As I type this my family and I are coming to the end of our stay at the beach. The last 30 days were filled with much-needed rest, relaxation, and recharging. We checked into the beach house on November 1st and completely unplugged from work until the morning of the 9th. We then proceeded to work a modified schedule from the 9th until Thanksgiving. And finally, we had the 26th through the 29th completely work-free.

One thing I learned is that a week is about all I need/want in terms of being completely unplugged. Being productive is a big part of who I am and where I realize fulfillment. That said, the modified work schedule was very enjoyable and needed.

In addition to relaxing and recharging, I also got Rolfed!

I had never heard of Rolfing until the weekend prior to heading to the beach. Mrs. GYFG and I were watching something completely unrelated that happened to show some people getting Rolfed. It caught my attention and after looking it up on Google, I thought it was something I ought to try to continue the healing process of my back. I have to say that I wish I had found this directly after finishing my non-surgical decompression program as I feel great after completing the 10-session program. This couldn’t have come at a better time as I plan to begin the next leg of my quest to get back to a level of fitness (and aesthetic) that I haven’t seen in years.

Lastly, we hosted my entire team for a business planning session (more on that below) as well as an early holiday dinner.

Let’s dive into the details of this month’s financial report!

Financial Dashboard

Note: The income figure you see in the chart above for 2020 is our current projection for the calendar year, which is different than our TTM income figure that clocked in at $1.301M this month (down from $1.354M last month, which I expect to continue falling for the next couple of months.).

Net Worth:

Current Net Worth: $2,359,535 (up $689,214 or +41.3% for 2020)

Previous month: $2,312,319

Difference: +$47,216

Note: I’m still not holding a value for my business in my net worth. Depending on the multiple you use, the value of my business is somewhere in the range of $500,000 (1X) to $2,500,000 (5X). I’m hesitant to hold a value in my net worth for this until we achieve a liquidity event.

Net Worth Break Down:

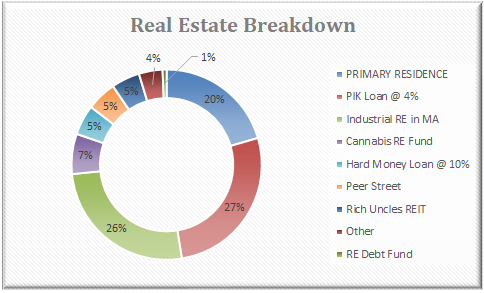

Real Estate (62%) – This category includes the equity in our primary residence, a hard money loan at a 10% interest rate, our investment in the Rich Uncles commercial REIT, and our hard money loans through the PeerStreet platform. This also includes a 4% PIK loan that will be converted to an equity position in 2022. We have officially reduced our concentration here by completing a cash-out refinance on our primary residence. In the charts below, you can see that our primary residence no longer makes up the largest chunk of the overall real estate allocation. More notably, our primary residence only makes up 13% of total net worth (down from 23% in September). I expect the concentration to continue its downward trend until we move into our new house in October of 2021.

Last Month

Current Month

Net Cash (27%) – We are now sitting on almost $625,000 cash vs. $700,000 last month. Last month I shared where we had already earmarked $235,000 of that cash balance to go and below you can see we still have another $80,000 of that $235,000 that hasn’t hit yet. We have identified another $30,000 (increasing the remaining amount from $80K to $110K) that will leave our account for new appliances that will replace the old appliances we are removing as part of our kitchen remodel (to begin in Jan/Feb of 2021).

– $100,000 will be added to our Industrial Real Estate investment in MA (no debt used and cash on cash returns at 25%+). This will allow us to defer taxes on an additional $100,000 in capital gains. Due to the pandemic the normal six-month window to re-deploy capital gains into an opportunity zone to defer taxes (which was up in August for us) was extended until December 31st of 2020. Completed

– $50,000 will be invested in an 80 unit apartment complex in Chicago with a target cash on cash return of 10%. The property has done very well through the pandemic and has had a very minimal increase in delinquencies.

