I’m absolutely stoked to share the details of my recent visit with the founders of PeerStreet and what I’m dubbing my favorite investment of 2017 and beyond. This is going to become a very substantial piece of my overall asset allocation. It’s not often I get very excited about an asset class, but this is different, because PeerStreet is in a league of their own.

My first introduction to PeerStreet was back in May of 2016, when Mr. Money Mustache himself wrote about his new investment experiment on the PeerStreet platform. Although I was immediately interested, my wife and I had just made a $50,000 hard money loan the old fashioned way (i.e., big chunk of capital, a huge concentration of our net worth, and no diversification).

We felt comfortable doing the deal despite these risk factors, because the loan was made with a family friend and my wife’s parents, and we funded the entire loan between the five of us. The duration of this loan was six months, so the idea was to circle back with PeerStreet once our $50,000 in capital was returned to us. Frankly, we didn’t know a platform like PeerStreet even existed prior to doing our own deal, until we read about it via MMM.

In September another roadblock presented itself and delayed us from opening up an account. I was offered an opportunity to obtain equity in the company I work for. What made this problematic to opening a PS account and making my first investment there was the check for $105,000 that I would soon need to cut in order to take advantage of what I consider to be an opportunity of a lifetime (I know, another concentrated investment).

This essentially put us on an investment hiatus for the rest of 2016.

Now early in 2017, I was determined to finally open and fund an account with PeerStreet. But before I did, I wanted to do a bit more due diligence. Brett Crosby, one of the co-founders, was nice enough to set up a 45-minute call to walk me through his background and give me an overview of how the platform works. At the end of the call he also invited to host me at their HQ in Manhattan Beach.

I couldn’t pass up the opportunity to meet the team and get a peek under the hood. We set a date for February 17th. In the meantime, I followed through with opening and funding my PS account with an initial $5,000 investment. I wanted to have some experience navigating the platform and making my first couple of investments before I met with the team.

Leading up to the meeting, I also listened to two interviews with co-founders Brett and Brew that were conducted on the Invest Like a Boss podcast:

These interviews were a great way to get to know the co-founders and wrap more context around the genesis of PeerStreet (the who-what-where-why story).

My Visit to PeerStreet HQ & What I Learned

I spent half the day with the PeerStreet team, including two of the three co-founders. It’s not very often that you get a chance to spend time with a founding team like this and I’m grateful for the opportunity. Let me tell you, this is a rock star team filled with extremely smart people.

So, What is PeerStreet?

PeerStreet has created a platform that has unlocked an asset class that was previously only available to a select few. To say they are disrupting the real estate finance space would not do it justice. They are completely reinventing the game. Through technology they are bringing both transparency and efficiency, and unlocking incredible amounts of value across the entire ecosystem of borrowers, lenders, and investors.

Some would mistakenly classify them as just another peer to peer (P2P) lending company, but they would be making a big mistake. As a lender in the P2P space, I know from firsthand experience that this is the wrong classification, and here are two main reasons why:

(1) As an investor on the PeerStreet platform you’re not making loans directly to the borrower. Instead, you’re helping provide a secondary market for lenders. In contrast, on a P2P platform like Lending Club, you are directly loaning money to the borrower.

(2) The loans on PeerStreet are backed by hard assets (i.e., physical real estate). The loans I make through Prosper or Lending Club are unsecured (i.e., not backed by any assets).

To be honest, the first point above doesn’t really matter to me, but the second point is HUGE and GAME CHANGING!

