I’m late getting this regular monthly update out because my family’s world has been consumed by the pain of a devastating loss. In February of this year, my mother-in-law was diagnosed with stage 4 liver cancer. We are in shock now that only two months after the diagnosis she lost this battle in early April. Death is very much a part of life. We can know that, but it is a loss like this that brings that truth home beyond a shadow of a doubt: time is rare and precious. It is our own mortality that makes the hours and days we do have so precious – time truly is our most scarce resource.

When you lose a loved one in their eighties or nineties it still hurts emotionally but it’s not normally as much of a shock compared to losing someone this early. We had expected at least another 20 years with my mother-in-law and now we feel robbed of that time we had planned for. My heart is crushed for my wife, her sister, and her dad. My mother-in-law was the quintessential mom. She was so generous and thoughtful. She always made you feel welcomed and you never left her house hungry – never! For 17 years she was the mom I never had and I’m so grateful for the time I got to spend with her.

Although I’m beyond sad that my son and our future daughter (yes, we found out we are having a girl) will grow up without their grandma, I find solace and count my lucky stars knowing that their mom is filled with the same generosity and thoughtfulness that her mother had. My children will experience the best of Grandma through her daughter, their mom.

We will share stories of Grandma with our kids for all the years to come. We lost her too early but we will never forget the shining light she was in all of our lives.

With that, this report will be much shorter than normal because I frankly don’t have much to say at the moment.

