“Most people fail in life not because they aim too high and miss, but because they aim too low and hit.”― Les Brown

Many of you reading this found me through my guest posts over at Financial Samurai and 1500 days. Ever since those posts went live, I have been getting a lot of questions about my $10,000,000 net worth goal. Some people think I am nuts and question if I really need that much money. But even more than that, they want to know how I plan to get there by the time I am 48.

I have a tendency to set goals and then work backwards, or “reverse engineer.” When I set that goal I had no idea how I was going to get there other than through pure ambition and determination, and of course substantial increases in my income in order to fund enough investments to ultimately achieve that gargantuan number. One of the reasons this blog was born was to serve as a source of accountability to myself on the way to achieving my goals. A lot of pressure and motivation comes from publicly announcing goals and tracking progress online, hanging out in “public” for all to see. This is especially true in a socially “taboo” arena such as personal finances.

(It always surprises me how uncomfortable people are when talking about finances. Yet they feel comfortable airing and unloading so many other kinds of dirty laundry.)

So after putting this post off for a while so that I could think about how I would reach my goal of $10M, I finally sat down and started crunching the numbers in Excel.

What do the numbers look like on the road to $10M?

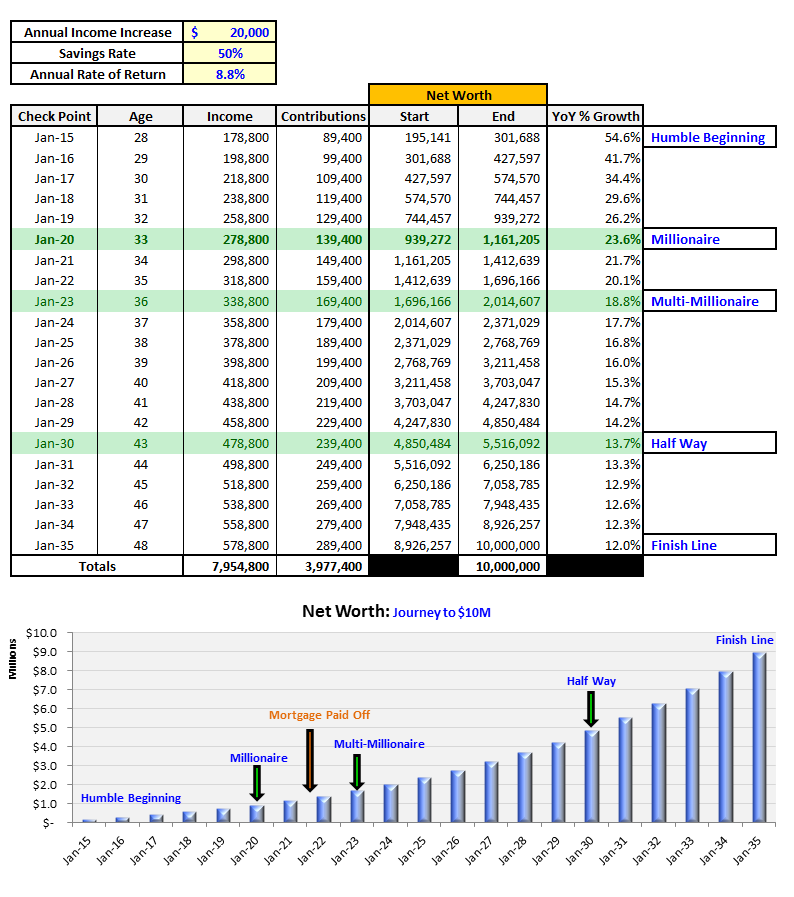

There is an old adage that says “a picture is worth a thousand words.” Below is a picture of the number crunching that I did in my handy-dandy Excel spreadsheet. Excel is probably my favorite tool in the entire world with the exception of the internet. For me, the table and the chart below says it all. I clearly see the milestones I have to hit if I want a chance at achieving my goal of $10M. But since you don’t live in my head like I do, I probably need to expand on my assumptions and give a bit more narrative of how exactly I plan to get there.

Let’s break down the Assumptions

After I explain the components and the plan I have in order to achieve $10M in net worth, we will get to the income side of the equation ($50,000/month). First things first: is my plan aggressive or conservative? In all honesty, I think it is conservative on the income side of the equation but aggressive on the assumption of an annualized rate of return of 8.8%. Taking those facts into consideration, I would tend to believe that my plan lies somewhere in the middle and lands at moderate. Only time will tell. What is great about putting a plan like this together is that it gives me milestones to hit along the way, and check both my assumptions and stretches.

