GYFG here checking in for the July monthly financial report. If you have been reading these reports for a while you will notice that I introduce each month with the same intro month after month. I do this for two reasons; a) for the newbies to the site (which make up about 50% of the sites traffic); and b) to remind everyone what these reports are all about. By all means if you have read the intro at least once, then please feel free to skip down to the “Summary of July 2016” section where the new content begins (click the orange link to be taken there automatically).

For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

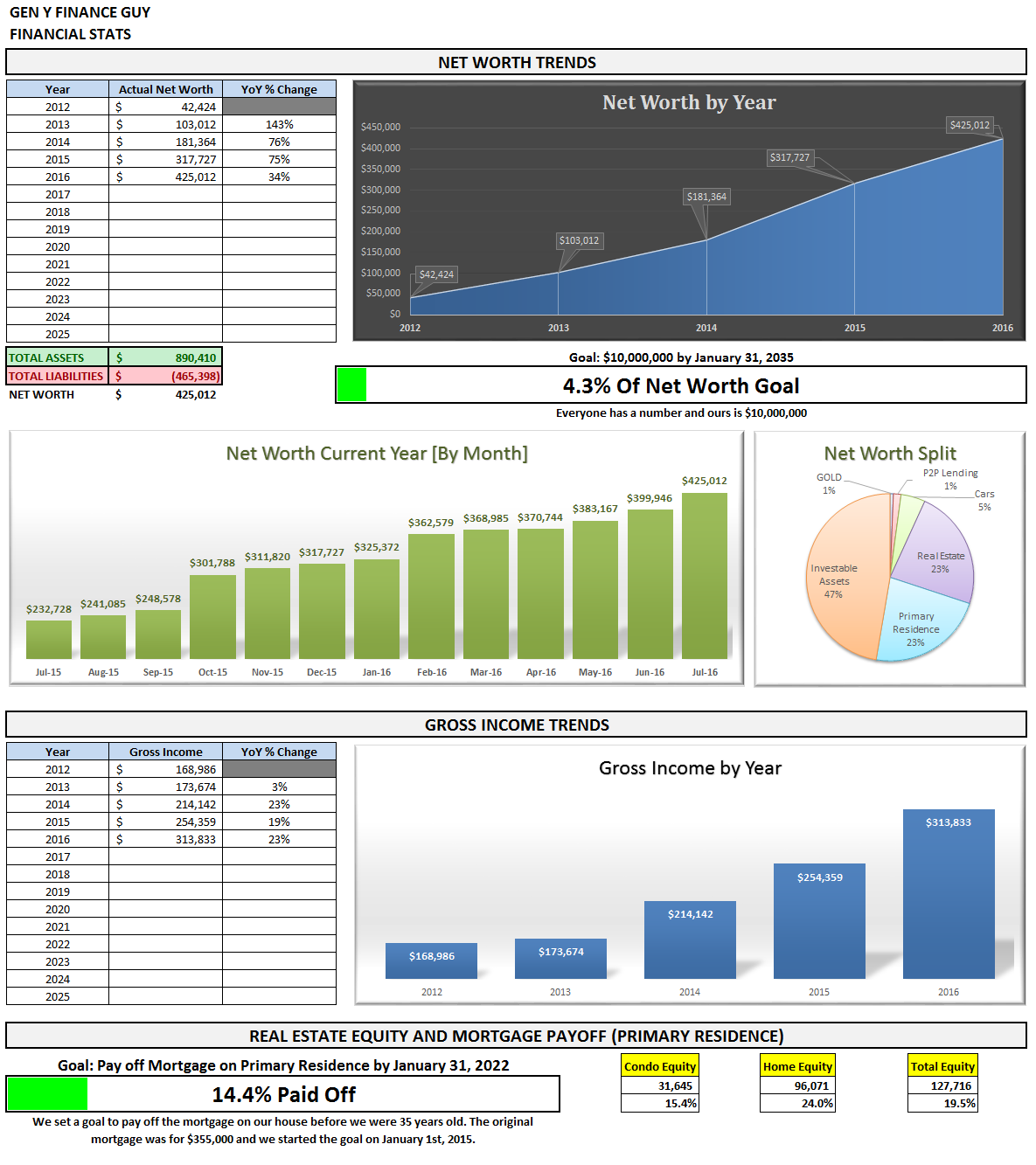

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, Savings Rate, and progress on the mortgage pay down goal.

Summary of July 2016

Wonder how I pull all this information together every month?

