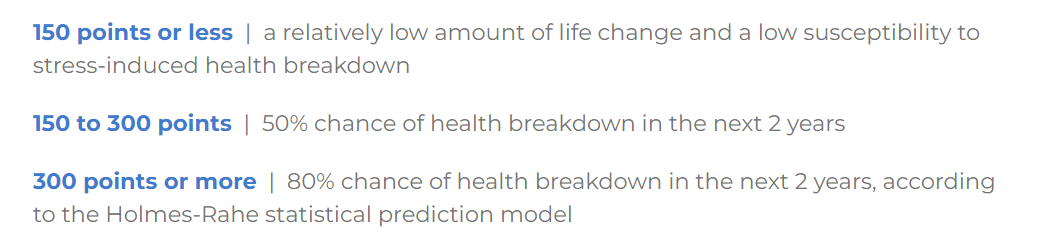

A reader (JayCeezy) left a comment last month and recommended I check out the Rahe Stress Test. After getting through the emotional rollercoaster that February was, I decided to do that before sitting down to write this month’s post. The test presents an inventory of 43 major life events with an associated point value for each item on the list. To take the assessment you go through and mark each item that has happened to you in the last twelve months and then add up all the points for the applicable events. You then take that score and compare it to three major buckets:

I’d be lying if I said that the last year (really two years) haven’t been the most stressful and overwhelming years I can recall. For two years up until February I have for sure been riding the middle zone of 150-300 points. Prior to that, I feel confident in saying that I was in the safe zone under 150 points based on the above. I’m acutely aware of the situation and this just confirms the feelings I’ve been dealing with for some time. But I blew out of that middle zone into the 300+ zone in February.

What was the kicker that propelled me into the full-on red zone? My mother-in-law was diagnosed with cancer early in February. Before the month was up the official diagnosis was Stage 4 liver cancer (worth 44 points on the assessment).

I’m confident that Mrs. GYFG and I will make it through this difficult time and will continue to try and make space in our own busy lives to stay healthy. For example, we had our ninth wedding anniversary in February, and even though there was a lot going on, we got away to a bed & breakfast for a weekend of good food (wine for me), massages, and lots of rest. We also have a trip planned to the mountains in March, so that will give us another opportunity to stop and take a breath. We have a lot of good things going on but even good things cause stress (check out the test and you will see what I mean). We just need to be conscious and strategic in working ourselves back down to a more healthy stress zone – ideally under 150 points. In the short term, we probably have a rough 6-12 months ahead. I’m all ears if anyone has any tips for us to keep in mind over the challenging road ahead.

That said, I continue to remind myself (and Mrs. GYFG) that it’s one foot in front of the other, and one day at a time.

The good news is that writing these monthly posts brings a lot of calm for me personally – I take solace in knowing that we have built a solid financial foundation to deal with life’s curveballs. I remain optimistic (even when darkness clouds my vision occasionally)!

With that, let’s dive into the details of this month’s update.

Financial Dashboard

I remember when I first created this financial dashboard back in 2015 and how that first update I shared had us at less than 2% of the way to our $10M goal. Here we are, six years later, at 26.4% of the way there. The most astonishing thing to me is the compound annual growth rate (CAGR) we have been able to maintain since 2012. Our income has grown at a robust 25.2% CAGR. Even more mind-blowing is that our net worth has been compounding at a 65.8% CAGR during that same time period.

Note: My current projection for GYFG household income in 2021 is less than 2020, but it has come up from last month’s projection of $1,175,441 (currently projected at $1,181,796). My goal is to surpass our 2020 income. I have set a personal goal to earn seven figures from my business through my W-2 earnings and profit distributions. When I reach this goal I will reward myself with the funds for an electric car – maybe a Tesla or maybe the new GM electric Hummer.

TTM Gross Income

The income figure I like to track most is our Trailing Twelve Month (TTM) gross income. We fell off the cliff as the $415,000 in February of 2020 fell out of the TTM range. The current TTM reading is $1,058,086 (down from $1,456,178 in January) and honestly, I don’t see a path to a new all-time-high in 2021(yet!).

