Below is a guest post that I did for Mr. 1500 over at 1500days. I am excited to share that at the time, it was his most popular guest post he had ever shared with his community. It got picked up by RockStartFinance as well.

Who wants to be a millionaire? Come on…don’t be shy…raise your hand.

Mr. 1500…please put your hands down (yes, both of them). You’ve already been inducted into the coveted Double Comma Club more times than some people can count. And yes, we know…you get to put $55,000/year into your Solo 401K, and we’re all a little bit jealous (of your dinosaur collection?). At least I am.

Look folks, reaching financial independence and building wealth is not that hard (or at least it doesn’t have to be). You don’t even have to be that smart. These days, although everyone has a number that’s unique to them, most people would feel pretty wealthy and financially independent with $1M (at least that’s the way it seems). Maybe your number is higher. Or lower. Regardless, the mechanics of getting to your number remain constant. This post won’t spend much time figuring out what the right number is for you. Instead, it will cover ten solid principles that if followed will help you reach your number, and thus FI in much less time than the “get rich slow” guys preach.

That’s not to say that there is anything wrong with the “get rich slow” approach, rather this is just the other side of the coin that isn’t talked about enough.

Before we get knee-deep into the main content, we should probably agree on a few definitions and assumptions.

Financial Independence (FI): is reached when your wealth can generate enough passive income to support your lifestyle. Some would distinguish Financial Freedom as the point at which your wealth is generating more income than you spend. I will let you draw the line. I tend to think and use them synonymously (as you will read below).

Building Wealth: goes hand in hand with reaching FI. Unless you win the lottery or inherit your wealth you really can’t separate the two. FYI: if your wealth-building plan is based on winning the lottery or inheriting your Great Uncle Scrooge’s fortune, this post probably isn’t for you.

From my vantage point there are two ways to become wealthy:

1 – The Slow Way: “Get Rich Slow”

OR

2 – The Fast Way: “Get Rich Fast”

Notice I didn’t say “Get Rich Quick.” It’s a subtle change in words, but there’s a big difference. This is not another “Get Rich Quick” scam. Although I love a good scam as much as the next person, this is solid real material to cover on building wealth and reaching FI.

Let’s talk about #1, the “Get Rich Slow” method. It requires living below one’s means by cutting expenditures to a bare minimum. Most people don’t want to do this in order to reach FINANCIAL FREEDOM because it’s painful! They think it involves cutting out all the joy in life.

You know what I’m talking about: those financial gurus who tell you that to get rich you need to cut out the $4 lattes and stop eating out. Then, after 40 years of diligent and above-average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life, and then, when you’re old, you will be rich (MAYBE).

I don’t know about you, but that’s not the plan for me!

The good news is there is another way. There is #2, or “Get Rich Fast.”

Do you think you’d prefer this way? Seems like a no brainer question, doesn’t it? As my grandfather would say “we want to get there immediately, if not sooner.” But there is no right or wrong answer, and you may come to find out that “Get Rich Slow” is actually the right choice for you, which is fine. In fact, there are plenty of bloggers writing about their own successful versions of that method.

Before you make your own choice, you need to know that “Get Rich Fast” is going to require HUSTLE, DISCIPLINE, and FOCUS. Lots of it.

Ask yourself if you’re willing to pay the price to achieve substantial wealth in 10-20 years instead of 40 years plus. Are you ready to be a non-conformist and go against the crowd?

Are you willing to live your life like most won’t for a few years so that you can live the rest of your life like most can’t?

If your answer is YES, here are the ten guidelines that will allow you to reach financial freedom in 10-20 years:

***Before I launch into these guidelines, let me begin by saying that when you start with nothing, or something much closer to nothing than to a million bucks, things can look pretty daunting. Don’t be intimidated. I truly believe that anyone can reach financial freedom, but only if you’re willing to do things differently (ten things specifically).

Whether you want to build a $1M “Freedom Fund” or a $10M “Freedom Fund” (like my $10M goal), below are the ten principles that will ensure you arrive at your ultimate destination in 20 years or less. Rest assured, I practice what I preach, as these are the same guiding principles I’m successfully using to build my own wealth and ultimately reach FI.

The Tenacious Ten

1 – Spend Less Than You Earn and Invest the Difference Wisely.