OK, let’s dive into the meat and potatoes of the assumptions of this plan and figure out how it all comes together to total $10M.

Starting Net Worth: As of my January financial report, you can see that my starting net worth is $195K. I only recently started tracking this but will update this number on a monthly basis via my detailed financial reports. I have created a dedicated Financial Stats page that will summarize my progress and it will provide links to all of my detailed monthly reports. I think it’s important to point out that I’m starting from very humble beginnings. I will say this though, it doesn’t really matter where you start as long as you get started!

Net Worth Growth Assumption: I have factored in a growth rate of 8.8% which I mentioned above may be a bit aggressive. The stock market has returned around 8% historically and the real estate market around 5% (in California). Although this may be aggressive, I think it is offset by my conservative approach on my income assumption.

Income: This assumption represents total household income (for both Mrs. GYFG and myself). If you look on my financial stats page you may have noticed that in 2014 we brought in $214K, yet I am forecasting only $178K for 2015. This largely has to do with a 2014 windfall of about $20K and income from my side business of $18K that we don’t expect in 2015. These two items not carrying into 2015 explains the drop in income.

Income Growth Assumption: In my model, I have assumed an annual increase of $20,000/year starting in 2016. Now keep in mind that the income is actually a combined figure for both my wife and myself. Additionally, the income increase can and will come from various sources including jobs, rentals, online business, and other cash flowing investments in post-tax accounts. This may seem very aggressive, but we are both in the sweet part of our careers, and the upside is looking really good. I alone have averaged increases of $12,000/year and based on my career path, don’t see that stopping or decreasing anytime soon.

If anything, that number is likely to increase over the next five years. Additionally, my wife made a strategic decision to take a pay cut of almost $25,000 to join her parent’s family escrow business two years ago (2013). She did this knowing that if she put in the time and the work her upside was much larger than at her old corporate job. In the coming year, we anticipate her income jumping substantially. There is also a ton of upside in the online business piece of the equation that could blow this current assumption out of the water by 2-3X. So I think this assumption over the next 5-7 years is conservative.

Savings Rate: A very large part of this 20-year plan to $10M is heavily reliant on an after-tax savings rate of 50%. If you would like to see the formula I will be using, please visit Mr. Money’s Mustache’s post here. He details it very well and I would rather let him lay it out for you, since that’s where I got it. You will notice that based on the formula Mr. Money Mustache presents, that my savings rate will be calculated on after-tax income (I do deviate slightly by including healthcare insurance expenses as a tax, as they are required by law).

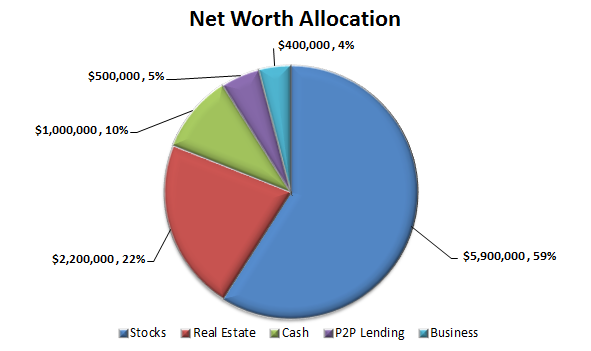

What will the asset mix of the $10M look like?

Great question. As many of you know from reading my posts on paying down my mortgage in seven years here and here, a large chunk of my net worth will be tied up in my primary residence. I factor in 20 years of compounding for the value of my home at a 5% rate of value appreciation. Pretty conservative for where I live. Also, from the table above you can see that almost 40% of the net worth comes from savings alone. But let’s break it down.

As I write this, I see the $10M net worth being comprised of 5 major categories:

- Real Estate

- Business

- Stocks

- Peer to Peer Lending

- Cash and Equivalents (things like CDs and money market accounts)

Over time, as my net worth grows, I realize that there will likely be new doors that open up that are typically only open to accredited investors and high net worth individuals. But we will cross that bridge when we get there. For now, this is where I see the mix.