Before we move on, I need to take a moment for those not familiar with the hard money lending space and quickly define what hard money lending is:

A hard money loan is a specific type of asset-based loan financing through which a borrower receives funds secured by real property. Hard money loans are typically issued by private investors or companies. – Wikipedia

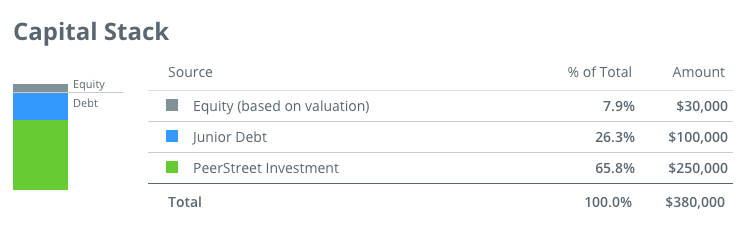

So, to be clear, with PeerStreet, you’re investing in real estate-backed debt. This brings us to another important concept to briefly discuss, which is the Capital Stack. To be more specific, your investment is backed by first position senior debt, which is the safest part of the capital stack, because investors in first position are the first in line to get paid back (whether due to a sale, refinance, or default).

Hard Money Lending For The Retail Investor

Before PeerStreet, not only was this market largely off limits to most investors, there were other flaws that have since been solved by the PS platform:

- The due diligence process, which can be very time consuming, is taken care of for you. It’s a very rigorous process with conservative underwriting guidelines. Think of this as the first level of risk mitigation.

- It all starts with vetting the origination partners (i.e., the lenders). When I visited PS HQ they were up to about 75 lenders that they have partnered with (and growing).

- They use Big Data Analytics as well as a manual team of real estate analysts to vet every deal. Only 40-50% of the deals submitted make it onto the platform.

- Every deal is also appraised by a third party. The team operates on a “trust but verify” policy.

- Previously, investors would have had to commit large chunks of capital, with minimums in the $50,000 to $100,000 range. But PeerStreet facilitates yet another step in risk mitigation by allowing diversification and low minimums.

- On PeerStreet you can invest as little as $1,000 per deal.

- This allows for much less concentration and the ability to achieve diversification across many loans.

It Gets Even Better

There are a few other characteristics to this asset class that are very appealing and exciting to me:

1 – Large Equity Cushion

I have already touched on the concept of the Capital Stack, and the fact that by investing on PeerStreet, you’re first in line to get paid back. That by itself isn’t all that exciting, but when you pair the safety of being in first position with a significant equity cushion, it gets very exciting.

PeerStreet limits a maximum loan-to-value of 75%. The actual average loan-to-value across their platform has recently oscillated between 63-65%.

To me, the loan-to-value gives you what Warren Buffett has famously referred to as a margin of safety. On a loan with a 75% loan-to-value, the property could fall by 25% before you’re ever at risk of capital loss (that’s before considering the interest payments, which only help to increase the margin of safety).

2 – Short Duration

The average duration of a loan on the platform is ~10 months and as long as 36 months. I have even seen duration as low as four months.

The short duration nature of these loans gets me excited about setting up a ladder of many different maturities, kind of like what you could do by laddering CDs. For example, let’s say you invest in one loan a month with durations of 12 months. By month 12 you would have one loan maturing – freeing up capital- every month for the next 12 months.

Besides the downside protection you get from the loan-to-value discussed above, I also see the short term duration as another way to mitigate the risk of capital loss.

3 – Robust Interest Rates

The annual interest rates have ranged from 6-12% to date.

Although I have only made five investments on the platform so far, my loans have interest rates between 7.5% and 8%, which is significantly higher than the 0.5% I am earning in the bank.

RELATED – PeerStreet – $0 to $77,089.45 in 5 Months

Summing It All Up

It’s not surprising to me that because of all the factors discussed above that there has only been one loan out of 550+ that has gone into foreclosure. But don’t let even that scare you too much because it doesn’t mean that investors have lost money. There are multiple types of defaults and the outcome doesn’t automatically mean losses to investors (probably another post ahead dedicated to types of defaults and what happens in the event of each type).

Update (October 2017): They have now surpassed half a billion in loans funded on PeerStreet, with zero losses to investors. Monthly origination volume has now surpassed $50 Million. This is over 1,500 loans now.