– $55,000 for a complete replacement of the HVAC system in our future house. This project will have been completed by the time this post goes live. Completed

– $30,000 for the installation of solar on our future house.

– $30,000 for new appliances for the future kitchen in our new home.

Note: Regarding the $55,000 for the HVAC and $30,000 for the solar system: I will be carrying those as an asset in our net worth calculation, in the form of equity we are building in our future home. We agreed on a price to purchase the property back in March and we believe that that price is now very conservative based on what the real estate market has done during The Great Lockdown.

Alternatives (7%) – This is a new catch-all category that captures our investments in the following: life settlements, a special purpose acquisition company (SPAC), and a private investment in the Robinhood trading platform (I recently read that Robinhood is looking to go public in 2021, which could be a nice liquidity event, but on a small investment of $10,000).

Stocks (4%) – We have $1,000 that is being invested weekly with Betterment. What I love about this robo-advisor is not only the very low management fee but also the automated tax-loss harvesting. I’ve been reading about other bloggers building up substantial “losses” that accumulate over time, all while avoiding the “wash sale” rule. I think this will be very handy in the years to come as a way to start accumulating a tax shield for realizing future gains all while not losing any exposure to the market. I encourage you all to take a look at the white paper on tax-loss harvesting that Betterment published to learn more.

Total Projected Income in 2020: We are currently on pace to earn $1,283,990 (down from last month’s projection of $1,307,629). Keep in mind that ~$415,000 of that is from a realized gain from selling the stock I owned in my previous employer. My big goal right now as it has been in previous years is to create enough momentum that we can not only match this income level but surpass it in 2021 (not an easy task with a big $415,000 hole to fill – especially given the fact that Mrs. GYFG is on track for her highest-earning year ever and plans to stop working sometime in the next 12-15 months depending on how long it takes us to get pregnant and deliver our second child).

Total Capital Deployed in 2020:

This month we deployed $4,000 into stocks via Betterment and another $100,000 to increase our investment in a previous real estate investment. Besides very favorable economics, the other driver in deploying an additional $100,000 into this specific deal is the fact it is in an opportunity zone and so it allows us to defer capital gains taxes on the gain realized from selling the stock in my previous employer. Due to COVID, the IRS has extended the normal six-month window to December 31, 2020. We received $75,000 of our $150,000 hard money loan back in the month of November and we expect to receive the remaining amount back in early Q1’21.

You’ll notice that I’ve filled in a few investments for December since I’ve already committed to those. I also plan to enter all of the dividends and interest earned and re-invested in next month’s report.

Net Worth Conversion Ratio

Definition: The Net Worth Conversion Ratio measures an earner’s ability to convert earned income into wealth (net worth). It excludes passive income since passive income is dependent on the earner’s decision of putting earned income to work or spending on consumption.

This is a new metric I will be updating and sharing monthly. Now that “the machine” is in full production, it is time to not only bring back the net worth conversion metric but to make it a star of the show. I once wrote that financial nirvana is reached once this metric exceeds 100%. When I first calculated this back in early 2016 the GYFG ratio clocked in at 25.3%. Since then we have significantly increased our savings rate and the gravitational pull of increasing both our savings rate and income helped us significantly improve the performance of this metric, which now clocks in at 73.0% (up from 71.6% last month).

You will notice that I have shared the metric based on ‘earned income’ and ‘all income’ but I’m most interested in the earned income calculation (per the definition above).

Last Month

This Month

The goal the past five years since adopting this metric was to focus on increasing our earned income while simultaneously saving at least 50% of our after-tax income in order to create excess capital for investing. I should note that I’ve excluded from the earned income calculation any income that’s derived passively from investments and more recently profit distributions from my business (I do include the W-2 income I earn as an employee of the business). That said, I do include the same metric on all income as a point of reference and differentiation.