Before I can give you percentages, let’s work backwards…

Real Estate Valuation

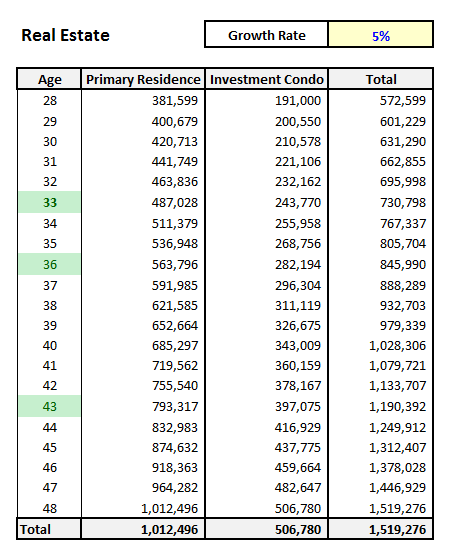

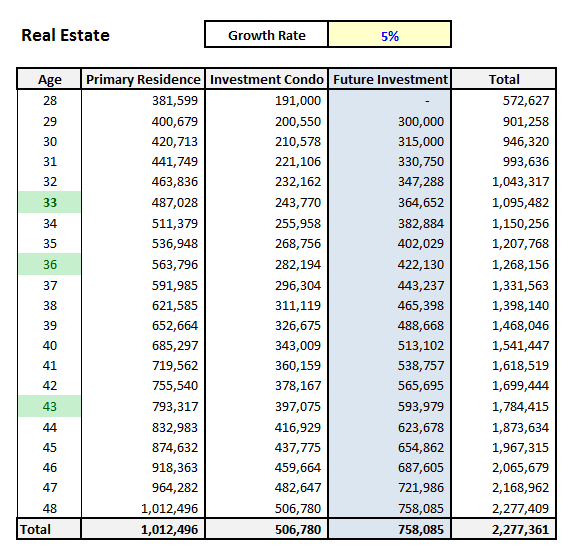

We currently own our primary residence as well as one investment property. In my model, I assume a 5% annual growth rate of these over that 20 year period. Also based on the accelerated mortgage pay down strategy on our primary residence, we will have this completely paid off in seven years instead of the 30 year term. We are also ten years into a 30-year mortgage on our investment condo and will have this paid in full by the time we turn 48. We have no current plans of paying it off early.

Update: we actually sold our condo as of October 2017!

Our current holdings bring us to a net worth valuation of about $1.5M. We do have plans to add another investment property sometime in the next 6-12 months. We will assume a $300K purchase price while financing 80% of that (or $240K). Let’s also assume a 4.5% interest rate and that by the time we are 48, we are 19 years into the loan. This would leave us with a mortgage balance of approximately $125K.

This now gives us a total valuation of $2,277,361. We have to deduct the mortgage balance to get the net worth portion of our real estate holdings ($2,277,361 – 125,000), which gives us a total real estate net worth of…

Real Estate Net Worth = $2,151,361 or 22% of total net worth.

Business Valuation

One of my goals is to turn my passion for personal finance and financial freedom into a business. To see examples of others who have monetized blogging and podcasting, look no further than John Lee Dumas of Entrepreneur On Fire and Pat Flynn of Smart Passive Income. These two really show what is possible with a completely online business.

I have big plans for this blog as a platform and a business. The best part is, I plan on doing this while still giving away 99% of what I do for free. You will see some affiliate links embedded in posts and a few product links and recommendations in the sidebar, but I promise to do this in the most tactful and unobtrusive way possible (the last thing I want to do is distract you from the content). I will only recommend products that I use myself or have used in the past. They will always be from companies/people that I know, like, and trust. In many cases, the products/services will be FREE to you.

A perfect example of this is the Personal Capital banner you see in the sidebar to the right of this post. Personal Capital is a wonderful technological tool to manage all of your financial accounts in one place. It fits my vetting criteria as something I use myself, something that will definitely help you out on your journey to Financial Freedom, and best of all, is absolutely free to you.

Now let’s talk dollars and cents. I believe that I can grow GYFG into a business that can produce $25,000/month in gross revenue. I know it is not going to happen overnight and could take years (and still may never reach the potential I see). But if I am successful, revenue will come from various sources that may include, but are not limited to: affiliate links, ads, digital products, sponsorships for a podcast, online financial summits, coaching, and other ideas I have.