We use Personal Capital to aggregate and consolidate our transactions from across all of our financial accounts (checking, savings, retirement, credit cards, mortgages, HSA, and other investment accounts). At the end of the month I then drop that information into my financial stats spreadsheet in order to produce this (beautiful) monthly report.

Tracking your finances is, in my opinion, the best way to stay on top of your finances. You can’t optimize what you don’t measure. You can’t make informed decisions if you don’t know what you having coming in vs. going out. Without a holistic view of how much you spend every month, there’s no way to set savings, debt repayment, or investment goals. It’s a financial freedom must!

If you don’t have a FREE account with Personal Capital, stop reading and go sign up for your account right now! (Seriously, this financial update will be here when your done. There’s no time like the present to take action. You will thank me later!)

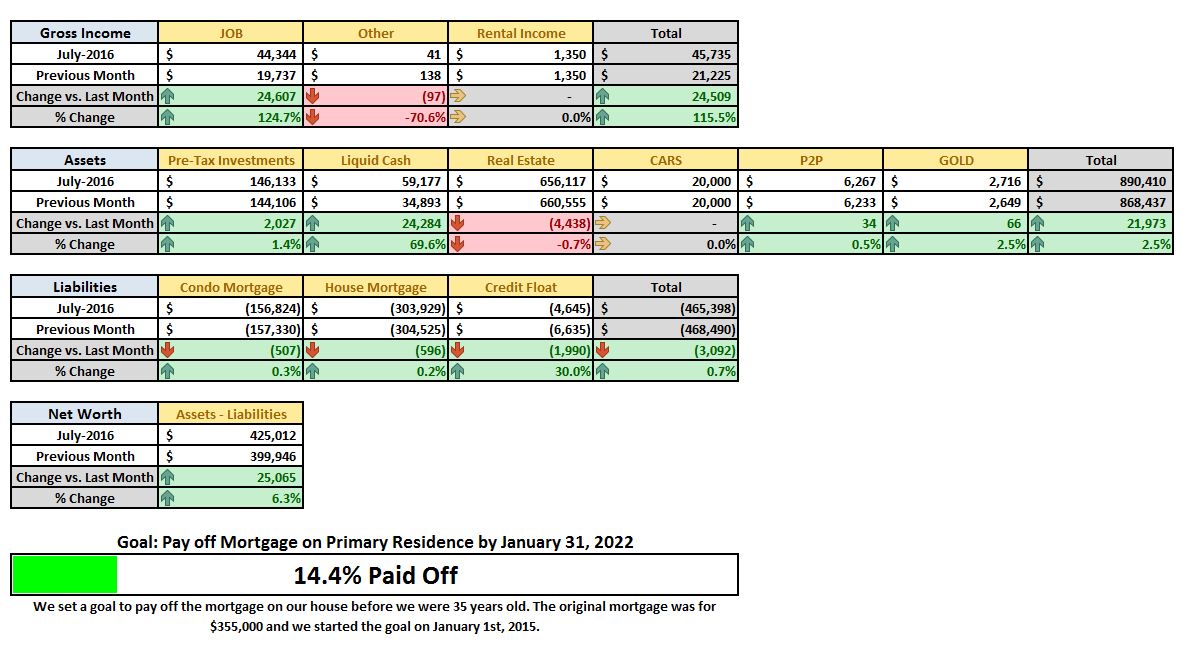

Month Over Month Financial Summary

Just three things to point out in case you missed it:

- Cash was up a nice 69.6% in July due to two primary drivers; my mid-year bonus, and a $5,000 return of capital from our Rich Uncles Investment account.

- Income from the day job was up 124.7% due to my mid-year bonus and of course Mrs. GYFG still killing it 🙂

- Due to the return of our original investment funds from Rich Uncles our Real Estate holdings are down by almost $5,000. You may wonder why it’s not down by the entire $5,000 and that is because we added the accrued interest we are owed on our hard money loan to net worth this month. We should be getting that money back sometime in August or September.

What went down in July?

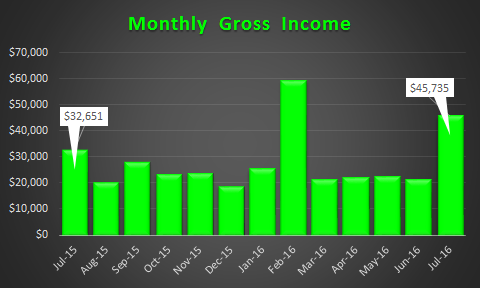

There are two months I absolutely love when it comes to the day job and those months are January & July (this year the January bonus actually slipped into February). This is because they are bonus months, and they also happen to be 3 period pay months for us, due to a bi-weekly pay schedule. This month is our second highest income month ever, and both records have been set in 2016.

