It’s beginning to feel a lot like…change!

Yes, I can feel myself evolving and preparing for the next chapter of life I wrote about back in 2020. For the last ten years, I’ve been head-down aggressively and obsessively building a financial foundation that would enable my family and me to live life by our design. I’m lucky that I’ve had a partner (Mrs. GYFG) that was willing to dream with me. She has been there to not only support me but work alongside me to manifest our future life together. This took long hours and sacrifice. The “living well below our means” sacrifice was the easy part. But the harder part, the part that can destroy a relationship and a family, is the sacrifice of time and attention they don’t get. I’m not saying I haven’t spent time with my wife and our family, I’m just recognizing that they have mostly received the short end of the stick when it comes to my time and attention.

I recently finished reading a book that was gifted to me almost ten years ago but which I didn’t read until recently, Choosing to Cheat: Who Wins When Family and Work Collide?, and boy did this book find me at the right time. I’ve been working towards this next chapter of my life, struggling to find a way to stop over-indexing my time away from my family. This book put it simply by stating that you can either cheat your family or you can cheat your work. No matter who you are or where you are in life, you (and I) are constantly “cheating.” Cheating is really about trade-offs. I’ve personally hit an inflection point in my life (at 35) that I’m no longer willing to cheat my family. I embraced the work/life blend for the past decade and it worked well in achieving great career and financial success. But it was only meant for a season in life and that season has now passed. I’m now interested in embracing the life/work blend where instead of fitting life around work, I will fit work around life.

I’m not really sure what this shift will mean in terms of the next chapter of my career other than that I will be ruthless with my calendar by prioritizing my family over work. I’m still figuring it all out but I have already started putting up the guard rails on my calendar to protect my family time. I currently allot 40 hours a week for work but going forward that is all work will get from me. The way I look at it is that I got the long hours (70-100 hour weeks) out of the way before I had kids and when my first child wasn’t really old enough to notice. I’m also totally content if that means I earn less money going forward because now the currency I want the most of is TIME. My career and my business were nothing but means to an end in order to build up enough wealth to buy back our time to live life on our terms.

Speaking of time, I think this and December will be the last monthly updates that I write. I will still review our financial position monthly to keep my finger on the pulse, but starting in 2022 I will only be writing a quarterly financial update. In the short term, I’m not sure if I will leverage the two months out of every quarter that don’t have a financial report as an opportunity to write something else or not. Change is in the air!

With all that said, let’s dive into the financial update, and go through the details of this month’s update.

Financial Dashboard

I remember when I first created this financial dashboard back in 2015 and how that first update I shared had us at less than 2% of the way to our $10M goal. Here we are, seven years later, 75.3% of the way there. The most astonishing thing to me is the compound annual growth rate (CAGR) we have been able to maintain since 2012. Our income has grown at a robust 35.2% CAGR. Even more mind-blowing is that our net worth has been compounding at a 78.7% CAGR during that same time period.

TTM Gross Income

The income figure I like to track most is our Trailing Twelve Month (TTM) gross income. We have officially gone parabolic on the chart and I expect to hit another all-time-high in January that will take the TTM north of $3,000,000 where it will likely stay until October of 2022 before an extended decline unless something else not on my radar happens to change it.

Note: The reason I know that our TTM will be north of $3,000,000 in January is that I receive another seven-figure payment related to the sale of my business, with the final payment (almost seven figures) coming in October of 2022.

Net Worth

Current Net Worth: $7,528,214 (up $5,148,774 or +216.4% for 2021)

Previous month: $7,521,552

Difference: +$6,662

The majority of our net worth that isn’t cash or stocks only gets re-valued periodically and even after making some updates this month, our net worth continues to be understated, which means we will periodically have large and lumpy changes to it. This month was a flat month but given the amount of money that we shelled out for tax planning and our re-model, I’m surprised that we didn’t realize a decline vs. last month (our spending was north of six figures for the month).

Net Worth Break Down:

Real Estate (33%) – This is a mixture of private placement deals, equity, debt, and crowdfunding.