If you look at Pat Flynn and John Lee Dumas (who are absolutely crushing it online, making between $100,000 and $300,000 a month from their online business), you can see I am talking peanuts compared to their success. If I do better than this plan calls for, it will just be gravy. The guys over at Empire Flippers say that an online business can estimate its valuation by multiplying monthly net profit by 20 (representing 20 months). Let’s assume I can keep expenses at 20% of gross revenue. This would produce net profits of $20,000/month.

Business Net Worth = $400,000 or 4% of Net Worth. (20,000 x 20 months)

Peer to Peer Lending

Although P2P lending is a rapidly growing market, I really don’t know how scalable this is. Meaning, how hard would it be to put $500,000 to $1M to work? But I will assume that it will only grow in scalability with time. So I am going to assume that I grow this to about $500,000. June will be the first month that we start allocating money to this piece of our portfolio at an initial rate of $500/month.

P2P Lending Net Worth = $500,000 or 5% of Net Worth.

Update: Since writing this several years ago, I have since pivoted and moved into hard money lending for this piece of the pie.

Cash and Equivalents

The goal here is keeping about 10% of our total net worth liquid in order to be ready and able to take advantage of opportunities that come up in the market. I call this “dry powder.” We don’t know what these opportunities will be, but they happen more often than you might think. It could be someone selling a business at a fire sale price because they need the money. Or maybe it will be an opportunity to invest in a start-up. Whatever the case might be, I have always believed it is a good idea to have cash (or something quickly turned into cash like CDs or money market accounts) readily available to take advantage of such opportunities. Hopefully, interest rates will rise a bit in the future so that, properly held, this idle cash can earn something better than 0%.

Obviously, this will be something that is built up over time. But I do plan to have this component set by the time we are 48.

Total Cash and Equivalents = $1,000,000 or 10% of Net Worth.

Stocks Valuation

I envision the majority of my wealth tied up in equities. After figuring out the other four categories, this leaves the remaining 59% of my Net Worth in stocks. You will notice that I don’t have an allocation for bonds, and that is by design. I anticipate rates to stay low for an extended period of time, but I just don’t know how low or for how long. At this point, I am not interested in allocating capital for 30 years for a 3% gain. If rates rise substantially I may reconsider this allocation, but for now, this is the planned allocation. Additionally, I may choose to sell some equities to pay off the remaining debt on the projected third investment property of $125K, if we didn’t decide to do it at an earlier date.

As you saw from the table above, I have planned to contribute almost $4M into investments. As you can probably guess from what I just stated, this will almost entirely go into equities (my favorite asset class to invest in). In doing this, I will be employing options which I use to enhance returns and mitigate risk. I use two main strategies: Covered Calls and Short Puts.

Total Stock Valuation = $5,900,000 or 59% of Net Worth.

The Big Picture

I promised to also touch on the other side of the goal which is a monthly income of $50,000. In the business valuation section above I stated that I plan for GYFG to be eventually contributing $25,000/month in income. The remaining income will come from rental income, dividends, interest, day job (assuming I still have one by then), and any freelance work I might do.

The only other thing I would point out is that I am not planning for this to happen overnight. I have given myself an aggressive timeline of 20 years, but also plenty of runway so that it seems achievable and maybe even beatable. This is something only time will tell. Many people reading this may ask why I want to accumulate so much. The simple answer is because it’s a game and a challenge. Since it’s my game, I get to set the rules of winning, and $10 million is a number that I believe represents enough winning to afford me a lifestyle to do as I please. Personal finance is….well…personal. I don’t expect you to have my same goals, and your motivations may very well be different than mine.

So what will I do with all this money? I don’t know exactly just yet. But that will be a part of the journey. It will be fun figuring that out along the way.

Laying this all out, and having to reverse-engineer it to make the numbers support my vision was actually a very interesting and valuable exercise to go through. Do you think I am a crackpot? Maybe you see places to poke holes through my overall plan. I welcome either of those reactions with open arms. The GYFG blog has many purposes, one of which is providing a place for me to get my ideas, goals, successes, failures, and learned lessons out of my head and out to the world and I appreciate all interaction as I do that. This plan could change entirely in a year or two, but it’s my starting point and something to hold me accountable. Most of all it gives me milestones to hit.

I have always believed that it is better to move forward with a good plan than wait for a perfect plan. If you wait for a perfect plan you may never actually take any action: analysis paralysis. Version one is better than version none! Will this plan change? No doubt in my mind that it will (and has – see “updates”). But it gives me a very high-level roadmap as to what it is going to take to get to my $10M in 20 years goal.