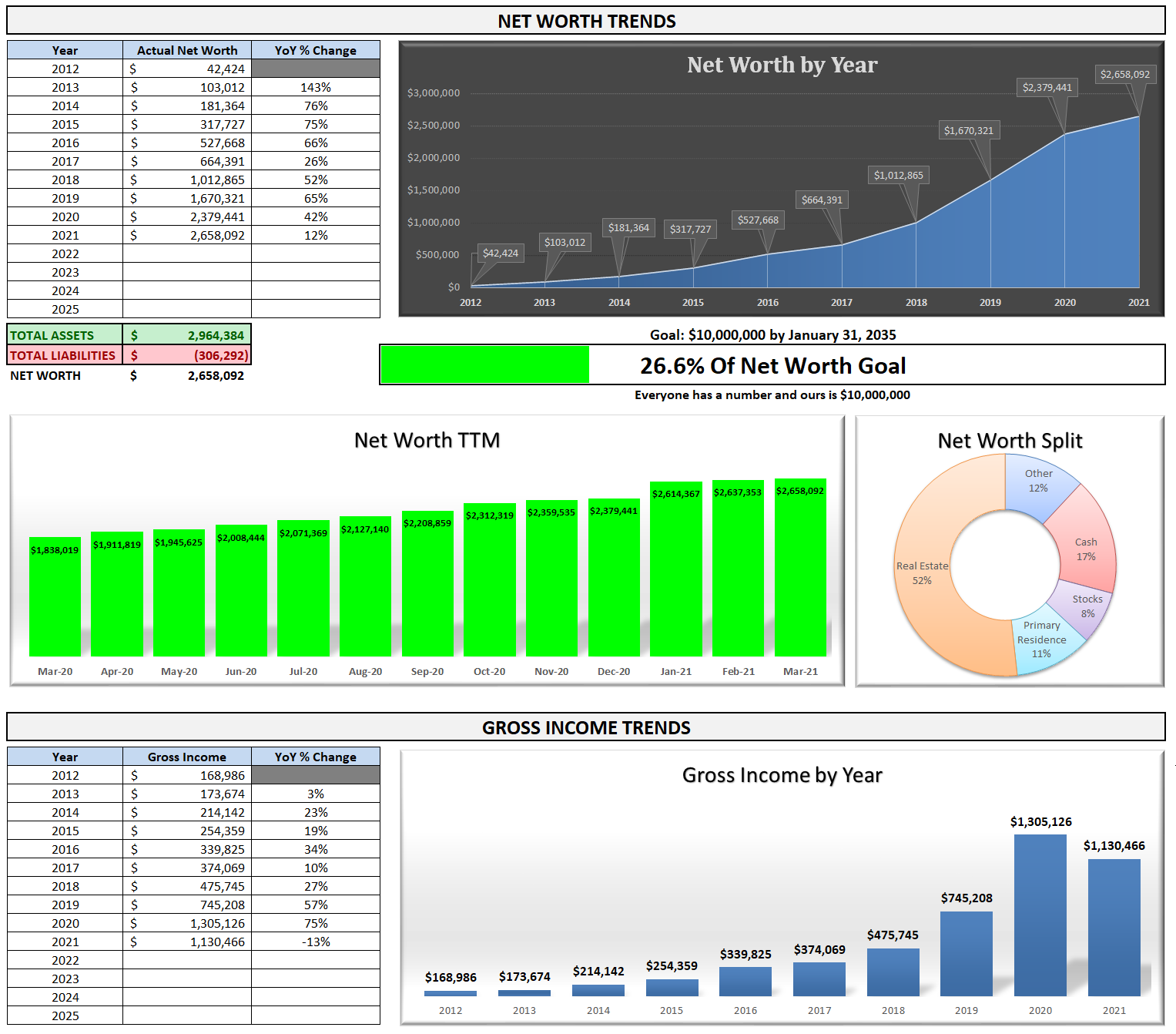

Financial Dashboard

I remember when I first created this financial dashboard back in 2015 and how that first update I shared had us at less than 2% of the way to our $10M goal. Here we are, six years later, at 26.4% of the way there. The most astonishing thing to me is the compound annual growth rate (CAGR) we have been able to maintain since 2012. Our income has grown at a robust 24.6% CAGR. Even more mind-blowing is that our net worth has been compounding at a 65.1% CAGR during that same time period.

Note: our income is currently projected to show a decline YoY for the first time in a decade.

TTM Gross Income

The income figure I like to track most is our Trailing Twelve Month (TTM) gross income. After falling off a cliff in February we had a small bounce up but we have some tough numbers to beat last year as we move through the rest of 2021.

Net Worth

Current Net Worth: $2,658,092 (up $278,652 or +11.7% for 2021)

Previous month: $2,637,353

Difference: +$20,739

A fairly large portion of our net worth only gets re-valued periodically and I currently think our net worth is understated, which means we will periodically have large and lumpy changes to our net worth.

Note: I’m still not holding a value for my business in my net worth. Depending on the multiple you use, the value of my business is somewhere in the range of $700,000 (1X) to $3,500,000 (5X). I’m hesitant to hold a value in my net worth for this until we achieve a liquidity event.

Net Worth Break Down:

Real Estate (52%) – This is a mixture of private placement deals, equity, debt, and crowdfunding.

Primary Residence (11%) – I decided to split this out on its own because it is something I do want to manage separately from our overall holdings in Real Estate. Our primary residence currently makes up 12% of our total net worth (down from 23% in September 2020) due to a cash-out refinance (locking in 2.8675% for 30 years) that put a mortgage back on the property. I expect the concentration to continue its downward trend until we move into our new house in October of 2021.

Net Cash (17%) – We currently have $466,000 in cash vs. $461,000 last month.

Alternatives (12%) – This is a catch-all category that captures our investments in the following: life settlements, a special purpose acquisition company (SPAC), a private investment in the Robinhood trading platform, and the newest addition of Bitcoin (separate section on this below).

Stocks (8%) – We have turned off our weekly investments to Betterment and are currently working to have our 401K accounts maxed out by the end of March.

