus on cash flow, which is the lifeblood of any healthy company. According to Fortunly, 20% of businesses fail in their first year and it states that the major reason was due to cash flow issues even if they were highly profitable. The problem is that if you can’t turn your sales into cash fast enough and you don’t have any other forms of liquidity it’s an “e-ticket” to the graveyard. And according to this article on Freshbooks, most businesses are not profitable their first year, typically taking 18-24 months to reach profitability.

I don’t have the statistics, but I’m still willing to bet that we are in the top 1% in terms of performance for a start-up business. We have not only been profitable since day one, but we have also had more than ample cash flow to self-fund our growth (as seen in the charts below). Even more amazing is that we are on track to quadruple vs. last year ($1.6M vs. $428K in Revenue and $600K vs. $220K in Profits). Cash flow has been so good that to date we have been able to pay out profit distributions on a 30-day lag, meaning we have not been retaining earnings to fund working capital to grow the business.

The magic that makes all this work is that we pre-collect all revenue upfront before starting a project. That, paired with the almost 100% variable expense model that I have chosen for the business, makes us extremely nimble.

In the above chart, you can see the side by side comparison between money in vs. money out over the last twelve months. November has just barely begun but if you look at the other 11 months, we received more cash in that we had flowed out. To further visualize what this looks like, I’ve provided a complimentary view below that shows you the building of our cash balance over the last twelve months.

If you ever plan to start a business, don’t underestimate the importance of cash flow. When I first started this business, I had taken out a $420,000 line of credit because my original model had the business cash flow negative for the first 13 months, but that was before I learned that the industry standard was pre-collection.

Cash flow is king! (Just as true in business as it is in your personal life!)

Closing Thoughts

Last month I ended with the following closing thoughts:

I feel like I’m on the last leg of an ultra-marathon and the finish line (vacation + beach house) is so close I can finally see it up ahead. I’m looking forward to no email, no phone, really no communication on anything work/business-related for the first full week of November. Mrs. GYFG is looking forward to the same. It will take us a couple of days to really relax and come down from the grind.

Fortitudine Vincimus — “by endurance we conquer.”

I can’t express in words how amazing it feels to be on the other side of the self-imposed finish line. I can say with certainty that I grew more in the last ten months than I did in the last five years. It’s the first time in my life that I pushed past a limit that had me questioning whether I could pull through and finish what I started. I’ve always believed that magic happens outside of the comfort zone, and although I had made a regular habit of living outside of my own comfort zone, I had never traveled so far from it. I realize that some of this was driven by fatigue and going far too long without a proper break to breathe and reflect.

That said, I’m now recharging my vitality and preparing for the next “race.” The only difference is that when I “get back in the race,” I will be strategically braking at each water stop, which in my analogy means more frequent vacations to unplug. At a minimum, I need to unplug completely one week every six months, but ideally, it will be one week every quarter. This week – and this view – reminds me of my need for the recharge.

Cheers!

– Gen Y Finance Guy

2 Responses

Enjoy the recharging time, Dom! Love seeing the family pics.

If your wife stops working to take care of a second child, will she go back at some point? Or, is there someone who would take over the business?

Congrats on the latest NW update… you’re one month from overtaking me (not counting your biz… in which case you did that a long time ago… haha).

Hey Michael,

The past 8 days have been amazing! Today my wife and I start our modified schedules working from the beach and will take the last week of the month off again – we are in the beach house until 12/1.

My wife doesn’t intend to stop working to become a full-time parent…at least not indefinitely. This is going to give her the space she needs/wants to figure out what she wants to do. She thought she wanted to take over the family business but after seven years that is no longer the case. They tried selling the business but couldn’t get what they thought it was worth, so they decided they will keep the doors open until March of 2022 when the office lease is up. At that time they plan to close the doors as her mom retires. There is a chance that one of the employees may want to take it over…but that is TBD.

Yes, our net worth has been doing well, but I suspect it to slow down into the end of the year.

Dom