Net Worth

Current Net Worth: $2,637,353 (up $257,912 or +10.8% for 2021)

Previous month: $2,614,367

Difference: +$22,986

Our net worth increase in January was a little overstated which led to this month’s increase being a bit less than it would have otherwise been. This was due to the Real Estate Holding Company I was in the middle of creating with my brother – more details below.

Note: I’m still not holding a value for my business in my net worth. Depending on the multiple you use, the value of my business is somewhere in the range of $700,000 (1X) to $3,500,000 (5X). I’m hesitant to hold a value in my net worth for this until we achieve a liquidity event.

Net Worth Break Down:

Real Estate (52%) – This is a mixture of private placement deals, equity, debt, and crowdfunding.

Primary Residence (12%) – I decided to split this out on its own because it is something I do want to manage separately from our overall holdings in Real Estate. Our primary residence currently makes up 12% of our total net worth (down from 23% in September 2020) due to a cash-out refinance (locking in 2.8675% for 30 years) that put a mortgage back on the property. I expect the concentration to continue its downward trend until we move into our new house in October of 2021.

Net Cash (17%) – We currently have $461,000 in cash vs. $571,000 last month.

Alternatives (12%) – This is a catch-all category that captures our investments in the following: life settlements, a special purpose acquisition company (SPAC), a private investment in the Robinhood trading platform, and the newest addition of Bitcoin (separate section on this below).

Stocks (7%) – We have turned off our weekly investments to Betterment and are currently working to have our 401K accounts maxed out by the end of March.

Total Capital Deployed in 2020:

It looks like I’m going to have to check myself into some deal junkie anonymous program soon. As you can see in the above, I ended up deploying almost $175,000 in the month of February. Some of you may think that I truly lost my mind with a big six-figure allocation to Bitcoin…and only time will tell if that is true or not.

In March the only investment planned is to make the final contributions to max our 401K accounts, which is looking like an additional $11,440 between Mrs. GYFG and me.

The Investments Made in February

- $25,000 into a Commercial Real Estate deal in Silicon Valley. The office building currently has ten years left on a triple net lease with a tech company that has been doing very well both before and during the pandemic. It has a current 10% cash on cash return.

- $50,000 into a consumer goods company that has been growing triple digits. There is no cashflow on this deal but it did come with very attractive terms in the form of a convertible note with a substantial discount on the conversion to equity.

- $100,000 into Bitcoin – I’ll go into detail in the next section. I did re-allocate some funds from Betterment ($22,387) to Bitcoin since we had so much in new contributions into our 401K accounts and the re-deployment of cash sitting in our self-directed IRA.

- $6,300 in SPY Short Puts. I was rolling my position out in time. I’m still very nervous about the market and want disaster protection I’m willing to lose money for years to gain peace of mind. The puts did get more expensive on the roll as you can see when you net the liquidations to this move.

- $58,030 into stocks. This includes our 401K contributions and $37,400 in cash that was sitting in our self-directed IRA as hard money loans have matured on the PeerStreet platform.

Adventures in Bitcoin

This investment was a big surprise to me after ignoring it for years. To be honest there was certainly a bit of FOMO involved getting me over the initial hump and comfortable with investing in Bitcoin…let alone a six-figure sum. The reality is that although I had been aware of Bitcoin, I had never done any real homework.

Then the Pandemic broke out and the central banks and governments around the world decided they would go to any length to save the world economy from going into a global depression. We are talking trillions of dollars created out of thin air (and trillions more in other currencies around the world). Yes, we have been debasing our currency for decades, but this is at a whole new level.

I’ve talked about my inflation concerns in previous updates. One of the reasons I decided to put a mortgage back on our paid-off house was to create a synthetic short USD position. As inflation goes up, debt becomes cheaper. I still don’t like debt but it was/is one of the best options I could see. Additionally, I have been deploying significant amounts of capital into hard assets (i.e., Real Estate). But the thing I’ve been struggling with lately is how to protect the purchasing power of the large cash reserve that we hold.

