As many of you know, I go through the exercise of producing a detailed monthly financial report each and every month on this blog. In order to provide an up to date report I have to access a number of accounts:

- Two Checking Accounts

- Two Savings Accounts

- Two Mortgages

- Four retirement accounts (one 401K, two IRAs, one SEP IRA)

- Seven Credit Cards (which we pay off completely every month)

- One Regular after-tax brokerage account

- One P2P lending account

- One REIT account (Rich Uncles)

Total accounts = 20 (and likely growing)

The task of logging into these accounts is the easy part (but still cumbersome). But the thought of manually categorizing all this income, expenses, investments, assets, liabilities, etc. is daunting!

There had to be a better way.

Ask and you shall receive. Personal Capital allows me to aggregate my entire financial life into one account. All I need to do to see all my accounts in one place is link each account once through Personal Capital (granting read-only access) and voila! But it doesn’t stop there. PC automatically categorizes all my income and expenses for me. Plus, those nice folks over at Personal Capital also add in the estimated value of my home from Zillow and the Kelly Blue Book value of our cars, all automatically.

In my monthly financial reports I want to present my data in a certain format. Personal Capital allows me easy access to the data I need to plug into the custom built reports I use to report Net Worth, Income, Expenses, Assets, and Liabilities. But they also offer some really nice looking charts and graphs within the application itself for someone not wanting to create anything custom.

Let’s take a look under the hood of Personal Capital

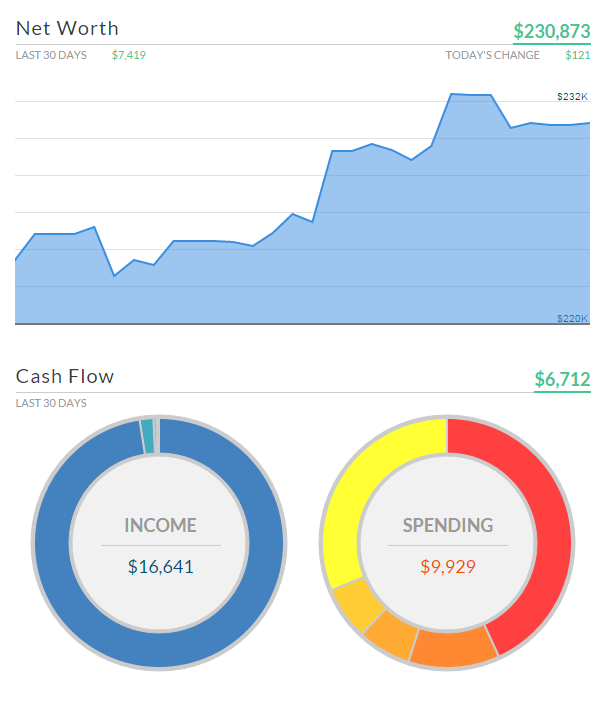

When you first log into your PC account, you will be taken to your dashboard page. On the dashboard page, you will see all of your linked accounts on the left-hand side of the page (not captured in the screenshot below), a summary of your net worth, income, and spending for the last 30 days.

Note: Due to account privacy I am only showing you partial screenshots, taken sometime in June 2015.

With this kind of tool you now have the technology you need to stay on top of your finances. The dashboard gives you a high-level look at how you are doing financially. With this simple but effective view, you can start asking yourself questions like:

- Do I have a spending problem?

- Maybe it’s actually an income problem, instead?

Building wealth is actually fairly simple when you think about it.

Spend less than you earn and invest the difference wisely.

Expense Tracking

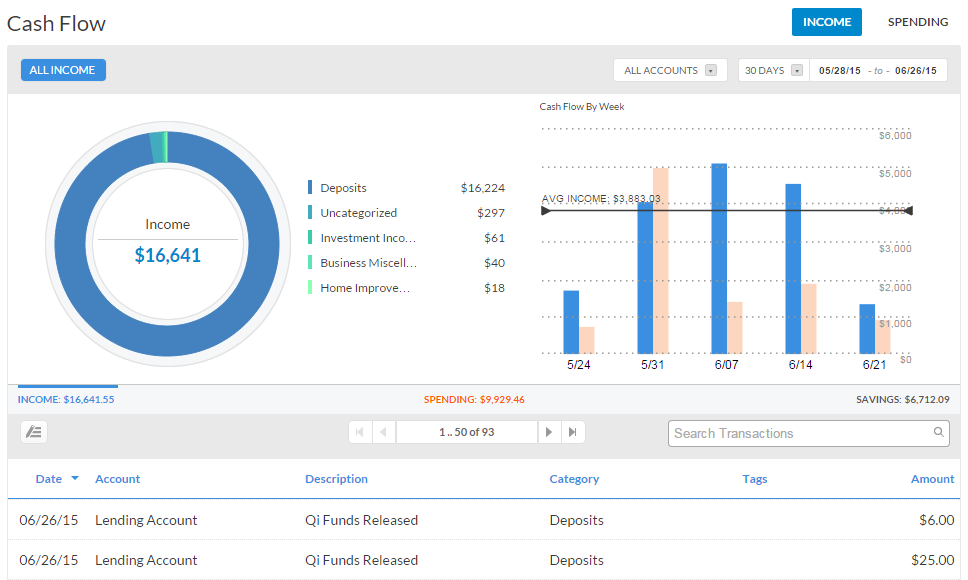

Let’s say you think you have a spending problem. All you have to do to drill down into that issue is click on “Cash Flow” and then you are brought to the detailed cash flow page, which contains all your juicy spending details. Note that it automatically categorizes all your expenses for you. To the right of the spending summary it also shows you income (blue bars) and spending (orange bars) by week. This is all based on the time frame you select, but it defaults to the last 30 days.