This has officially become my favorite asset class and one I plan to grow very aggressively over the course of 2017. The initial plan is to invest $3,000 to $5,000 per month, which could potentially put the account value near $60,000 by the end of 2017.

The fact that I can earn ~8% on my money on an asset class with such a large amount of downside protection is just mind-blowing to me. That paired with the fact that PeerStreet has made it so easy to invest in this asset class in a diversified and streamlined manner is nothing short of amazing.

For my own risk profile, this asset class has the ideal combination of characteristics: short duration, robust interest rates, a large margin of safety, and a robust due diligence process. All that plus loans that are asset-backed, first position, and passive (future post on automated investing features and my personal setup).

– Gen Y Finance Guy

p.s. If you are interested in checking out PeerStreet yourself, use this link and you will get a 1% yield bump when you make your first investment.

47 Responses

Gyfg,

How are gains taxed through this platoform?

Nick

This question was my concern as well. Are the gains taxed as regular income at my marginal tax rate?

RocDoc – yes, the gains are taxed at your marginal tax rate.

One of the things I am evaluating is setting up a self-directed roth IRA in order to perform the back door conversion (due to our income). I will have a post exploring this option in the future. But I also hope to get a bit more clarity on what happens with Trumps effort to reduce taxes at what the effect would be at different levels of income.

Hey Nicky – the gains are taxed at ordinary income tax rates. However, you can set up a self-directed IRA that will allow you to at least defer taxes.

Good to know. This was my question as well. Thanks for sharing!

Such a high interext rate on sch a short term…. Who are the borrowers that use this? Why no take a bank loan? With a ltv of 75pct, bank rates could be lower? Is there something i do not see or overlook?

Hey AmberTree – Yes, the rates are high in the hard money lending space. Typically the types of borrowers taking these loans out are investors that are looking for short term loans to either “fix & flip” or to purchase a property they plan to “buy & hold” (and rent out) but need the short term financing to buy a property as if they are doing it with cash (only to refinance later with a traditional bank).

The borrower in the second scenario may be picking the property up at foreclosure at a significant discount to fair market value, but may need to make improvements before it is ready to rent, and before a traditional bank would provide lending.

Commercial banks here in the states don’t get involved with short term bridge financing, so hard money is a niche lending market.

Thx for clarifying the commercial space this company works on.

Belgium is less of a fix & flip market due to the gain tax when you sell within the next 5 years. =you then have to pay 25pct tax on gain.

Interesting . I would definitely be interested in a follow u posts on the types of default. I do not yet quite see the risk that is associated with the very high interest rates the platform offers (6%-12% wow!). What is the businessmodel behind it for PeerStreet .

Some very interesting options are coming to us in the fintech space. I’d need to do some research on the options available to us in Europe.

Thanks for the review!

Make Wealth Simple – Don’t worry, I plan to have plenty more posts about my experience with this asset class.

Think of it like the P2P lending space where investors are loaning out to consumers, only in PeerStreets case the loans are backed (collateralize) with a physical asset (consumer loans on a platform like Lending Club are unsecured).

The risk is that a borrower defaults on the loan and doesn’t pay you back. Then you have to go into foreclosure on the property, but the good news is that because these are are first-lien position, debt holders are the first to be paid back when the property is liquidated. On top of that you have that 25% equity cushion (or more) to protect you from the downside. As the first-lien hold you are entitled to your capital and any accrued interest before any junior debt (anything not in 1st position, like a 2nd mortgage) or any equity investors are ever paid back.

Property values would have to fall 25% or more before your investment capital is ever at risk. Due to the short duration of these loans I think the risk are very minimal. Of course that doesn’t make it risk free, as anything can happen.