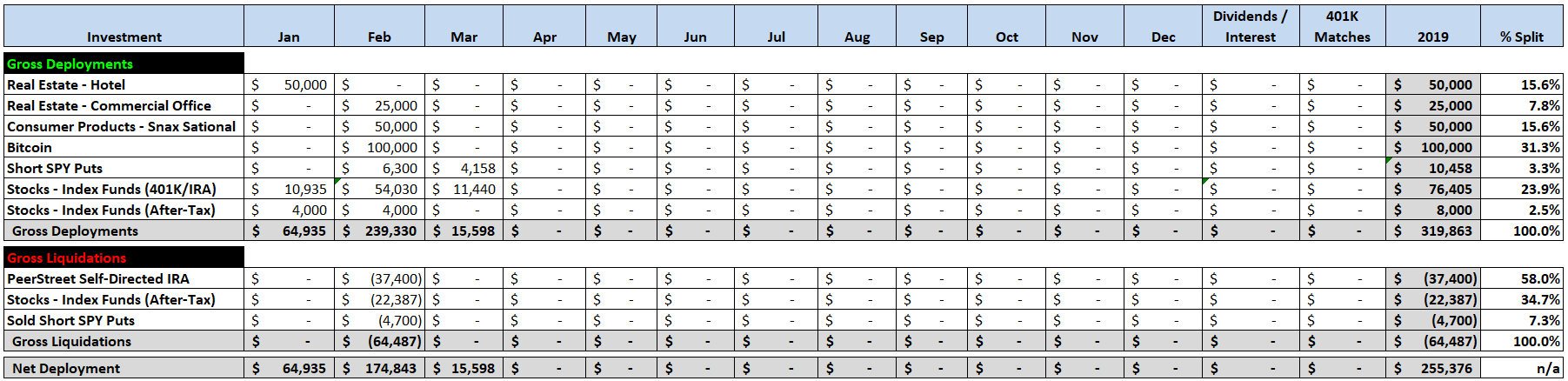

Total Capital Deployed in 2021:

This month we finished maxing out both of the 401k accounts we have available and I purchased some additional puts as the S&P 500 makes new highs. As a reminder, I’m willing to lose up to $10,000 per year to protect my family’s net worth from Black Swan type events (i.e., 40%+ moves to the downside). I’ve never been a fan of the lottery, but you can think of these puts as lottery tickets…or insurance. My thesis that the cost is relatively low to our current and growing net worth and that our overall gains more than offset this cost of “insurance.”

I intend to keep new investments to a minimum in April but I have identified another Industrial Real Estate deal that I plan to participate in for a $25,000 allocation. Like a handful of other deals I’ve participated in recently, I will be making this through the Crowd Street investing platform.

Closing Thoughts

In the midst of this dark time, we did find light when we found out that the baby we are expecting is a girl. We are grateful for the amazing friends and family we are surrounded by and who have offered an overwhelming amount of support if/when needed. I’m typing this with the news barely a week old. I know that the pain will eventually fade but we will forever miss the woman who showed us what motherly love truly is. Our duty is to honor that love and to live well and give well for as long as we are lucky to be on this earth.

– Gen Y Finance Guy

7 Responses

Dom, my thoughts and prayers are with you and your wife. A loss like this is never easy, and yet, as you say this is a part of life. I lost my own Mom to an aggressive cancer in a similar and very quick manner. And although your kids will miss having their Grandma, her legacy will live on through your wife and you.

Looking forward to learning more about your upcoming girl. That is certainly warming news, especially during this time. Take care, and good for you for handling your finances so well that you can take care of what matters most when you need to.

Dominic, so sorry to hear this news. Thank you for sharing it with us readers, and your words of tribute are great and I’m sure you have found a way to use those thoughts to comfort those in your family.

Also, I appreciate Michael Quan’s contributing his personal experiences and good wishes for your new family addition.

This might not be the time or place, but if I am being inappropriate here then let us just say that it is ‘on-brand.’ There is a FEMA program to help pay funeral costs up to $9,000 for COVID-19 related expirations. Another time I will share why this subject is familiar to me, but for now you and your readers can find more detail at this link: FEMA COVID funeral cost assistance

“Requiescat in pace.”

Sorry for your loss

Sorry for your families loss at this difficult time. There are no words to say that feel right other than we appreciate you as a community and what you have shared. Eventually, look to the blessing on the way for hope.

So sorry to hear about the loss of your mother in law Dom. I send my prayers and love to you and your family.????????❤️

So sorry to hear this, but what a beautiful thought this is: “my children will experience the best of Grandma through her daughter, their mom.”

I’m sorry for your loss. It’s not easy to lose a loved one, especially when they pass away so young.

On a happier note, congratulations on finding out you will be having a daughter! The Genyfinanceguy clan is growing. Maybe one day they will take over the world.

I remember your $10MM goal like it was yesterday. I have no doubt in my mind you’ll get there years earlier than expected.