Now it’s your turn

This post has gotten pretty lengthy. But before we go I want to ask you: what is YOUR number? Do you have one? In the comment section below let me know what your number is and at a high level what you envision the asset allocation to be as well as how many years you anticipate it will take you to achieve.

– Gen Y Finance Guy

Still reading? Right on!

Do you want to help keep the GYFG lights on? You’re under no obligation, but your participation would be very appreciated! By accessing the following resources via the links provided, GYFG gets a small commission and it doesn’t cost you one penny more. You’ll actually save money on #3!

- Personal Capital – You know how big I am on tracking my finances: “You can’t improve what you don’t measure.” -Peter Drucker. Personal Capital’s FREE software helps you see all your financial accounts in one secure and convenient place (checking, savings, investments, and retirement accounts). I use Personal Capital myself, daily, and recommend that you do, too. Without a tool like Personal Capital, these reports would take 2-3 times as long to complete. You want to track your income? Your expenses? How about your Net Worth (everyone likes watching that bad boy climb upward and rightward). Just sign up and link your accounts today. Absolutely free to you!

- Amazon – I order just about everything from Amazon. Not only does Amazon have the lowest price, but with Amazon prime I get FREE two-day shipping as well as the following: One Million ad-FREE songs, FREE instant streaming of thousands of TV shows and movies, FREE unlimited photo storage in the cloud, and FREE books for Kindle. At some point we all actually need to spend money, but we might as well get the best price, and some freebies. Anytime you use this link and make any sort of purchase on Amazon within 24 hours, GYFG gets a very small commission at no additional cost to you.

- Blue Host – Has GYFG inspired you to create your own blog? Everyone has something unique to add to the world of information, whether in the financial sphere or another. Let me save you some money in doing it. I use Blue Host to host GYFG, and recommend it to you. It is stupid cheap and the customer service is amazing. The normal price is $5.99/month, but if you use this link you will get a 34% discount (only $3.99/month). It took me less than five minutes to buy my domain, install WordPress, and get the first version of this site up and running.

Also check out our Recommended Products and Resources page for more things I use and recommend. I firmly believe in sharing what works for me so these proven shortcuts can save you time and resources. Who doesn’t like that? Others have shared with me, and I am happy to pass along any help I can offer to you.

68 Responses

Ambitious, no doubt about that. I think some will question or criticize your goal of hitting $10MM, but given that aren’t factoring in inflation, this isn’t all that unreasonable over a 20 year window. At 3% for inflation, that $10MM is more like $5.5MM in today’s dollars.

Ultimately the real point of this is setting your eyes on a goal and logically laying out what needs to be done to hit that goal. Given your savings rate, you will be financial independent long before you hit the $10MM mark. For you the point isn’t really FI, but that you’ve achieved something you’ve set out to accomplish.

Best of luck on this journey.

W2R,

That is a great observation. I have not factored in inflation and like you pointed out that using 3% this would bring it closer to $5.5M using a present value calculation.

I am actually hoping that people question it, but more importantly poke holes in it so that I can iterate. This is still very high level and I know there are other factors that I have not considered.

So anyone reading and debating to comment, if you have some constructive criticism, it is more than welcome.

Although Financial Freedom is a goal, I would need far less than $10M and if things go according to plan I should be there in 7-10 years. The ideal situation is that I am able to build my business into something big enough to hit my income assumptions, that would allow me to completely step away from my job.

Or there is the possibility that I get to Multi-Millionaire status and I re-write the plan. Because by then I will be playing by different rules.

Anyways thanks for stopping by and for your support.

Cheers!

GenY,

10 Million is a great number and a wonderful goal to shoot for. I think with 2 Million I could ride off into the sunset and never look back. Never trying to sharp shoot anyone, but do you think 5% on real estate is realistic. Our home in South Carolina has done that however the area I live in now is going down. The projection on Zillow shows it losing 2% over the next year or two. Also property taxes in MD keep going up and up.

Thanks Army Of Dollars!

$2M is plenty to be financially free. But as W2R pointed out above, this isn’t just about financial freedom.

Regarding the 5% assumption for real estate growth. There is definitely risk there as in any of the assumptions. Just like there is risk in assuming the market will continue to return on average 8% over the long term.

Its a great question and one that only time can answer. If we do eventually get some inflation then I think its a slam dunk.