The other thing I like about this asset class is the short duration, so even if/when we do hit another rough patch in real estate, you get to put fresh money to work at lower valuations, but still at the same lending requirements (max 75% LTV). What I mean is your are not locking up your money for long period of time. It also means there is not much interest rate risk, meaning as interest rates rise, the rate you can expect to earn on these types of loans will rise as well. So as older loans mature, you will be putting money to work at higher rates.

The fintech space is doing a great job disrupting a lot of old models.

Oh, and I forgot to mention that PeerStreet takes 1% of the yield before the loan is sold to investors. So, if the loan was originally 9%, it will go to investors at 8%.

Ahhh, it’s interesting to see P2P lending for real estate. I was only aware of P2P lending just for things like personal loans. But it stands to reason that it could be applied to nearly any type of loan. I’ve heard people had mixed experiences with P2P platforms, so I’m not sure if it’s right for me, but it’s definitely a neat experiment to see what kind of returns you can get.

Mrs. Picky Pincher – I have been a small investor in the P2P space through platforms like Prosper and Lending Club. But the thing I don’t love about those platforms is the unsecured nature of those loans. I actually plan to pull completely out of those platforms and go much bigger in the PeerStreet platform with these short term asset back loans.

The other thing I don’t love about the other P2P platforms in the consumer lending space is that you are locking up capital at a 3-5 year duration, which could not bode well in the next recession.

Very cool that they are structuring the debt products in an advantageous way for their investors. As you said, some very smart people working for this platform.

What are the loans used for? Down payment? The entire property?

– Erik

Erik – The hard money lending space is all about short term bridge financing. A good amount of the lending is what fuels the “fix & flip” market. It’s also a borrowing facility investors like to tap to pick up properties in the short term before they can secure better financing from a bank.

Regular banks don’t operate in this lending space.

The loans are used for a lot of different reasons. There is another whole post on what these loans are used for and why. In short, they are used by investors in order to access capital more quickly and with more flexibility…and are short term in duration for whatever reason.

BTW, the size of this market annually is about $16B.

Thanks for sharing Dom. Two important points that I think need to be included are: 1) you need to be an accredited investor to use the platform, and 2) your income is taxed at your ordinary income tax rate, so for someone in a high bracket like yourself, this will eat away at a lot of those gains. Interested to see how your portfolio performs over the next few years. Take care.

FF –

Both valid points. Currently, the platform is only open to accredited investors, but I know PeerStreet does eventually want to make this available to ALL retail investors.

The income received is taxed at ordinary income gains, which based on our income projections our marginal tax rate for 2017 will be somewhere in the range 37% to 43% range (federal + state). You don’t have to pay FICA or Medicare taxes on passive income, so that is at least one piece of taxes I will be saving on by building up this new source of income.

Therefore, with a current average yield around 8% on my loans, my expected return is around 4.56% to 5.04%. However, there are three potential changes on the horizon that could make the expected returns even better:

1 – rising interest rates

2 – lower tax rates

3 – my wife shifts to working part-time or stopping altogether when we have kids

At the end of the day, there are always going to trade off’s in any investment. I like all the risk mitigants built into this asset class, and am willing to accept the after-tax returns as is (with the hope they get better)…especially based on the alternative places I could put money to work at the moment.

I will add that there is an option to invest through a tax-deferred account to at least delay taxes. Something I will look into later this year or sometime in 2018. I still have to evaluate the cost of setting up a self-directed IRA and the associated fees.

Cheers

If gains are taxed at marginal rates, that puts significant tax drag on the investment in my situation. I might have to keep this idea on the back burner for early retirement when earned income and tax rates will decrease for me. Great post Dom and thanks for the idea as this investment could work out well at a lower tax rate.

RocDoc – Totally understand the concern. As I mentioned in my previous comment, investing through a self-directed Roth IRA may be a good way to mitigate this issue.

Glad you enjoyed the post.

Interesting, I didn’t know this existed!

It sounds like they structured things wisely. The risk is hard to judge, but worst case you end up partially owning the property? Not horrible.

