Have you ever wondered how the IRS comes up with certain pieces of tax code? It seems like every time I turn around there is some piece of tax code that makes absolutely no sense to me at all. Do they use any logic? Recently I wrote a post about joining the double comma club (i.e. becoming a millionaire) and as one of the 3 commitments I listed to max out all tax favored accounts. In my particular situation that means maxing out a 401K, HSA, and IRA for my wife.

All was good in the world…That is until the IRS gets involved.

There always seems to be some sort of penalty written into the tax code for doing well. Although this article will primarily be about how the tax code around IRA’s make absolutely no sense, and what you need to know so you can make other arrangements for the “Hit” that is coming your way as you continue along your Financial Journey.

The best thing about writing a personal finance blog is that I don’t make this shit up. I only write about real things experienced in my own life. You get a front row seat into a reality show that is all about the Benjamin’s. My hope is that it isn’t nearly as brain numbing as the reality crap that is on TV and that you can actually learn from the mistakes and victories I write about on this blog.

I will admit that I am not the smartest person in many rooms, and to be honest I prefer it that way. It leaves a lot of room for growth and learning.

Even if I’m not the smartest person in the room, I try to make sure that I am the hungriest to learn. Be a perpetual student and success is your reward. That said, consider yourself warned that I am no tax professional and this should not be considered advice, but rather food for thought. I am learning as I go. Trying to stay just one step ahead of the tax man to make sure I pay the minimum amount of taxes legally possible.

With that, let’s stop the dribble drabble, and get on with the show.

The Marriage Penalty

Did you know that the tax code is actually written to penalize a married couple with two working professionals?

I know it sounds nuts. Here you are marring the love of your life and little do you know the IRS is waiting around the corner to punch you in the face. Besides what a marriage represents emotionally, it usually brings other synergies with it as well. You know the big one I am talking about, the consolidation of expenses. Instead of paying to maintain two households you now only pay for one. For many couples in my generation, including myself, we tend to move in with our future spouses before the big day and enjoy the benefits of splitting expenses.

Life is good!

We are living with the person we love and our rent just got cut in half. Our utilities just got cut in half. Let’s be honest, it’s way more economic to be in a relationship and live with that person than to be single living by yourself.

This is not to say that the only reason you would be in a relationship and move in together is for the financial benefit. Instead it is just an added benefit for being in love (I am smiling as I write this right now as I do a little CYA).

Time passes and you realize that you’re ready to take your relationship to the next level and get hitched. Then your file your taxes jointly for the first time. That’s when you realize the IRS had just sucker punched you. Why doesn’t anyone warn you about the financial consequences of getting married? Do people not pay attention?

Not saying this should or would stop you from tying the knot. But it would be nice to know.

Let’s take a look at the difference in filing single vs. filing a joint return.

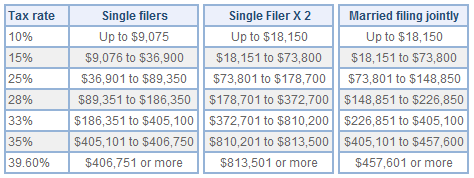

In the above screen shot I wanted to provide you with the tax brackets that I used from 2014. Please note that I added in the middle column titled “Single Filer X 2” to represent what the tax bracket would be if the “Single filers” was doubled, which is not the case as you can see in the “Married filing jointly” column. I would also like to point out that we are only focusing on the federal side of taxes, but in certain states like in California where we live, there is also another hit to married couples (but that will be for another day).

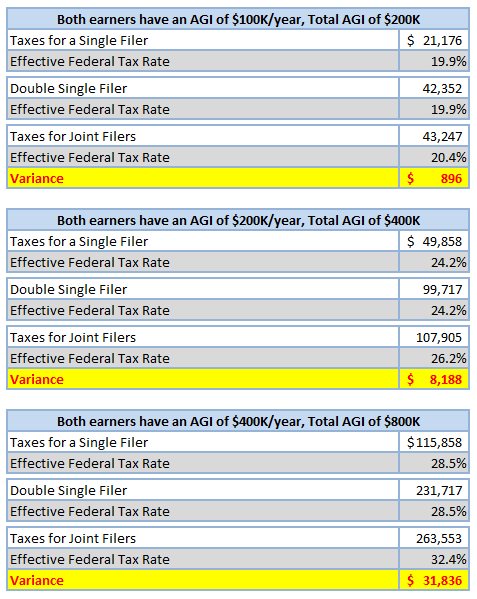

Now let’s take a look at what this actually means to the married couple filing their taxes.