Primary Residence (5%) – I decided to split this out on its own because it is something I do want to manage separately from our overall holdings in Real Estate. Our primary residence currently makes up 5% of our total net worth (down from 23% in September 2020). I expect the concentration to continue its downward trend until we move into our new house in January of 2022 (we just completed the kitchen remodel and have painters scheduled for mid-November.) Once we are moved into our new place, I expect this to grow from 5% to ~12% in January. Once we move, we had been planning to sell our current primary residence as we didn’t want to get into the direct landlord game, but keep reading for more thoughts on that.

Net Cash (13%) – We currently have $1,047,893 in cash vs. $1,287,084 last month. I expect this to double in January to approximately $2M.

Alternatives/Other (46%) – This is a catch-all category that captures our investments in the following: life settlements, a special purpose acquisition company (SPAC), a private investment in the Robinhood trading platform, Crypto, Bowery Farming – a vertical farming company, and Cannabis-related investments. This also includes the value of the equity I still own in my business – including the remaining sale proceeds I have yet to receive (the next payment comes in January).

Stocks (3%) – Our 401K accounts are maxed out and we don’t have any new investment planned here for the year. The only thing that could tick this up is when we get the shares from a SPAC that we participated in that currently sits in the alternatives bucket above.

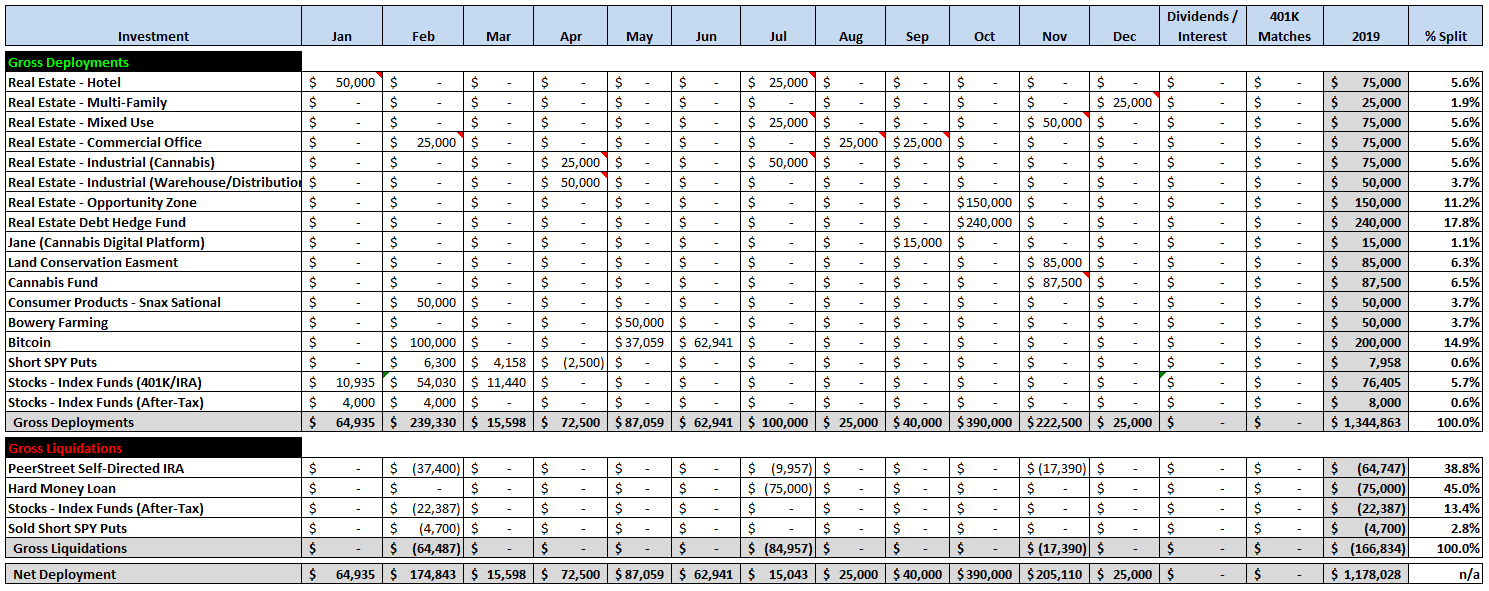

Total Capital Deployed in 2021:

We deployed $205,110 in new investments during the month of November. I’m constantly surprising myself with the amount of capital we’ve been able to deploy this year. Due to the amount of cash we have and expect to have, I think we will deploy $50,000 to $100,000 per month through 2022. We are contemplating paying off the mortgage we will be assuming as we move into our new house but that wouldn’t happen right away. We do want to decide whether we are going to keep our current house as a rental or sell it to cash out the equity. We have doubled our money on our current house and the gain would be tax-free due to the $500K exclusion you get as a married couple. We thought we were dead set on selling it but we have a potential renter that we are seriously considering. If we leave the mortgage on the property we would add about $18,000 per year in net free cash flow and if we pay the mortgage off we could double that to $36,000…TBD.