Then I witnessed a tipping point in Bitcoin when Michael Sailor (CEO of MicroStrategy), Jack Dorsey (CEO of Square), and Elon Musk announced massive allocations of their cash balance to Bitcoin. This was the push that caused me to go deep down the Bitcoin rabbit hole. I consumed a 15-part podcast series, read the original white paper published by Satoshi Nakomoto, started consuming blogs, and I’m currently reading several books I ordered from Amazon. I am a believer that Bitcoin could really become a permanent part of our global money eco-system. I’ve also learned a lot of interesting things that people far smarter than me are doing to enhance the original blockchain technology with what I consider to be on and off ramps to and from this genius de-centralized eco-system. (here is a one-page summary of what Bitcoin is if anyone is interested)

The dilemma I now faced was that Bitcoin was currently at all-time-highs (topping out at $58,000 in February) and that was not the entry point I was looking for. And as a store of value – really what Bitcoin is supposed to be at this point – I don’t love the volatility that comes with it. That said, with the big money coming into this space I suspect volatility will decrease with time. I was determined to find a way to gain exposure to Bitcoin but in a way that would allow me to take advantage of the crazy volatility and that is when I found the LedgerX platform. This is a fully regulated platform that allows you to buy and sell Bitcoin, Bitcoin futures, and Bitcoin options. Bingo!

The premiums are rich due to the high level of volatility and the volume is decent enough for the size I was interested in with a $100,000 allocation. The commissions are very reasonable vs. what I’ve seen on other platforms (highway robbery in some cases). So, I was able to combine a covered call strategy with a short put strategy to gain exposure to Bitcoin for an effective price after premiums collected from selling options of $31,844 with upside between $75,000 to $100,000.

As I continue learning I may be willing to continue increasing my allocation here up to 5% of net worth. My current allocation is right around 3.7%.

Is anyone else gaining exposure to Bitcoin?

Real Estate Holding Company

I’ve been working with my attorney for the last two months to create a real estate holding company – an LLC created just to hold investments. My brother had expressed interest in wanting to invest together and the best way I thought we could do that is for him to jump in on the investments I’ve recently made. I offered him the opportunity to gain exposure to my current investments by contributing capital to the new LLC and that he would then get a pro-rata share ownership stake.

Between my investment contributions (at cost) and my brother’s capital contribution, we ended up with about $700,000 in value transferred into the LLC. My brother now owns 10.55% of the LLC and the associated cash flow. I’m stoked to be able to help my brother get exposure to deals that he would have otherwise never been exposed to. It’s also great to see him so interested in investing and setting up his future.

Closing Thoughts

I’m typing these closing thoughts about four days into my company’s winter retreat. It’s been a nice distraction from the chaos currently present in our lives. I’m grateful for the great friends that we have in our lives. The fact that I get to build a company with them is just icing on the cake. For the past four days, we have had ten adults, five kids under three, and two dogs. We’ve enjoyed a lot of good food paired with an abundance of laughter (and wine, of course). It’s going to be fun to watch the kids grow up as we continue these celebrations over the years.

Today everyone but the GYFG’s will be heading home after breakfast, allowing me and my family to have a couple of extra days to spend with each other before we go back to the chaos of our current season in life. Our focus over the coming months will be preparing for baby number two, moving into our new house, and doing everything we can to help my in-laws along a rough road ahead. Yes, we are accelerating our move-in date to spend more time with our in-laws and be a part of the support system that will help my mother-in-law through the treatment plan ahead.

A stage-four cancer diagnosis is a difficult pill to swallow and the internet is filled with deep dark holes filled with very scary statistics. This is not something anyone planned for nor is it something any of us have control over. All we can do is remain cautiously optimistic and supportive while the doctors provide the recommended treatment.

This is a big fat reminder that sometimes life is random and that none of us are guaranteed a tomorrow. It is events like these that remind us of our own mortality. It’s a wake-up call to us all to not take life or the time we have on this planet for granted and to love, live, and laugh as often and deeply as possible.