Here are the assumptions used to create these three examples:

- Standard deduction of $6,200

- For simplicity, assume no other deductions

- Effective tax rates are based on gross income (AGI + standard deduction in this case)

- AGI = Adjusted Gross Income

As you can see in the first example (Total AGI of $200K), the impact is minimal for the couple at an additional $896 in taxes owed. Since my wife and I got married, we have had an AGI of less than $200K. But looking ahead at the 2nd and third examples, you can see that the marriage tax penalty becomes much greater as a couple does better financially.

The thing that perplexes me about this whole thing is that it is more tax efficient to remain unmarried (especially if you plan to earn some serious dough). Just looking at the last example with an AGI of $800K, a married couple would save almost $32,000 a year in taxes.

Ok, so maybe most earners will never experience the 2nd and 3rd examples. Especially when you consider that the median house hold income as of 2014 for professionals age 25-34 is $54,835. However, I still think it is something to be aware of if you are a high earner that is trying to optimize your tax bill down to the least amount of taxes you can legally pay. It should also be pointed out that maybe the IRS didn’t just double the tax brackets for single filers because of the following:

- As a married couple you will likely have more deductions due to the likelihood of having kids.

- As a married couple you will likely have more deductions due to the increased probability of home ownership with a potential dual income.

Whatever the reasons the IRS has decided to create the tax brackets for married couples, it doesn’t really matter. These are the rules we have been given to play with and if you want to get married they are just something you have to except. At the very least know what you are really getting into from a financial perspective. Once you are aware, you can at least plan to optimize your deductions to reduce the marriage tax penalty as much as possible.

This is something I have come to accept and live with. And just when I thought that was the end of it…

The Marriage Penalty Strikes Again

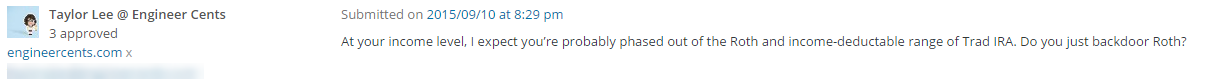

As if the increase in taxes wasn’t enough. Earlier in the post I mentioned a post I had recently written declaring my 3 commitments in becoming a millionaire. One of those being to max out a traditional IRA for my wife since the family business she works for does not currently offer a qualified plan like a 401K for her to contribute too. I was under the impression that if your work did NOT have a retirement plan you could contribute to, then you would get the full tax deduction for contributing up to the max $5,500 into an IRA. That was until a smart reader left the following comment:

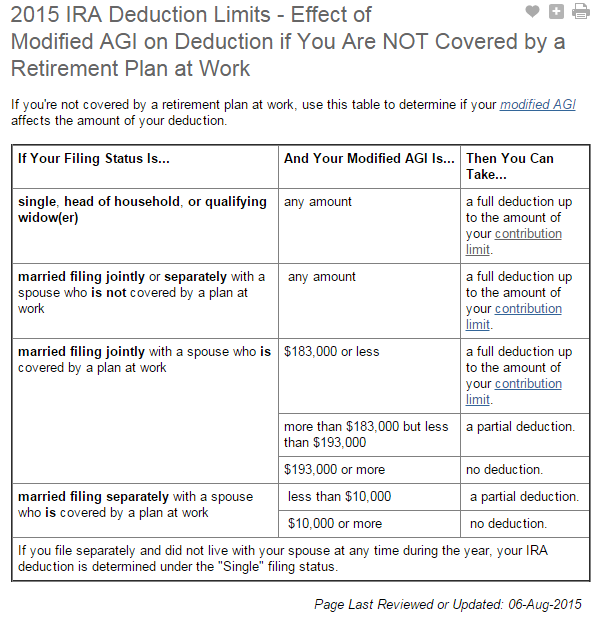

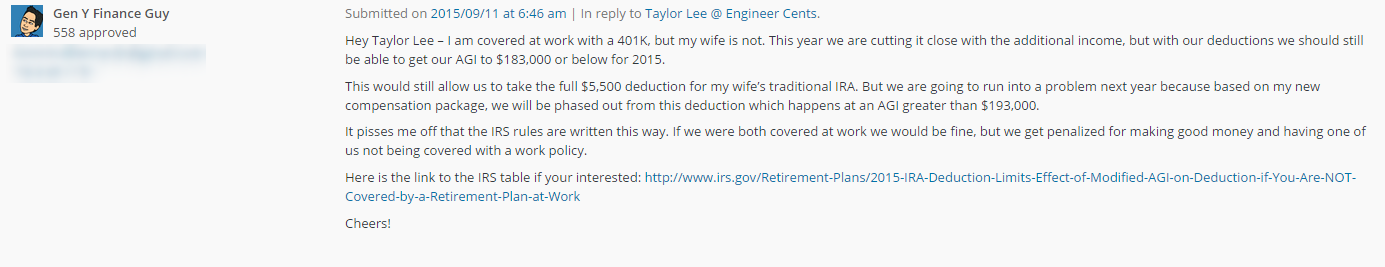

This forced me to go to the IRS website to either prove my assumption right or wrong. I was dead wrong, according to the IRS you only get the full deduction if you have an AGI of $183,000 or less. If you look at the IRS table below you will see that it says that if you’re married filing jointly and have a spouse that is covered by a plan at work then you need an AGI of $183,000 or less for the full deduction, you get a partial deduction up to $193,000, and anything above $193,000 comes with ZERO deduction.

WTF???

First, thank you TaylorLee, for bringing this up. Luckily after finding this out I did some quick calculations to see where I estimated our AGI to be for 2015. Because it has been an incredible income year for us, I feared that we were at risk of receiving no deduction for the contributions we had made for my wife this year. Fortunately, after doing the math we will just barely make it under the $183,000 limit after we account for all deductions.

I am glad that TaylorLee left this comment because although we will get through 2015 under the limit to qualify for the deduction, 2016 is looking to be even a better income year for us, and based on our numbers we will exceed the $193,000 phase out AGI unless we figure out other deductions or a way around this.

After my first reply to TaylorLee, I then replied a second time with ideas on how to ensure we don’t lose any deductions next year.

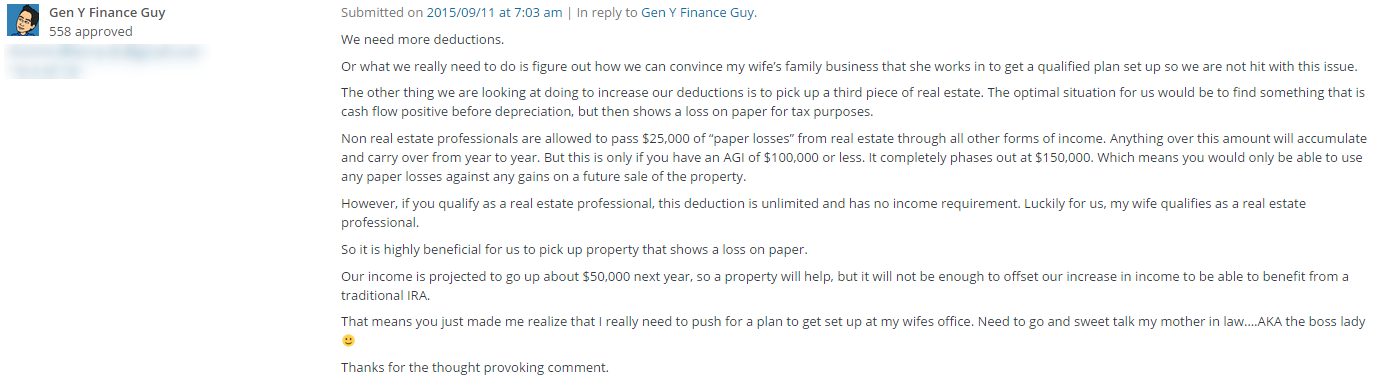

In the comment above I mention two things that we are looking to do in 2016 in order to continue our investing efforts while at the same time trying to optimize our taxes lower. The big one is going to be setting up a qualified plan at my wife’s work. Luckily her mom (the boss) has been wanting to add a plan for her employees for a while, now its just a matter of doing the due diligence and getting one in place.

A plan will not only get us around this phase out of deduction, it will also allow us to increase our current contributions from $5,500 a year to $18,000 a year.

Lastly, we are also putting an income producing property back on the table. The perfect property would be cash flow positive with nice cash on cash returns, but then show a loss on paper after you account for depreciation (non-cash expense). We are still in the early stages of due diligence and are not even sure such a property exists.

Side Note: I still don’t understand why you can contribute $18,000 to a qualified 401K plan at work, but only $5,500 if you’re not fortunate to work for a company that provides a qualified plan.