The reality is that if you want to build wealth and ultimately reach FI, you will need to create a gap between what you earn and what you spend. This is the most fundamental of fundamental truths. This is the beginning, so that you can then invest the difference wisely. (Wisely, people: see #10 below).

This is where most FI pundits would jump in and tell you to live below your means by living like a college student. Not me! Yes, you have to live below your means, but you have two ways to do it, and two sides of an equation to consider. Extreme frugality – the outgo side of the equation – is one way. However, I advocate living below your means by expanding your means. This considers the other side – the income side – of your equation. In order to live expand your means you need to spend more effort on increasing your income than you do on reducing your expenses (see #7).

The reality is that there is a natural floor to the amount you can save from cutting expenses, yet no limit on the amount of money you can earn. Without going into what makes a “wise investment” just yet, let me add that you will need to begin tracking like a maniac, too, in order to get a vise grip on exactly what you earn, and what you spend. Do this now, when the numbers might be small, and the process will bear infinite fruit later when your numbers get really big. I use and recommend Personal Capital to successfully manage upwards of 20 accounts, including investments, retirement, checking, etc.

2 – Avoid Consumer Debt at All Costs. Never Carry a Credit Card Balance.

Don’t fall into the trap of spending future earnings. It will be impossible for you to create a surplus and be compliant with #1 above if you allow yourself to rack up credit card debt. This is not to say you should not have or use a credit card. I personally use a credit card to pay for almost every single purchase in my life. However, I never spend more than I can afford to pay in full every month. This method allows me to take advantage of rewards (i.e. get paid to spend what I was already going to spend) and also provides additional protection on the purchases I make.

***Don’t be a sucker to debt: learn the difference between good debt and bad debt. Good debt is productive debt that either makes you money or saves you money. Bad debt not only takes money out of your pocket but is used to buy things that depreciate in value (think cars, boats, clothes, vacations, electronics, etc). Toys must be paid for with cash.

3 – Maximize Tax Deferral to Pay the Least Amount of Taxes Legally Permitted.

Don’t underestimate the power of tax deferral. Your goal should be to defer taxes on as much of your income as you can.

The first way to do this is to max out tax-advantaged accounts available to you, like 401Ks, IRAs, HSAs, etc. This one is a bit hard to fully demonstrate in this already lengthy post due to vastly different variables for each individual (maybe a future post). But do it. And certainly do not leave any “free money” on the table: if you have an employer match available, contribute AT LEAST the amount you need to in order to get that match.

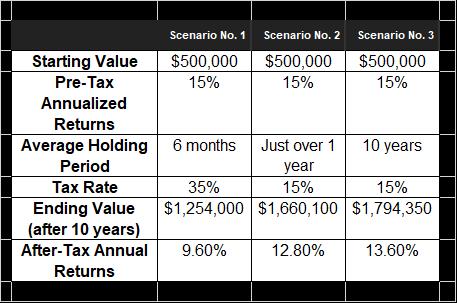

However, the other way that you can defer taxes is by holding investments for the long term (or at least longer than a year). See the comparison below of three different scenarios to convey the power of tax deferral:

Looking at the table above you can see that over just a one year holding period tax deferral makes a huge difference when it comes to your compounded return (12.8% vs. 9.6%). This is mostly due to the fact that investments held for a year or longer are taxed at more favorable capital gains rates vs. ordinary income rates. In all three scenarios above $500,000 was invested. Over a one year period, the returned value gap is more than $400K. And over 10 years that gap grows to over $540K with a return of 13.6% vs. 9.6%. Churning and burning will cost you, so do your due diligence and only invest where you are willing to hold an investment for the long term (with very rare exceptions).

(Read on for another way to defer taxes by taking advantage of depreciation on real estate investments – #8.)

4 – Aim to Save 50% or More of Your After-Tax Income.

It is really amazing how applicable math is in almost any endeavor, which is why I love it. It is especially applicable when it comes to building wealth. I’m very fond of the following quote:

“The path is all math.” – Ryan Blair, Nothing to Lose, Everything to Gain

This guideline is an expansion of #1. Here is a summary of the simple math as related to your savings rate and translated into terms of Financial Freedom:

– If you save 5% of your income, you can take 1 year off every time you work 19 years. (That is a lot of time to work to bank one year of freedom.)