Closing Thoughts

I’m happy to be wrapping up the year. I am personally preparing to take almost three weeks off to recharge and spend time with my family.

I wish you all a Merry Christmas and a Happy New Year!

– Gen Y Finance Guy

14 Responses

Very close to $10 million! Keep on going! It looks like $11 million is the threshold for a top 1% net worth figure.

Can you elaborate on the tax liability you incur and how you pay/minimize it?

Also, any thoughts on writing posts about how you started your business, scaled it up, sold etc? I think it would be very interesting to read beyond just the monthly net worth updates.

thanks!

Sam

Hey Sam,

Thanks for stopping by. I’m just trying to make it to the 8-figure club with you. You were a big inspiration to me when I first found you blog in late 2014.

I am working on a post that elaborates on how I started, scaled, and sold my business – well 60% of my business. Expect that to get published in Q1 of 2022. The total return on the $267 it cost me to start is a mind-boggling 3,243,616% (and that’s just so far). More to come….

Re: tax liability and how I manage it

I work aggressively with my CPA to pay the legal minimum in taxes. Over the last couple of years I’ve leveraged all the typical tax advantaged accounts but have also leveraged re-investing capital gains into opportunity zones to defer the taxes and land conservation easements to effectively “buy a deduction.”

Owning a business has also had a big impact on the tax efficiency of my personal life. I always hesitate to write too much detail around taxes because it seems so polarizing and I tend to save that for offline conversations with my CPA – I’d rather people explore these with their own CPA based on their specific circumstances. I’ll have a think about this.

Cheers,

Dom

I agree! I’d love to hear more about minimizing tax liability. Are you doing more of the land conservation tax deductions? Any more thoughts on how that went from the last time you wrote it?

I’m still early in my career and have started seriously contemplating starting my own business and would love to read more about how you scaled your company and obstacles you overcame.

Congrats on getting to this next season of life!

Keenan,

Thanks, Buddy.

I did my first land conservation deal in 2019 and it worked just as expected and as I detailed back then when I shared it. The biggest thing to consider is to make sure the company/sponsor is vetted and following all the rules.

The typical range for this is 4-5X your contribution. For example, if you commit $100K To buy units in an investment vehicle that could be voted to be treated as a land conservation you are effectively buying a deduction worth 4-5X your contribution (that is donated).

Let’s us 5X in our example. Your net tax savings is calculated by taking your marginal tax rate * (contribution * 5) – contribution.

At $100K your deduction is $500K and your tax savings at say 37% is $185K gross and $85,000 net of the contribution. The higher your marginal tax rate the higher your savings.

Lastly, the deduction can’t exceed 50% of your AGI but the good news is it does roll over for up to 15 years I believe.

Dom

p.s. see reply to Sam about a post on starting, scaling, and selling a business.

Thanks for the feedback!

I just realized too that it’s in the form of a charitable contribution so I’d also need to factor in itemizing and giving up the free standard deduction into that calculation. It looks like we’re also considering only state and federal taxes since this doesn’t affect FICA taxes (unless I’m missing something) – so my current situation doesn’t quite justify this yet (~21% effective tax rate between federal and state).

As my income and effective tax rate increase this may become more enticing.

Is there an ideal level of work you’d like to maintain into the future? I see that you’re keeping it strict to 40 hours for the foreseeable future but is your eventual goal 15-20 hours a week into perpetuity?

I’m too Type A to completely retire early and am targeting somewhere around 15-20 hours a week of work time long term so that I’m kept on my toes, intellectually stimulated, and cover my family’s living expenses while letting our investments compound.

I’m curious what your thoughts are on that.

Hey Keenan,

Yes, you’re right that FICA doesn’t get a break from a land conservation easement. The HSA is the only vehicle I know of that is not subject to FICA.