I will only try to control the things I have control over. The other things will do whatever they do and I will have to pivot and adjust accordingly.

Cheers!

Do you have your homes/investment plugged into Personal Capital. It updates quite often for us and is a pretty good number.

Yes I do. That is exactly how I update my home value on my monthly financial reports.

Thanks for the tip though.

Wow Gen Y! You put a lot of work into this one.

I can’t find fault with your numbers. You have a great salary so if you keep that savings rate inline with expectations it seems doable.

The only way I would end up with $10M is if I win the lottery, hah!

See ya around,

Robert

Hey Robert!

This one took at least 4 hours to put together between the writing and the charts & tables. Plus the countless hours I thought about the goal before ever sitting down to write about it.

I just got done writing my February financial report and due to some planned home improvement costs we didn’t save outside of our pre-tax retirement accounts. However we still made the extra payment on the mortgage and saw our net worth increase by around $2,000 for the month. March and April will be tough as well because of some business coaching my wife is doing and the check I will need to write to the IRS for taxes. But May through December should be some EPIC saving months.

As I mentioned in the post, 40% of the $10M comes from contributions alone. So the savings rate is in my opinion the most important variable to monitor.

Looking forward to climbing the ranks on your new side project tracking net worth’s in the blogging community. Let me know if there is anything I can do to help keep that updated for you.

For other reading, here is a link for you to go check out Roberts blogger wealth project: http://bloggerworth.com/leaderboard/

If you ever want to do a guest post about it, I would be happy to have you.

Cheers!

In that income bracket it’s not magic. Just time, savings and compounding. I enjoyed the specific breakdown and plan. Mine doesn’t look all that different, but I would probably bail on my day job before $10M ($4-5ish?) at least based on my current career.

Thanks Adam!

The savings rate is in my opinion the one metric that matters. Since it is responsible for 40% of the net worth alone. Plus, if I don’t make those contributions I don’t get the opportunity to realize the compounding.

Looking forward to see a future post from you on your plan. Always interesting to see others goals and how they plan to get there. Something Even Steven pointed out recently in his blue print to financial freedom, is that he has noticed that most have a preferred asset class to invest in that dominates their portfolio. For me its Stocks, but for others its real estate or something else.

Let us know when you write that post 😉

Cheers!

It is quite doable to invest $1 million on the Lending Club fractional loan pool. Some have even had that much money put to work in less than 48 hours as long as there’s no filtering.

Great read. Thanks for sharing.

Hey Simon,

You would be the man to ask a question like this. Thanks for confirming it. And I assume it only becomes easier overtime as these P2P platforms continue to grow in popularity.

I wonder what the average loan size is in a portfolio of $1M.

Cheers!

Definitely wouldn’t be difficult to do. With nearly 32,000 fractional loans issued in just the fourth quarter of 2014, you’d be in great shape if you weren’t concerned with too much filtering. I’d say realistically, if you went for $500 per loan, you’d fill up within a week or two. Since you’d be building an account over time, it would be even less of an issue.

I think it is a decent plan, the only area I think you are being a bit aggressive is $20k/year income growth. I just turned 32 and when I got out of college 10 years ago I had a job making $65k/yr. My total compensation is over $300k/year from my job, but I have very little prospect to increase my compensation much. Also, very little increase over the last couple of years. I also get the feeling my boss is paid a small amount more than me and I know the C levels make more, but it certainly isn’t worth it in my mind. Of course, you’re counting 2 incomes, not just one […]

Good luck.

Thanks Elroy! Sounds like you have done well over the past 10 years with $300K in income. As you pointed out this is an income assumption based on two incomes. Based on the plan our dual income won’t match your single income until we are 34. But you make a good point that there could be risk in the $20K/year increase in income. As with any plan that goes this far out in the future, many variables are likely to change.

I fully expect to tweak and pivot as time goes on. Now I have to get to work in order to catch your single income 🙂

Cheers!

Holy crap this is a seriously impressive plan you’ve put together. You’ve clearly thought this out and ran some numbers. I’m honestly not sure what my number is, but I’m always focused on moving in the right direction.

Thanks DC!

Onward & Upward!

Always good to be making progress in the right direction.

Writing things down and visualizing them in charts and tables is a big part of turning goals into reality. Sometimes when we come up with targets we’re excited and start off strong, but fade because we lose focus and don’t really understand what it’s going to take to get to our end game. Solid job with your vision and laying it all out!