Here is a look at the trend for the last 13 months:

I updated the 2016 forecast, and it’s now forecasting gross income of $313,833 for 2016 ( I still think we will actually come in closer to $315K or more). If you’ve read my blueprint for how I plan to reach $10M, you will notice that we have jumped about 6 years ahead of schedule on the income front.

I didn’t have us at this earning level until 2022 in the original blueprint.

In a few months I plan to add another chart that will show our income on a trailing twelve months (TTM). What is crazy is that I just took a look at that and on a TTM basis, we have actually earned $332,237 (that is freakin bananas).

The Juicy Details

- Previous Month: $21,124

- Difference: +$24,509

Now where did all that money go?

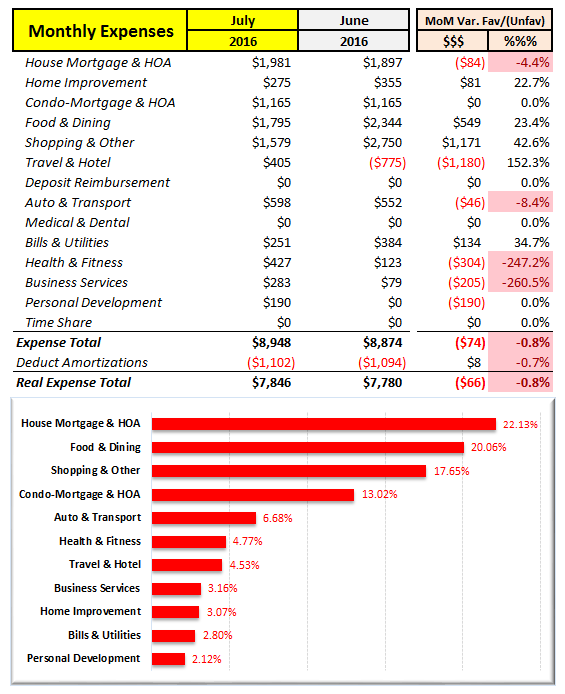

I have come to the realization that there are always going to be unplanned expenses. Our goal is to save 50% of our income and live off and enjoy the difference guilt free. With that type of rule governing our financial life, it is a free pass to inflate our lifestyle, but only proportional to our income. You can see prior financial reports here. We do however try to line up expenses with expected income as much as possible.

There is actually not a whole lot to say this month on spending. It was essentially flat vs. last month, which has been a nice trend to see. However, I will point out that we have not been doing anything intentional to reduce our spending. Our monthly average for the year so far is approximately $10,100/month, which compares to $9,668 vs. this time last year (based on adjusted spending that removes amortizations, which are just balance sheet moves).

Here is the trend for the last 13 months:

I have now changed the chart to reflect the add-back of loan amortizations to reflect what I call “real spending” above. This is done because amortizations are really just a balance sheet transfer from cash to pay down liabilities, it has no impact to net worth.

Expenses are down substantially vs. July of last year, which happens to be when we purchased our hot tub, can’t believe it has already been a year.

It’s nice to see expenses trend down while income continues to trend up!!!

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

Our mortgage payment is automatically set up to pay $1,600 in additional principal.This will be put on hold until further notice (see below)- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- My HSA contribution is automatically deducted at a rate that will ensure I max out by year end ($6,750)

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

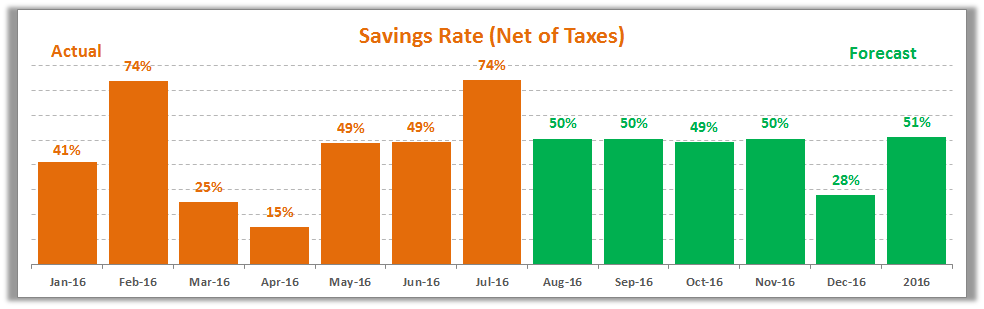

Savings Rate

Below is how we’re tracking to our goal of saving 50% of our after tax income.