Conclusion

Make sure you understand how the tax laws effect your current situation and at least one year out to ensure you have plenty of time to make optimizations that will decrease your tax bill and mitigate phase outs when/if possible.

Whatever you do, don’t take this back to your loved one as a way to convince them marriage is not for you because you could save a few bucks. I promise you it will not go over well, and I am mainly speaking to the male readers. The last thing you want to do is turn your marriage into a financial transaction. Seriously!!!

That would be relationship suicide.

Now it’s your turn…

Were you aware of the marriage tax penalty? If so, was it ever a discussion before getting married? Also, did you realize or have you ever had to deal with the deduct-ability of IRA contributions? What other tax issues have you had to deal with as a married couple?

-Gen Y Finance Guy

27 Responses

I am aware of the marriage penalty. It stems back to when it was the norm for the wife to stay home and take care of the house and kids, while the husband went to work. Hence only one income for a married couple. Now although American society has made a large change from this, the tax code has obviously not caught up to the fact that a house most likely has two income earners. It sucks no doubt. But I try not to dwell on things I can’t control too much. This is why I’m single (haha jk).

Agreed FF, no reason to dwell, just be abreast of the tax code that personally effects you.

I would argue that the benefits of not being single far outweigh the incremental taxes you pay 🙂

And you cannot even take advantage of Roth IRA’s at that income level (trust me, I ran into that for last years taxes, good thing I was waiting until I filed my taxes to see what I could contribute to our Roth’s (which is the last thing I will fund as we are both covered by 401k’s)).

http://www.irs.gov/Retirement-Plans/Amount-of-Roth-IRA-Contributions-That-You-Can-Make-For-2015

Daniel – Yep, it is a bit of a bummer. Hopefully, I can get a 401K plan setup at my wife’s work. I just sent my mother inlaw all the info and even offered to cover the $150/month fee to maintain the program. I estimate that it will save us $5,400 in taxes by being able to max out another $18,000/year. So, it would be worth the $1,800 expense. I doubt we will actually have to pay for it. But I want to make sure it actually happens.

I think looking at least a year ahead on tax issues is great advice. I think the reason the marriage penalty is not mentioned often is because it only affects the top 3-4% or so of income earners in the US (not a statistic, but my guess).

With my wife not working, we fall just under the current limit, so I can contribute the $5,500 to her account. If/when she goes back to work, I hope it is with a 401k plan. We can then max it out and get more benefit (her take home would be pretty small, but who cares).

Vawt-

Totally agree, that it doesn’t affect the majority of tax earners.

Next year will be the first year that our AGI will exceed the limit. As I mentioned to Daniel in my reply, I think I am going to be able to get a 401K set up at my wife’s office, so that is going to help mitigate this whole thing.

Cheers

If you end up being above the Roth IRA income limits, can’t you just do a backdoor Roth IRA conversion? I believe that is the way to “beat” the income limits…

Ryan – I don’t know much about the mechanics of the backdoor Roth IRA conversion. But, I do think you are right after reading this link on Bogleheads: https://www.bogleheads.org/wiki/Backdoor_Roth_IRA

This is good to know and have in my back pocket, but our focus right now is trying to maximize tax deferral, and this backdoor roth strategy is likely something we start deploying/layering in next.

Cheers

I remember that one time in high school, my dad mentioned a marriage penalty. He also mentioned that he never expected it to affect him, but I’m guessing it does now (he’s been quite successful in the last few years, and none of us (5) kids live at home now).

The marriage penalty affects about the couples who have two earners in the top 5% or one earner in the top 2% and another earner.

Just a quick correction on your facts:

The median household income includes households of all sizes (including single person households), not a 4 person household.

For households with 2 or more people, the median income is actually $64K not $54K

http://www.deptofnumbers.com/income/us/#family

The median income where both people are employed full time is $84k.

Hey Hannah – Thanks for pointing out the correction. I actually forgot to update my comment to mention that that median income was for working professionals 25-34 as of 2014 (at least based on the link I provided). And it is based on household income (for 2 or more like you said). It is good to have your comment so others can see other statistics.

My guess is that the statistics will vary from source to source.

Thanks for adding some more color.

Hey GYFG, this would be a good problem to have. Not going to try to explain the IRS rules, but agree with your acceptance that we play by the rules of the game. Coupla, three things…

1) a thought for your own situation; speak with your accounting dept. and request deferring your Dec’15 paychecks into 2016.