The details of the expense bucket are found right under the charts. Personal Capital does a great job automatically applying categories to your expenses, but it does get it wrong from time to time. It’s simple to fix the category manually so that it gets counted in the right expense bucket. I’m hoping that in the near future they will add functionality that allows you to create a rule that categorizes certain expenses with the label you define based on certain criteria.

Income Tracking

Once you’re done digging into your expenses you can switch over to the income report. It essentially gives you the same view as the expense tracking but for your income. If you look closely I have not done much to split out the different streams of income, which is mostly because I’m lazy and I don’t want to go through the effort of classifying my income each month. So I just do that offline, but eventually, I plan to do it within the PC application.

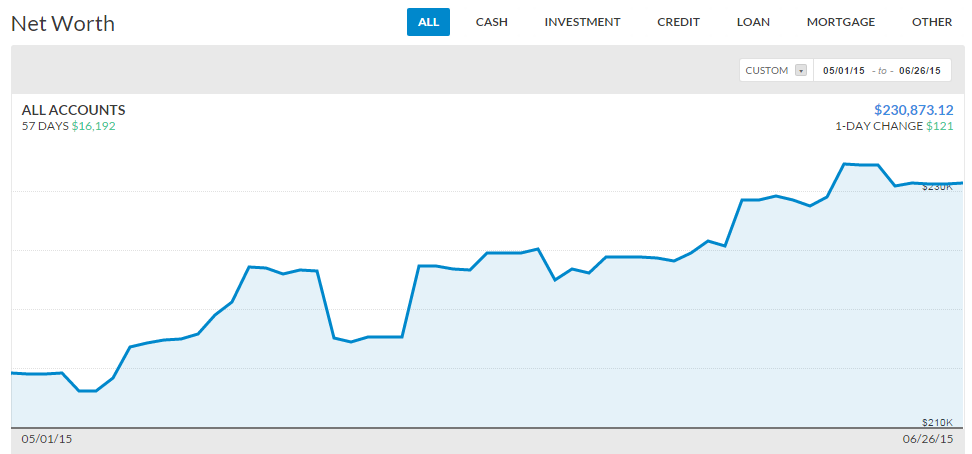

Net Worth Tracking

My favorite place to go in Personal Capital is to the Net Worth page. For me, this is the one metric that matters as I’m in wealth building or accumulation mode. On this page you can select any time frame within which you want to view your net worth progress. And of course we’re all hoping for a trend that is up and to the right.

Other Cool Features in Personal Capital

- Fee Analyzer – When I first got Personal Capital, this was one of the first tools I checked out. Most people don’t realize how much of their accounts they are giving up to fees. I hope that after you use this tool, you will think hard about the different funds in which you are invested. Fees can equate to hundreds of thousands of dollars over the life of your portfolio. Mutual funds are notorious for outrageous fees, and you have a right to understand what that means to you financially. Could you be better off moving your funds out of the mutual fund and into a low fee index ETF? Further motivation to do that is the fact that 80% (or more) of mutual fund money managers underperform the benchmark indexes for their respective funds. So…what are you really paying for?

- Investment Checkup – This tool allows you to compare your current investment allocation to the ideal allocation, set to minimize risk and maximize returns in order to reach your financial goals. It will make recommendations to optimize your portfolio and even allow you the ability to do some backtesting.

- Net Worth Tracker – I talked about part of this tool above and showed the screenshot of the net worth chart that Personal Capital provides you. But this tool also allows you to dig deeper into the breakdown of your asset allocation and portfolio performance. It even allows you to benchmark your performance against the major indexes like the S&P 500 and the DJIA.

- Cash Flow Analyzer – This is really what I already mentioned in the above “Income Tracking” and “Expense Tracking” sections.

- Money Management Services – Once you open your FREE account you are entitled to a complimentary financial consultation where they will review your entire financial world and point out strengths and weaknesses. You’re under no obligation but they will offer you their money management services to execute a personalized plan on your behalf. The management fee starts at 0.89% up to the first million and then tiers lower as your assets under their management increase. (note: I turn them down when they periodically call and tell them I’m only interested in the free software)

- Retirement Planner – This is actually one of the newest additions to the suite of tools found in the application. It allows you to run many different scenarios and has access to your actual income and expense as a solid starting base. It’s one of the most robust retirement tools I’ve seen out there. You can plan for future expenses like a new home or college tuition. You can even plan for different types of income events like social security or inheritance. Check out this short video:

https://player.vimeo.com/video/131793767

Summary

I personally use Personal Capital for the amazing free tools they provide. They are great to monitor my financial health and progress towards my goals. I used to use Mint, but found Personal Capital to be much more investment-focused, whereas Mint is more budget-focused (both are free).