You can see that although our goal for the year is 50%, we bounce all over the place on a monthly basis.

So far in 2016 we are still on target to hit our goal of 50% (we’re actually now looking to beat it by 1%).

Speaking of savings rate, have you checked out my post where I mathematically prove the importance of your savings rate as a higher priority than the compound return? If you’re trying to build wealth quickly, then you have to read this post.

Net Worth and Mortgage Pay Down Update

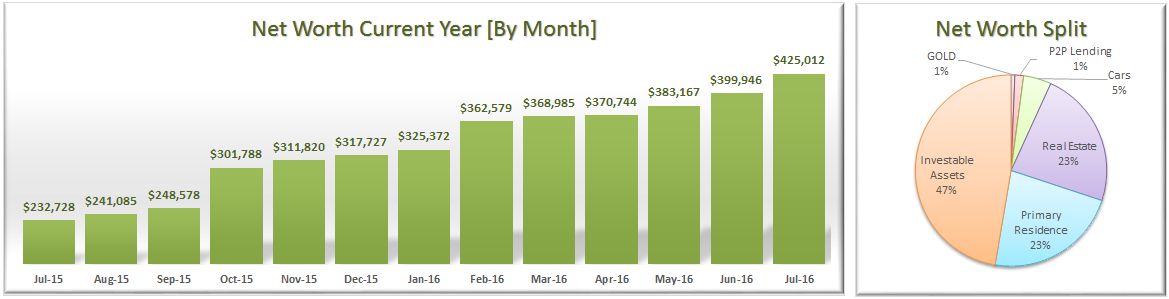

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income (at the end of July we are officially 4.3% there). Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate.

I am not anywhere close to a 7-figure net worth yet (or what some refer to as the double comma club). However, it is growing at a very respectable rate (just take a look in the side bar for growth at a glance). If you want to see how I plan to get there you can read all about it here.

July Net Worth $425,012 (this puts us up $107,285 or 33.8% vs. 2015 with 5 months to go)

- Previous month: $399,946

- Difference: +$25,065

Since publishing the first financial report we have been able to post 19 consecutive months of positive gains to Net Worth. Let’s see how long we can continue this trend. The larger the number becomes (and the more invested we become), the more difficult it will be to continue this trend.

Net Worth Component Break Down:

With the refinance closing in April, our primary residence crossed a threshold over our target of 25% or less of net worth (now 23% of net worth as of July). This means we will be discontinuing our additional principal payments until we can dilute this number to reduce our concentration risk (would like to get this well under 20% before resuming). This doesn’t really effect the pay down goal, as the refinance forced us to bring in enough cash to satisfy our scheduled extra payments through April of 2017.

We are currently on track to increase net worth by $141K in 2016 vs. our original goal of $112K.

Something I have been thinking about and worth pointing out is that our net worth was actually negative to the tune of almost -$300K back in early 2009, so we have come a long way in a short period of time. Until now I had only reported our ending net worth from 2012. I am thinking up a post that would give the full story of how we started so negative right out of college and how we have improved it so dramatically in such a short period of time (it’s on the list). I mention the first drag in this post about our investment condo.

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments (in the early days of your journey). In the short term, savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings. Actually, check out the post I recently wrote: Savings Rate – The Most Important Variable to Wealth Building [and the math to prove it]

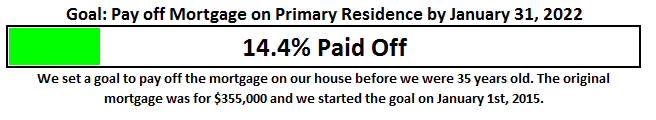

Progress On Our Mortgage Payoff Goal

You can read about our strategy to pay off our mortgage in 7 years (and 3 months). When you break it down and follow the 3 simple rules, it’s not as hard as it sounds. We bought our house in February of 2014 and then refinanced it into a 5/5 ARM in September of 2014 to remove PMI and free up cash-flow to put towards the principal and keep us on track to pay the mortgage off at an accelerated pace. We have since refinanced again into a 3/1 ARM at 2.25%, which has freed up almost $400/month.

The progress chart above shows how much of our goal we have completed. The goal completion percentage is up 0.2% vs. June.

This goal will move a bit slower over the next few months as we work to reduce the concentration of our net worth in this area. We should be able to get it well below 20% by January of 2017.