Thanks Sydney!

I couldn’t agree with you more. You have to ink it and not just think it as they say. This certainly gives me goals and milestones to hit. Do I expect things to go exactly as planned? No. But I do have a solid framework to work from and pivot off of.

Its going to be fun working from this blueprint over the next 20 years.

I love the fact that your plan is so detailed and working the numbers backwards certainly makes sense.

Ambitious, no doubt – but with the kind of income you’re churning, it seems feasible. After all, what’s a man without ambition 😉

This has just inspired me to come up with a detailed plan like yours.

Cheers,

Josh

It took a while for me to figure it all out. I put writing the post off for weeks, but man it was a great exercise to go through. Now I have a blue print. The income assumption paired with the savings rate is really the linchpin to the whole thing panning out really.

You know what they say…Every overnight success is 20 years in the making.

Looking forward to seeing your own plan.

Cheers!

I should implement a plan also just like this. Currently I am single and with a net worth of about 500k. Currently my allocation is mostly index funds, REITs, bonds, and some cash. I live overseas and I am currently out of the US. So getting into rental properties would seem way to tough to handle if my plan is to be overseas many more year. I currently bring in about 150k a year, and my expenses are extremely low. I generally can save and invest up to about 120k a year depending on my expenses of course.

I forgot to add, I also use lendingclub. But this portion only represents about 1-2% of my over all net worth. I am slowly adding but have not been aggressive enough. I started about two years ago with a lump sum. I generally quickly re invest interest as it comes in. It started off as a hey I’ll try this with a small amount of money. I am averaging about 9.5% currently from it. I need to add new money on a monthly basis to get this up at least 5% which I feel comfortable with. Once I reach a million, I would like to get into more investments that involve being a Accredit investor. I do some research on it here and there. But will have to wait until I reach that mild stone to actually implement it.

9.5% is a great rate of return. I am right there with you, I look forward to hitting the Accredited Investor status.

I had a return of about 14% at one point, I did not have many loans at a higher rate. A lot of my higher rate loans were paid off rather quickly. Also had two go into default… then I did not replace them with higher rate notes with interest earned and went a little bit more conservative. Its such a small sample size, I really do need to add more money to my account.

Sounds like you’re doing great. Investing $120K/year is impressive.

Where overseas are you? Sounds like taxes must be extremely low wherever you are. And your living expenses must be low.

Thanks for stopping by!

Currently I am in the middle east, the IRS has different tax laws for overseas income. I work for an American company so I get paid in US dollars and the usual comes out of my paycheck. Some advantages are the Foreign tax exclusion which is up to 97k a year, also if any foreign taxes are paid, you can write those off against any federal taxes owed.

Other perks that I get from my company include housings costs and a food stipend. Most of my spending goes to traveling to places near by when I have free time to do so. I feel like I am spending a lot on traveling currently since that is were my most expenses are going too, since everything else is covered. I basically save whats left over which quite a bit of change. The experience is great too, as I can travel to places that I normally would not go to if I was working and living state side. The ability to save and invest a lot is huge for me… if I had a comparable job state side, I would get paid less and also now I would to cover rent, mortgage and other living expenses. I plan to do this as long as I can or other opportunities come up. In the mean time, its all about getting my money to work for me. The pay is great and includes about 70-100 days off a year. So with that much time off its really tempting to go have a good time too.

Great article though! and great plan! I have been just going with the flow without much thought. I am not much older than you, will be turning 31 this year. I have never really gave it a thought as to what number should I achieve, or what I want my ideal retirement income to be on a monthly basis. I have got a lot of things to ponder on and figure out some set goals.

I have become pretty good at managing my own portfolio, keeping things in balance and re balancing as needed with new money.

I do use personal capital and mint to help stay organized and on top of my entire financial picture.

Sounds like a solid opportunity! I wouldn’t mind 70-100 days off a year. I would milk that one for as long as you can.

Especially with that tax perk!

Interesting post. I think that making money from a blog is certainly doable (I’ve been doing it for half a decade plus and sold several blogs in various niches for into six figures profits).

All that said I think you could make more money faster from a “business” that’s solves a problem by selling a solution.

Final point: most people skilled and talented enough to make a lot of money rarely stop working. Because that talent and drive is what got you there in the first place it’s unlikely you will let it go to waste by not wanting to continue building wealth.