– If you save 10% of your income, you can take 1 year off every time you work 9 years.

– If you save 20% of your income, you can take 1 year off every time you work 4 years.

– If you save 30% of your income, you can take 1 year off every time you work 2 years and 4 months.

– If you save 40% of your income, you can take 1 year off every time you work 1 years and 6 months.

– If you save 50% of your income, you can take 1 year off every time you work 1 year. (Where the GYFG house is currently at. I could see us eventually saving between 50-60%.)

– If you save 60% of your income, you can take 1 year and 6 months off every time you work 1 year.

– If you save 70% of your income, you can take 2 years and 4 months off every time you work 1 year.

– If you save 80% of your income, you can take 4 years off every time you work 1 year.

– If you save 90% of your income, you can take 9 years off every time you work 1 year. (This seems pretty out of reach and extreme to me.)

Now keep in mind that this doesn’t take into account any investment returns, but instead shows you how powerful brute force savings is in achieving FI. Your savings rate is the most important variable when it comes to rapid wealth building.

5 – Buy a House that is Half the Price the Bank Says You Can Afford (or Less).

Most people make the mistake of buying as much house as the bank says they can afford. However, the last thing you want is to have all your money going to service a huge mortgage with little if any left for saving and investing. This is called being “house poor!” This is an area where you can strategically live a bigger lifestyle, and save a significantly higher amount of money if you get a mortgage that is way less than you can afford.

This also allows you the ability to pay off your mortgage much sooner than the typical 30 year term. Debt is the biggest dream killer for most people. You get the big mortgage and then you’re stuck: for one thing, you can’t leave the job you hate. Nor can you mobilize capital to make strategic investments and take advantage of opportunities when they come along. I won’t get into the argument of whether it makes financial sense to pay off your mortgage or not (which I am a big fan of), but I will ask you to imagine your life and the choices you could make without a mortgage hanging over your head.

Personally, my wife and I were approved for a $750,000 mortgage to buy our first house but ended up taking out less than half of that ($355,000). Today the mortgage payment accounts for less than 10% of our gross income, and we are actually in Year 4 of a seven year plan to pay it off completely.

6 – Learn Two Basic Investment Strategies with Options.

These are the covered call and short put. Use these strategies to invest in index ETFs and dividend-paying stocks. These are great vehicles that allow you to invest at significant discounts to market prices (think Warren Buffett margin of safety). They can actually be used to reduce your risk, contrary to what the financial media would have you believe. My favorite feature is that they give you more than one way to profit!

If you want to read more about these strategies and how you might use them in your own portfolio, I have created a PDF of a guest post I wrote for Financial Samurai that you can download here.

7 – Focus 80% of Your Efforts on Increasing Your Income.

Start a business, even if it is just a side hustle. I believe everyone should have a side hustle at all times, if only for the tax benefits. But there are also some legitimately awesome ways to earn significant extra money via side hustles. In 2014, after learning about digital analytics and digital marketing, I moonlighted by offering consulting services in this area and earned $100/hour (which means I got paid to learn new marketable skills and gain experience) and earned an extra $18,000, all in my spare time.

Rent out a room in your house. If you follow #5 above and buy a house that is less than you can afford and you happen to do it in an area where the cost of living is very cheap, you can strategically overbuy in size (not price), thereby creating excess capacity you could then rent out. That is exactly what my wife and I did. We have been consistently collecting $400 – $600 rent a month since we bought our 3,300 square foot house (way more house than any two people need).

Learn new skill sets that will make you more valuable in your career. I witness way too many people stop learning once they are done with school (violating #9 below). You always need to be refining and retooling. Don’t ever become content with your skill set. The reality is that the ladder to the top is never crowded because most people are never willing to pay the price (do the work) to climb the ladder in the first place.

The further mistake I see people make here, even if they do learn new skill sets, is that they never ask for what they have earned. Don’t ever rely on someone else to take care of you and your future. No one cares about your future more than you do. Ask for the raise! You will never get what you don’t ask for. Sometimes you may find yourself in fortunate circumstances where you are taken care of without asking, but probably not. And don’t settle for annual 2-3% cost of living adjustments. I would rather get a kick in the baby maker. People that ask for more money MAKE MORE MONEY!

The information age we live in, and the internet, have made it easier than any other time in history to make money. There’s really no excuse not to!