6 month deals are way more predictable than 1 year. Not just 2x, probably 10x. So to avoid the “risk” I would look for those.

Good post, I invest in something very similar in Canada and it’s also available to all investors. The only thing is that it’s not online investing, still old school paper.

My favourite part is that it’s liquid annually. The fund in Canada has also very low default rates too, over the last ten years.

I can’t wait to hear about your performance. All comes down to the underwriting process in the company.

Now it’s a matter of convincing the company in Canada to go techy.

Awesome work on reaching on to the team Dom! Looks the good and like that it’s great to know it’s back by physical assets. Some good Due Dilligence questions raised by Amber tree about who would be taking on the loans, which is a consideration although sure there are some checks plus the physical asset backing is great.

Out of interest did you ask if they had any plans to expand internationally i.e. Australia anytime soon? Probably not given the tough regulator environment out here although thought I’d ask

Thanks Jef!

There is still so much for me to write about this asset class and all the due diligence questions that could come up. This post was more a introduction to something I plan to discuss in much more depth and detail over the coming months.

At this time they don’t have any plans to expand internationally. There is so much here domestically for them to take advantage of, that they plan to focus for now. Who knows what the future will bring though.

Cheers

Hi — love your site, this is my first visit I think. I’ll add you to my Blogroll tonight!

I’ve used Prosper for a long time but I’m just starting to check out real estate marketplace lenders. Have you researched any others (RealtyMogul, Fundrise, etc.)?

Best,

R

Rich – I have looked at RealtyMogul and Fundrise as well. I will likely put some money into the Fundrise platform eventually, but right now due to current goals, I like the short term nature of the hard money loans on the PeerStreet platform, so this is where my focus will be through 2017.

Sounds like a great platform. Unfortunately, I don’t qualify as an “accredited investor” and can’t access the system. Maybe 10 years from now if I manage to cross the $1 million net worth mark it’ll be doable. I’ll keep following this topic though. I’m interested to see what your results are.

Hey Kevin – the accredited investor test for net worth of $1M or there is also an income test that as well ($200K for individual or $300K for couple). Stay tuned as I will also keep everyone updated if/when they are able to file the necessary paperwork (and pay the extra fees) to get this open to all investors.

I’m very impressed with PeerStreet. I researched them for a couple of weeks and just recently their automatic system placed me into an investment (loan) that I’m very happy with. My first loan has an APR of 9.5% plus I get another 1% bump (because a friend gave me a referral link) for a total return of 10.5%! This investment has a low LTV of 61%, which I like.

Feel free to use this referral link:

http://www.peerstreet.com/join?ref=hadmf6

I asked PS customer service what would happen to my principal $ if they went out of business and he replied “PeerStreet is set up as two companies. I work PeerStreet Inc. which is our operating company. It pays all the expenses of the business. We also have a bankruptcy remote special purpose entity called PeerStreet Funding LLC (PSF). PSF holds all the notes and its sole purpose is to service loans and pay interests and principle back to investors. If PeerStreet Inc. were to go out of business for any reason, a springing member would be activated (we pay a monthly premium for this, think of it as an insurance policy) who’s sole responsibility would be to continue servicing the existing loans and return capital back to investors”.

Thanks for adding to the conversation Dave!

The major risk with this concept would be a real estate bubble and crash similar to 2008. Almost all major flippers and heavy real estate investors went into default and eventual bankruptcy when the bubble crashed. If you are fully invested at the wrong time here, you will lose all of your money.

Ted – Real Estate would have to go to zero in order for you to lose your all your money. You need to remember that you are in first position, meaning you are first in line to get paid back. On top of this you have the equity cushion that acts as the first line of defense against losses.

The average LTV of my current investments is about 70%, meaning the values of those investments could fall 30% before a single dollar of my investment is at risk. The longer you have collected interest the bigger that downside cushion grows.