The End

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 15-20 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

One last thing before we go. If you are new or even if you’re not new and you have been wanting a more guided tour of the blog, I finally launched a “Start Here” page. I highly recommend you check it out.

Cheers!

– Gen Y Finance Guy

Oh, you’re still reading.

Do you want to help keep our lights on? You’re under no obligation, but if you were already thinking about it or were a little bit curious, why not help us out?

Here are a few ways you can help us out:

- Personal Capital – You know how big I am on tracking my finances, that’s why I totally recommend Personal Capital’s FREE software that helps you see all your financial accounts in one secure and convenient place (checking, savings, investments, and retirement accounts). Without a tool like Personal Capital, these reports would take 2-3 times as long to complete. You want to track your income? Your expenses? How about your Net Worth (who doesn’t like watching that bad boy climb). Just sign up and link your accounts today. Absolutely FREE to you!

- Prosper or Lending Club – Lending to consumers is a great industry that’s produced profits year after year for a handful of banks. Now with Prosper, you as the investor get unprecedented access to this market. My personal P2P portfolio is earning over 5%. Open a FREE investment account today!

- TD Ameritrade – They are hands down the best broker for the retail investor. TD Ameritrade provides a number of investing platforms that are more robust than any other platform I have ever used. My particular favorite is the “Think or Swim” platform. Oh, and did I mention that they have over 100 ETFs that you can trade commission FREE?

- Blue Host – Have we inspired you to create your own blog? Well let me save you some money. This is the hosting company that I use for this blog. It is stupid cheap and the customer service is amazing. The normal price is $5.99/month, but if you use this link you will get a 34% discount (only $3.99/month). It took me less than 5 minutes to buy my domain, install wordpress, and get the first version of this site up and running.

OR you can check out our Recommended Products and Resources page.

10 Responses

Man your income is getting seriously super-sized! Very impressive stuff. I imagine the increases can only continue so much? It’s really quite impressive what that company is paying you, as I know several people in small-sized companies in the C-suite lucky to clear $250k a year including bonus. Keep up the great work. You and your wife have skyrocketed past me and my wife’s income as we are at a projected $260k or so for this year. Couple that with living expenses that are roughly 2x+ where we live and you should be catching us fast on the net worth front 🙂 I expect I should be able to increase my income by about $40k/year, every year.

My net worth increases have slowed down dramatically and I am now sitting at $555k.

Sean – This month was unusually high due to 3 pay period due to the bi-weekly pay schedule I am on and getting 30% of my year end bonus. Not sure how long the increases can continue, but I do expect that they will continue to be significant for at least through 2018. My bonus will continue to grow as our company grows, as it is indexed as a % of the bottom line performance of the entire company.

I also don’t know the details just yet of my new comp package once promoted to the c-suite later this year, but I do know based on compensation of our upper management that my base compensation has at least $225K worth of upside and my bonus has at least $100K worth of upside. Now that is not to say it is going to happen all at once, but this gives me a strong level of confidence that our income can continue to grow substantially over next 2 years.

But enough about me…

$260K is nothing to cough at, but I can see how the higher cost of living could make things difficult to move things as fast as you would like to. That said, $40K/year increases will add up fast and is still incredible growth to income.

You have still maintained a significant gap between our net worth figures. You are certainly giving me something to chase.

Onward & Upward!

Damn, dude. Are you planning on keeping that bonus as cash, or investing it?

Hey Pia – For now it is just sitting in cash and that will likely be the case at least through October. We want to by another piece of real estate, but with work as crazy as it is, that is on hold (and we also need to get the $50,000 back that we loaned via hard money as well).

Cheers

Hey love the blog!

Quick question, when calculating your net savings rate, how do you include your pretax savings like 401k’s? How would i calculate our net savings rate if we max out our 401k pretax and max out our Roth IRA’s?

Thanks for the great info!

Thanks for stopping by.

You can check out this post for the formula I use to calculate savings rate (it’s towards the end).

Cheers

Looks like July was a kick a%s month for you Dom! Nice work on the bonus and your wife’s income.. I’d like to call something out as well on this point you made: “I am not anywhere close to a 7-figure net worth yet (or what some refer to as the double comma club). ” I’d say you’re closer than what you think especially with the compounding growth impact you’ll see continue to take affect..

Keep up the great work!

Jef – we have certainly made a lot of progress and are currently projected to hit the halfway point to 7 figures by the end of the year. But it will likely be another 18-months before we really get close to 7-figures. I am not feeling to confident on the overall economy, which could slow things down. But we only focus on what we have control over.

Cheers!