8 – Invest in Cash Flow Positive Real Estate, and Take Advantage of Depreciation.

People often tend to miss this aspect of rental real estate. Most of us know that rental real estate can be a great vehicle to build wealth. But it is an even more dynamic asset class than most people realize as another great vehicle for deferring taxes, due to the capability to depreciate the value of the rental property. You can actually have a scenario where most, if not all, of your positive cash flow is tax free. And, you can get the added benefit of being able to sell properties via a 1031 exchange without paying any taxes on profits due to appreciation as well. My buddy Brian over at Rental Mindset has already done a fantastic job describing the 5 dynamics of rental real estate (check it out if you have time).

9 – Never Stop Learning.

The day you stop learning is the day you stop moving forward. The perpetual student will always have the knowledge edge. Stand on the shoulders of giants who have gone before by reading books, taking classes, listening to podcasts, reading blogs. You can shave years off your learning curve by following in the footsteps of those who are already doing (or who have done) what you desire to do. Success leaves clues. Furthermore, successful people are actually often very generous to those who reach out to them politely and respectfully. Do you have a question? Do you have something to thank them for? Reach out. There may be a mentor ahead for you.

Spend the currency of your time in bettering yourself; this is the rare investment that pays guaranteed dividends!

10 – Run from Investments that Sound Too Good to Be True.

If I have learned anything from the blunder of financial mistakes that I have made, it’s that if it sounds too good to be true….it is! Turn around and run the other way!!! And if the bite of that beautiful red apple is just too too tempting, run the idea by someone more experienced than you in the endeavor you are considering. Their BS-meter is likely better tuned than yours, which could be clouded by emotion. Then, please listen when they tell you to run!

Summary

Remember, these are principles that you can grow into and work towards. It doesn’t matter where you are financially in your life right now. Start improving immediately, and keep going. We all have to start somewhere.

You have to be intentional with your finances if you ever want a fighting chance to make it to Financial Freedom. But it doesn’t have to take 40-50 years of slaving away for The Man before you have the option to retire. I personally think that 10-20 years is really all you need to reach financial independence. The more aggressive folks (i.e., extremely frugal, not like me, or the very high earners) can probably reach financial independence in 10 years or less (maybe me).

I hope this post inspires and motivates you to action. Don’t take a passive role in your finances and hope for the best. Hope is not a strategy. This time next year, where will you be on your path to Financial Freedom? Twelve months will pass by whether you take action or not, but get time on your side and start taking these first 10 steps today.

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!”

– Jim Rohn

I look forward to chatting with you all in the comments below.

Cheers!

– Gen Y Finance Guy

13 Responses

These are great guidelines to financial independence, thank you for sharing! I really like the % savings compared to years cut from working-life comparison… very eye opening to see how the changes in a savings rate can chip away at the time until FI!

Mrs. Adventure Rich – The savings rate math was revelatory to me as well. Would love to get to the point of saving 75%, where savings buys 3 years worth of your cost of living.

Man you got me motivated brotha! Thanks for the great post, I especially like only buying half the house the bank will allow you to, as my wife and I are getting ready to buy.

Thanks for the Inspiration

Glad you liked it Tip!

This is a GREAT list. I suspect a lot of people will be unhappy when they get to the “Aim to Save 50% or More of Your After Tax Income” point. FI really does need to be a priority for it to be achieved. If it’s REALLY a priority, then saving 50% of your take-home pay should be acceptable to you. Most people when it comes right down to it though will put spending on short-term “stuff” ahead of FI – pushing them way behind schedule for achieving FI awesomeness.

Brad – That is exactly why I worked so hard to get my income up, in order to make saving 50% easy and thoughtless.

Thanks again Dom for the shout out. Hope your summer is off to a great start!

My pleasure Brian! Summer is off to a great start, however, I fear it is going to go by way to fast.

I’ve already made it to the 8 figure club. I can say these are all good points and I’ve used all on the way up, except for #6. Thanks for reminding me to take another look at #6.

Hey Joe,

Thanks for stopping by. I would love to feature a guest post if you’re ever interested.

Did you ever go back and find your old blog?

Cheers

When you say 50% of your income, are you talking about Gross or Take Home?

4 – Aim to Save 50% or More of Your After Tax Income