If the real estate market were to fall 50% like it did in 2008 (it fell a little more in some areas, and less in others), then I would only be looking at a 20% haircut on my principal (before considering interest collected, and transaction costs to liquidate the property).

So, I don’t know how you lose all your money with this asset class.

Maybe we don’t see something you are seeing?

Looking forward to you response.

Ted,

With a LTV below 65% things would have to be extreme to miss out on any of the principal. My first loan was a 61% LTV, my second loan was only 21% LTV.

Update from PeerStreet on their one foreclosure (Venice Beach):

“Yes, the Venice property was paid in full last week. We were able to recover all principal balances as well as pay some accrued interest over the time period.”

Thanks for the update Dave! That’s nice to hear that all the investors were not only made whole, but also got some of the interest they were owed.

I don’t think you are exactly getting 8-12% annualized return. What about default rates? Also, at your 33% marginal rate or so, an 8% return before tax becomes more like 5.36% after tax. Why not invest in stocks getting 10% expected return instead?

JTF – To date I have $57,000 invested with PeerStreet and $50,000 of that is in a pre-tax account. But regardless, you are right, the returns I am sharing are gross returns before taxes. Because my income is very high right now, and thus a high marginal tax rate, I plan to keep the majority of my investments in a pre-tax account. I also don’t know what defaults will do to the return, but I expect that over the long term it will be somewhere in the 4-6% range (after taxes & defaults).

Why not stocks?

1. I don’t like the current valuations

2. I don’t think 10% returns can be expected over the next 50 years like they were in the past 50 years.

3. I like the short term duration of these hard money loans

4. I still invest in equities, this is just another asset allocation in the overall portfolio

5. I like the downside protection you get with investing in the debt portion of the equity stack (in 1st position liens). On a loan with a 70% LTV, as an investor, the property value could be liquidated for 30% less and I don’t lose a dime of principal. My losses don’t kick in until values fall greater than 30%. And the longer you collect the interest, the larger your equity cushion grows.

Again, I will reiterate, that this is not an investment in place of equities, but just another allocation in my portfolio. Of course I could put more money in equities, but I would rather diversify into other asset classes.

Would love to hear other thoughts you may have on this asset class.

Cheers

The average APR of my 5 investments at PeerStreet is 9% (LTV 21% to 70%).

Customer service is very helpful. Out of approx 700 loans PeerStreet has only had one foreclosure, and no principal loss to investors. For each loan/ investment they provide the full appraisal as well as a lot of other information such as borrowers credit score. The borrower of the one foreclosure had a very low credit score (below 600), I personally do not invest in anything below 650.

http://www.peerstreet.com/join?ref=hadmf6

Obviously we don t expect investors to like every investment available on PeerStreet, and many investors won t find PeerStreet appropriate for their needs, but we do run loans through a thorough process before making them available, but the whole story that goes on behind the scenes isn t always easy to show.

I’m having good luck with PS. I now have eleven investments with them, average APR just above 9.25%, max LTV 70%.

That’s awesome Dave!

What is the average size of your investments?

I currently have about $80,000 in my PeerStreet accounts, with $14,000 waiting to be invested (I just transferred it in this week).

I invest in $2,000 chunks per loan. My rate ranges between 7% to 10.5%.

I plan to run some more analytics on the notes, once the remaining cash gets invested.

Cheers,

Dom

Dom,

I average $4,000 (plus any interest) for each investment. I only ACH the amount I’m going to invest on the next investment, that way my $ is not just sitting at PS in cash.

I started investing in PeerStreet in Aug ’16. 10 months later, BAAM! 7.06%. I am a huge fan because of two major factors:

1. As addressed above, the investment (loan) is collateralized by the asset. What more could an investor ask for???

2. PeerStreet has a reputation to uphold as they keep boasting ZERO principal losses. In order to maintain those bragging rights, they are going to make sure their investors remain happy.

I’m in!

Thanks for sharing!