I’m a firm believer that the day I quit working is one second before my last breath. I’ll be financially independent long long long before that point but my motivations for continuing to work will certainly change.

Hey Chris,

Thanks for chiming in. I totally agree about a business will accelerate one’s ability to earn. The bigger the problem you solve the more money there is to be extracted from the market. I have several business ideas that I plan to leverage the blog to help launch over time.

Like you I don’t ever intend to stop working or building wealth. It is way too much fun to quite before you HAVE to.

Thanks for stopping by.

Cheers!

Very impressive goal, and impressive break-down! You have a great head start, and will be interesting following your progress with this blog. I believe you can do it! 🙂

Thanks man!

Only $9.8M to go, no big deal 😉

Hi GYFG,

I’m very impressed with your blog and your long-term FI plan. It is very ambitious and if you believe you can do it, you will be able to do it!

My goal is to reach $2.5M by the time my partner and I are both 55 (we’re 30 now) in 2040. I should start a blog so we can monitor and compare each other’s performance.

Glad you are enjoying the site. It has been a work in progress ever since launching almost 7 months ago.

The goal is to make the site and content better over time. I have been very fortunate to connect with some really cool people during the process…people just like you.

I think it would be a great idea for you to start a blog as I would love to see your plan for achieving $2.5M by the time you are 55.

There are several ways to start a blog for free using either blogger or wordpress.

However, I usually recommend buying the domain and paying for hosting so that you have more control of your content. The cost is so minimal for hosting that it might as well be free.

If you do decide to start a blog, let me know and I will be more than happy to help you.

And if you decided to go the hosted route then be sure to use my link in order to save like 35% on hosting and I think it even comes with a free domain name.

https://genyfinanceguy.com/bluehost

No worries if you don’t use the link.

Cheers!

Hey man, liking the passion you write with here, you can really feel it through the screen haha! 😉

I’m going to have to sit down and really take a read through for a second time although I’m going to be more about passive income rather than net worth.. Generating $10k a month “residual or passive” income is my goal and while part of that will be through accumulating assets such as shares & property it’s also about getting creative i.e. with property development, generating large amounts of cash then popping part of the proceeds into cash generating assets..

After all to me the most valuable resource we have is time :)!

Glad you can feel the passion Jef!

I really need to carve out some time to update this road map as we have absolutely crushed some of the assumptions over the past 14 months since first putting this together.

As you will find once your read through for a second time. The net worth goal may be the focus, but it is also what drives the $50,000/month in passive income goal (or mostly passive).

I agree that time is our most valuable resource. Did you happen to read any of my posts on time? Don’t remember when, but there was a period in time…no pun intended…that I was writing about this.

Cheers,

Dom

Yeah I’m positive I’ve read them although if you asked me to recite every line or word I’d struggle haha

Cool; would be good to have an updated road map, although appreciate it’d take a decent amount of time 🙂

Cheers!

The updated road map will eventually come 🙂

Good blog post. I ϲertainly love tҺis site. Keep

writing!

Just happened across this post, and I love it. I’ve been using a similar calculator since I was 28 (got a late start!) and love checking my progress each week. As far as your $10M goal goes, I think it’s spot on and realistic. A big part of it is simple math. But more importantly, an even bigger part is the psychology – the belief that you’re worthy of $10M. Most people have a limiting belief that it’s simply too out of reach, but you don’t. THAT’S the key.

Late start? 28 is pretty young compared to when most people have their financial epiphany (if they ever have it).

What exactly do you track weekly, I would probably go a little nuts tracking weekly, even with as much as I love data.

I totally concur on the limiting beliefs, people create their own glass ceilings.

You will notice that I don’t have an allocation for bonds, and that is by design. I anticipate rates to stay low for an extended period of time, I just don’t know how low or for how long. But at this point, I am not interested in allocating capital for 30 years for a 3% gain

Does this statement not run counter intuitively to paying the mortgage off early or is the mortgage a hedge against this bet?

Enginerd555,

Thanks for the question.

When we started paying off the mortgage our interest rate was 3.75% with 1.35% in PMI. It is much lower now. But the quote you called out, was essentially saying if I could only get 3% by buying 30 year bonds, I would much rather treat my mortgage as a bond substitute, where I could earn a similar return (by saving in interest expense).

But yes, you could say it is a hedge against my call on long term bond returns.