– Gen Y Finance Guy

9 Responses

Please contact me

Cherif Medawar

408-858-5748

More power to you on the Bitcoin allocation. I really feel like Bitcoin at this point is a real alternative, and should be looked at as such. I had the same realization as you but I was trying to time the market and wait for it to dip back down into the 20s. Eventually I just started to dollar cost average every week, but the far I’ve only been confident enough to increase .5% of my net worth.

Accidentally Retired,

Where are you buying your bitcoin as a part of your weekly DCA?

GYFG, am keeping good thoughts for your MIL and the family. You all sound like great people to have in your lives, and I admire all of your commitment. Hope Mrs. GYFG is feeling good, and your accelerated move goes smoothly. Am curious about any further insight you may gain from the Holmes & Rahe Stress Test, my own gains on stress-management came through the following year after taking it. My big takeaways were breathing (“Wim Hof, call your agent!”) and sleep, and stop listening to thrash and rap; big drop in blood pressure.

Also, appreciate your delving into Bitcoin and sharing the experience with us. I have been curious for years, experienced the questions and doubts you describe, and thank you for a path forward. For me, the “risk-compression” for continued ZIRP and the intentional destruction of the dollar as a store-of-wealth, is pushing me into the pool. Will be following this in your portfolio.

Some seasons back you turned me onto James Altucher, whom I really enjoy and appreciate. He also has a new book, “Skip The Line.” Wanted to note that James has an 8-part tv series on Amazon Prime, “Choose Yourself: The James Altucher Story” which brings him current into today with the virus and his pursuit of stand up comedy. Stand up comedy is a big interest of mine for many decades, and James’ is part-owner of ‘Stand Up NY’ and my takeaway was this excellent ‘grooming’ of a receptive audience (they have to be taught and reminded) that will enhance every show experience:

Please turn off your cell phones and put them away

Please refrain from any table talk during the show

Please note that any recording of the comedians, calling out, or heckling can result in your removal from the showroom

Both well worth my time, as was your prior recommendation; thanks again! Continued success to you!

Hey JayCeezy,

First, thank you very much for recommending the stress test. For me, the insights are that I have to be very intentional during this period of my life to take time to decompress, eat healthy, and exercise (I need all the free endorphins I can get). Breathing is a big one I’ve been working on during my morning walks with the dogs. The timing of the transition on the work front couldn’t have come at a better time.

I just started the James Altucher series last night after reading your comment. I’m a couple of episodes in and he has already lost all his money 3 times – LOL!

Dom

“… he has already lost all his money 3 times – LOL!

This is part of his audience ‘grooming’; once you see it, you can’t unsee it!:-)

Congratulations Dom on your foray into crypto. Selling our California home and relocating out of state has turned into one of our best financial decisions. After setting aside cash for the down payment on our next home, we placed a large allocation of the remaining proceeds into crypto assets late December/ early January and since then our portfolio has grown to a 2X market value. In addition to bitcoin, take a look into Cardano and Etherium (especially Cardano ADA for long term). The latter two could be better plays in the intermediate to long term as their utility with smart contracts and staking become more apparent and developed. I’m not an expert by any means but one podcast I listen to and recommend is Digital Asset News – it is probably the most grounded and low hype crypto podcast I have come across.

Sorry about your mother in law. That’s a rough one and I wish her the best possible outcome.

Hey Rick – I’m so glad that things have worked out so well for you guys. I’ve looked at a handful of other crypto’s but I’m not ready to allocate to anything other than Bitcoin at the moment. I’ll check out the podcast you mentioned.

Best to you and Suzanne!

I don’t think it’s wild for you to invest a six figure amount into bitcoin. Since you actually understand the underlying technology behind the cryptocurrency, you actually see the value of it.

Not just looking at the price and going wow, I’m making so much money from it! The underlying technology is fascinating on how it works and am completely convinced that this is the future. It’s something people have never seen before.