Mint was the first tool I found way back in 2009 before Personal Capital existed. But if I didn’t have either account and had to choose one today, I would go with Personal Capital every time. I do hope Personal Capital will add in as a feature the ability to add classification rules like you can do in Mint. This is the only complaint I have.

Remember, “If you can’t measure it, you can’t improve it,” as Peter Drucker said. Use Personal Capital’s nimble tools and robust functionality when it comes to planning your financial future and optimizing your investments. Up and to the right all the way!

Sign up for a FREE Personal Capital account here.

Are you already using Personal Capital? Do you use a different tool? What has your experience been like? What do you love about it? What do you wish it could do or do better?

– Gen Y Finance Guy

26 Responses

Agree that Personal Capital is the superior tool. Started on Mint but grew frustrated that they didn’t support all banks or my Employee Stock Option accounts, and alternatively did not have a mechanism to manually add shares. Personal Capital does which I find greatly useful when tracking net worth as you don’t even need to add banks, just shares.

Godspeed.

Glad Personal Capital is working well for you Funancially Savvy!

It’s Net Worth tracking and investment tools are far superior to Mint. But I still like the budgeting feature and rules in Mint better.

Makes sense – I haven’t really gotten into the budgeting aspect.

wow! very original content. This is the first personal capital review I have seen.. going to use your affiliate link now and sign-up! thank you!

Glad you enjoyed it Joe. And thank you for the support in using my affiliate link to sign up for an account.

Let me know if you have any questions.

was being sarcastic.. I don’t mean to be a blog troll but please add some fresh content.. everyone and their mother has already written a review on personal capital (as I am sure you are aware).. i.e. you are not really adding anything new here.. I look forward to content on this blog down the road that I cant also find in a hundred other places.

Either way I appreciate you taking the time to leave two comments on this post. Whether you are a blog troll or not, you obviously have a lot of time on your hands.

You may have seen this on dozens or even hundreds of other blogs. What you don’t see are the emails I get from people privately asking about personal capital. This is my way of documenting it in one place, in my own words, using my own data, as a reference to now point people too.

Unfortunately for you it doesn’t makes sense for me to write to please just one person. If it was worth my time, trust me I would consider it, but it’s not.

Did you know you have actually now left 6 comments on my blog (two on this post and 4 on past posts)? Your first was very meaningful on 2/11/2015 at 9:41pm:

And while we are walking down memory lane, here are the other enlightening comments you left:

So again I thank you for your MEANINGFUL contribution over the past 6 months.

Cheers!

How well does Personal Capital link up to PeerSteet?

Thx

Perfectly! I have both my accounts with PeerStreet linked to Personal Capital.

Sweet, thanks. I need to give Personal Capital a try. Just the idea of someone else (Yodlee) having all my user names and passwords makes me a little nervous.

Today was another pay day at PS. 🙂

Dave

I have never heard of Yodlee, but by the sounds of your comment it sounds like another platform like Personal Capital. They only get read only access to your accounts and the way I understand it, your account login information is encrypted from them seeing it.

You can check out the safety details here.

What asset class did you list PeerStreet as in your Personal Capital account? Thx

Dave – They come in as “unclassified”, but I have manually adjusted them to “alternative”.

Here is an interesting article from March 2017 talking about how some of the banks are making it hard for companies like Yodlee and Personal Capital to get user data:

https://www.nytimes.com/2017/03/23/business/dealbook/banks-and-tech-firms-battle-over-something-akin-to-gold-your-data.html?_r=0

Thanks for sharing Dave!

You should read more about Personal Capital then! 🙂

Yodlee is the Co that holds your usernames and passwords and does the connection between your financial institution and Personal Capital.

Like you said if someone breaks into Personal Capital, not a big deal because it’s read only (and usernames and passwords are not stored there), but if someone breaks into Yodlee look out!

What we need is for all of our financial institutions to have a second username and password for each of us that only allows read only!

Help me get my number please

Are you able to track Rich Uncles holdings in Personal Capital? This doesn’t seem to be an account type that Personal Capital supports today.

Currently, you have to manually add Rich Uncles to Personal Capital. I update this once per month in my own Personal Capital account.

Dom

Are you concerned about personal capital being hacked? I want to use personal capital/mint but am concerned that all my information will be saved in one location. account numbers, passwords… not sure the extent of the damage if this service lost data to hackers

L – I’m personally not worried about it. If you read through the comment string I shared a link about the security of Personal Capital. Here is a link to the specific comment.

Thank you for this! I was raised in a “numbers-oriented” household, so this makes perfect sense. My mom was a math teacher and my dad was a stock broker, so we like to talk about numbers.

Personal Capital is a great tool! Everyone can benefit from using it.