The end goal is to get to a point where net worth is 100% or greater than earned income – bonus points if you can accomplish the same thing based on all income sources. I expect our net worth conversion (blue line) to finish the year somewhere between 70% and 75%.

Business Spotlight – Annual Planning

I’ve always used November as a planning month for my personal finances, and prior to starting my own business, I had led many business planning cycles for my previous employer that usually kicked off in mid-October and finished right before Christmas.

Last year (2019) was the first time I pulled together a budget for my business. The business was small and my co-founder and I pulled together a budget in about an hour. This year the business has grown almost 4X and understandably required a bit more time to contemplate the opportunities in the year ahead. I completed a first pass of the plan, spending a few hours the week before I had planned to have the team out to the beach house for a planning/strategy session. The annual plan for 2021 was one of many items on the agenda we covered in about four hours.

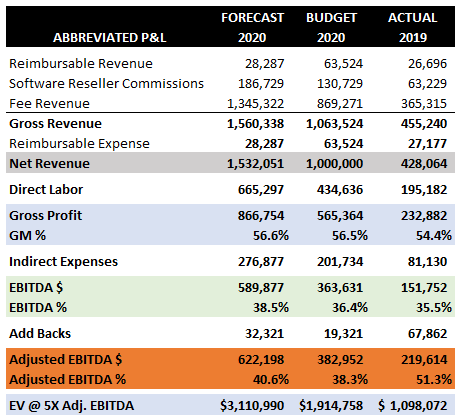

We kicked off the meeting by reviewing our performance to date, with a particular emphasis on 2020 vs. the targets that were set for the year (see below summary).

In the above table, I summarize the current forecast for 2020 (10 months of actual plus two months of forecast) vs. the budget and vs. 2019 (our first year in business).

A Few Highlights

- 2020 Net Revenue is on pace for a 3.6X increase from $428,064 to $1,532,051 (not the final number but will be close to how we finish the year).

- 2020 Net Revenue is on pace to beat our budget by 53.2%

- 2020 EBITDA before add-backs is projected to be up almost 4X by yearend.

After reviewing our current year’s performance we went line by line through the detailed business plan I had prepared ahead of the session. I walked the team through what was contracted as well as the probability-weighted pipeline that once added to the contracted backlog formed our topline target for 2021. I actually worked up the revenue target two different ways and landed at about the same number with both methods. The team has grown comfortable with my conservative forecasting as I prefer to set targets that are attainable. In my corporate days, I was used to setting targets that we were likely never going to achieve and I hated how that killed morale. But don’t get me wrong – we have still set a robust growth rate of 44% YoY (see below).

Although we all believe there is a ton of upside in 2021 this is the budget we all agreed we could achieve with a high degree of confidence. As an FYI, the stretch target in the back of my mind is $4.3M on the topline.

We finished the session by going through the different initiatives and strategies that will not only help us achieve the above plan but also give us a chance at hitting that upside stretch goal I mentioned. One of the big initiatives is me working with a business coach, which starts December 1st. My focus will be on the sales component of that coaching, but it is a comprehensive program with someone who has done what we are trying to do – built a services-based business and successfully exited (sold his company).

Closing Thoughts

Last month I closed with:

I’m now recharging my vitality and preparing for the next “race.” The only difference is that when I “get back in the race,” I will be strategically braking at each water stop, which in my analogy means more frequent vacations to unplug.

I’m officially ready to get “back in the race” as I had hoped would be the case at the end of this quasi-sabbatical. I didn’t mention it above but I also did pull together my goals for 2021 as is my own tradition during Thanksgiving week. So, with my business goals and personal goals locked in, I’m ready to get a head start on the world by officially getting to work on achieving those goals starting 11/30/20 (I love starting on Mondays).