2) You mentioned “needing more deductions” and may I respectfully request that you look at that idea from another perspective? You can get an additional deduction by donating $10,000 to a registered charity. Is it worth expending $10,000 in order to receive $3,000? Deductions are not going to get you where you want to go, and the tax hit will be coming eventually whether it is rental property or alpaca farms or orange juice futures.

3) there is an argument for wealthy paying more taxes (no, it is not because they ‘can afford it’). It goes like this…the wealthy benefit most from society’s continuing status quo. Roads, infrastructure, law enforcement, national defense, etc. all disproportionately benefit ‘makers’ a lot more than the 43% of the U.S. that pays no Federal Income tax. This argument is the basis for a ‘wealth tax’, and we will all be seeing a lot of this argument in the coming years. So, get your refutations ready now.

One last thing, congratulations on you and Mrs. GYFG and your happy marriage. From what I see around me, the order of things goes more like this: 1) have a baby; 2) break up with the father; 3) co-habitate with some loser who can’t keep a job; 4) guilt grandparents and siblings into “child care”; 5) get married; 6) get divorced. Rinse-and-repeat.:-)

Hey JayCeezy – Definitely a good problem to have. Just good to know the rules you have to play within and navigate.

Responses to your points:

1) I have thought of this before. I have yet to try it out…

2) Like you said the tax hit comes eventually. I guess I am always trying to defer taxes for as long as possible. Not looking to get deductions for deductions sake…I guess I am really looking for tax deferrals as much as possible.

3) I have no problem paying the minimum legal amount of tax. I love the fact that we live in a country with so much opportunity.

Thank you very much. I can’t believe that we have already been together for 10 years (married almost 4), it has gone so fast.

There are so many ways that the IRS can get you when you least expect it. My boyfriend and I are looking to move out of the US, and we were very surprised to learn that even if we live and work in another country and have no US assets, we need to file with the IRS.

The almost unique cost of American Citizenship (we are pretty much the only country that requires our expats to pay taxes and file tax returns).

Income per individual is excluded up to $100,800 for 2015 for ex-pats working overseas. The process is the same as filing taxes here in the U.S., download a software return and ‘check the box’ for overseas and you are done. Good luck with your adventure.

It would not be surprising if we each reach the $100,000 mark, but we are keeping our plan in place because we are going to a country with higher taxes, so we will not have to pay any US taxes. Our concern has been finding a qualified accountant oversees (and how much they’ll charge), so it’s very good to know we can still file online 🙂

Thanks for the well wishes, and all the best to you too!

Never get married! Simple solution. Why pay the government more to have a personal relationship with someone?

Only downside is losing the SS benefits if one partner dies. The government gets to keep!

Sam

That is a very rational decision, but simple? I don’t see that going over very well with the ladies, but good on you if you find one and are willing to have that conversation with them.

Thanks for stopping by Sam!

Although my effective tax rate was only 15% last year (even less if you consider the SEP IRA contribution from my employer), I think there’s still room for improvement, as we are only contributing the minimum amount to receive the company match in my wife’s 403b plan (7% of income). All of her remaining income is saved and invested in a taxable brokerage account. I decided I’d rather have the accessibility of a brokerage account (in case I ever wanted to liquidate it for something) than the tax benefits of a 403b plan, but now am reconsidering.

Question I’ve been wrestling with, since her 403b plan offers a Roth option: If I max her out, which would you choose (trad or roth)? Sure, I like the tax deduction now, but man, having as much Roth money as possible tax free in retirement sure would be nice. What do you think?

I think it gets the big fat “It Depends”

If you want access to the contributions and don’t want to worry about penalties for accessing the money should something come up, then the Roth is probably the way to go. Also if you are looking for a way to hedge your bets on taxes, then the Roth is probably the way to go.

I personally like to defer taxes for as long as possible. Tax deferral accounts currently get priority to after tax accounts. Meaning any and all tax deferral accounts that we qualify for get maxed out. Then we start putting money aside in after tax. In 2015 that is going to be about $29,300. In 2016 that will be $41,800 as my wife will finally have a 401K at here work.

I expect that over the next few years my after tax investments to be multiples of my pre-tax contributions.

Don’t think I helped you.

Late comment, love the blog GYFG! I noticed you were discussing AGI, these calculations are based off of MAGI, in my experience what can be deducted in MAGI is very limited.

https://www.irs.com/articles/what-modified-adjusted-gross-income

.

Thanks for the clarification and article Nick. I think for the most part my AGI and MAGI should be really close if not identical. But you bring up a good point for those that may have special circumstances that would require them to know both calculations when figuring stuff like this out.