Yes, the higher your income the more advantageous this tax strategy is. This is the last thing I turn to from the list of tax minimization strategies.

Regarding my ideal working hours. I think the range is in the 20-30 hour range. Like you, I don’t see myself living a pro-leisure lifestyle full time. Although I do imagine 3 months of travel and leisure every year.

In fact, I’m preparing over the next 10 months to go down to a 4 day work week or 32 hours a week targeting November 1st of 2022 to start this new schedule. To accomplish this I’m putting people and systems in place to continue shedding activities that don’t really need to be done by me.

Dom

Congrats Dom! Sounds like this part of your life is going well. Hopefully everyone is staying healthy in these crazy times too.

One thing that you may want to factor in your rent/sell calculus is that $500k cap gain exclusion. Unless you plan on renting it for the long haul, you may end up giving up more than you make. The exclusion gets prorated for how many years it was your primary residence versus a rental.

As an example, if you lived there for 9 and rented for one you would only get to exclude 90% of the gain on the property. At the marginal rate in CA, the $18k of cash flow may cost you $25k in taxes on the sale. Appreciation may pull you ahead anyway, but just something to factor in.

I’d sell it and focus elsewhere. Too many money chasing opportunities will prevent you from shifting to that next phase you wrote about. You can make similar returns on your capital elsewhere with less time investment anyway.

Hey Paul,

Thanks for the food for thought. I didn’t know that the exclusion worked that way. I thought it was as simple as as long as it was your primary residence for 2 of the last 5 years you got the exclusion and it started as your primary residence.

I thought the scenario you described only came into play if it started as a rental and then was converted to a primary residence (or a vacation 2nd home). This certainly needs clarification by my CPA.

That said, I think you hit the nail on the head, I’d love to just sell it but I’ve yet to convince Mrs. GYFG but getting clarity on how the exclusion works may be just what I need to get us aligned.

Cheers,

Dom

Even if I’m totally wrong on the proration, it’s still not worth your time. You have a skill set that created a business out of nothing into an 8 figure enterprise within a couple years. Obviously you have talent. When I see you making multi-seven figure incomes, the debate over $18k of cash flow seems silly. You’re at the point that you should focus on asset allocation more so than direct investment management. If you want to be more active, sounds like your highest and best use of time is on your business ventures. If you like real estate, just go Grant Cardone on it and buy some $200mm property to make the numbers worthwhile.

I’m guessing your wife might have a more emotional attachment to your house than it being about the profits… place where you have your nursery, where the business started, good memories, etc. if I were in your shoes I would find a way to get her emotionally vested in the next phase of life instead of trying to use financial logic on it. Life has changed for us all in the past couple years and for you more than most. She might be holding onto stability of the old house.

Either way, best of luck and truly first world problems!

Paul,

Your comments are very thought provoking and on point. I have no interest in actively managing a rental.

I’m curious as to what your own background is? (If your up for sharing)

Thanks for the thoughtful comments.

Dom

I run the capital markets function for a private equity firm currently. Previously, I was at an investment bank for a decade plus. Personally though, I have experienced a similar couple years to you. I have 2 young boys and my wife lost her mother suddenly during Covid. I’m also in my mid-30’s so similar phase of life. I go back and forth on direct real estate myself from time to time. I owned a couple properties earlier in my career that we sold and rolled all the equity into our current primary residence. Financially the rentals looked like 50% IRR investments (bought around 2010), but boy were they a huge pain in the rear.

Thanks for sharing, Paul.

Investment banking and then PE. That’s a path that fascinates me. Where do you deploy your money? Do you participate in the deals that your PE firm does?

My experience with IB and PE has been that they work insane hours but seems like a fast path to building wealth if your intentional. It would be interesting if you ever had the desire to share your financial journey going this career route.

I’m sorry to hear about your wife’s mom, our family is still processing the loss of my mother-in-law.

Cheers,

Dom

Just starting the data entry of my own with your ToolKit, thank you. At 53 years old, $10M is achievable, but at an age where my cognitive / physical abilities may not match fiscal assets.

The updated goal for the longer term is to build passive income to $200K / Year. Places the portfolio at $5Million. A play on numbers, yet the focus for me becomes what the net worth does for recurring income by just breathing – passive income.

Thanks for the tools!

My pleasure.