I have also strategically booked my next “water stop” by renting a mountain house for ten days in March. I have invited my founding team to join us for four of the ten days to celebrate our next milestone that we are projected to hit by yearend – $2,000,000 in cumulative revenue. I’ve told the founding team that we would do a retreat/celebration for every $1M in revenue. The first $1M took us 16 months to achieve, while the second $1M only took about seven months – we are picking up momentum.

I wish you a happy and healthy holiday season through the end of the year and I’ll see you on the flip-side.

Cheers!

– Gen Y Finance Guy

p.s. I’m starting to see this monthly post morph into a digital newspaper of my life. I don’t have a lot of extra time to write multiple posts a month, so I want to use this medium to give an update on my financial progress as well as other things on my mind…more to come in 2021.

5 Responses

Crush-ing it! (I expect no less).

Quick question on the identification of investments. For the things you’ve come across like the 80 unit complex, the life settlement, the SPAC and the Robinhood investment have you generally found those opportunities by networking, reading some form of trade / other publication, ‘keeping your ear to the ground’ or have you got another specific method of identifying potential investments?

I like the approach of using ‘water stops’ and setting sensible targets for the business and communicating them to your team so that everyone knows the flight plan. Far too many businesses have farcical targets which will inevitably be missed and don’t take a beat to let the rank and file staff know what the plan is (this results in the impression that the business is rudderless and has no plan, even when that isn’t the case). Out of interest, do you see the stretch target of $4.3m topline as equivalent to a BHAG for the business? I ask because on the personal side of things when you first set the $10m net worth target you described that as a BHAG and I wondered if you set goals of similar magnitude for your business and if not, the reason for not doing so.

From what I can see, it looks like you now have a tried and tested system locked-in. If I should be so brave as to summaries what you explain in far greater detail in this blog the system looks something along the lines of: set SMART goals (specific, measurable, achievable, realistic and timebound goals), find mentors to help teach you how to execute on those goals, make yourself accountable for meeting the goals (e.g. blog about the goals / let your team know what the goals are), keep risks (financial and otherwise) at an acceptable level, diversify investments, be clear on your priorities (family vs. work etc…), take time for rest and last, but not least, ‘smell the roses’ (i.e. enjoy the journey along the way).

As always, thanks for your insights.

HH

Hey HH,

Always a pleasure getting a comment from you. You are always so thoughtful!

Re: how I identify investments

I can say it is one single thing but really a combination of all the things you listed. I read a lot of blogs and books. I listen to a lot of podcasts. I’m constantly expanding my network through this blog, my business, and friends of friends. My level of transparency helps those types of opportunities pop up in my life. I’m a part of a few investor circles with people that have much higher incomes and net worths than I have. I learned early on that you have to constantly be exposing yourself to people that are where you want to go – Jim Rohn called it your circle of 5. I just try to remember to send the elevator back down so to speak.

FYI – I’d be more than happy to connect outside the blog if you want to dive deeper into this – shoot me an email at dom@genyfinanceguy.com if you’re interested.

Re: BHAG for the business

I guess you could call it a one-year BHAG, where the $10M BHAG was initially a 20-year goal that I’m now trying to accelerate to 12 years or sooner. My real BHAG for the business is a $25M liquidity event at a 5X multiple in the next 3-5 years. That would imply a topline target of $10M and a bottom-line target of $5M (based on a 5X bottom line multiple).

Re: My process

I think you certainly captured my process, so of which is still a work in process like taking time to “smell the roses” which I am getting better at every year.

Dom

From someone who should have statistically ended in prison to someone who has a TTM income of $1M+. Well done, Dom. It’s pretty inspirational. Can’t wait to see you blow past your $10MM goal to like $20MM or something, ha.

Thanks, David!

From your comment I can see you have read a bit about my back story.

Looks like you started your own blog. FYI – $250K by 25 is better than where I was at 25 – let alone saving $40K while in college. Keep up the good work!

I’ve been a long-term reader of your blog (probably for over 2-3 years). I just started my blog recently and wanted to start networking with other bloggers.

Thank you stopping by, I appreciate it!!