Bye, Bye 2019 – you were awesome!

This month marks exactly five years of detailed financial reports. It doesn’t seem possible that five years have already passed. It feels like just yesterday when I made the decision to share the intimate details of my financial life. I had three primary drivers for making the decision to publicly put my financial life on display:

(1) To put in place an accountability system that would not only ensure I hit my goals but also to expedite my path to the “finish line” of achieving a $10M net worth by 48.

(2) To be a source of hope, inspiration, and motivation to others.

(3) To remove the taboo around talking about money – even if it’s only online.

If the thousands of comments and hundreds of emails that I have received from you, fine readers, is any indication of success then I think I’ve hit my goal in sharing, and also found my tribe.

The Financial Highlights of the Last Five Years

– We have generated a cumulative gross income of $2,190,174 (over 60 months).

– Our household annual income started the five year period at $214,142 (2014 TTM) and finished at $747,427 (2019 TTM).

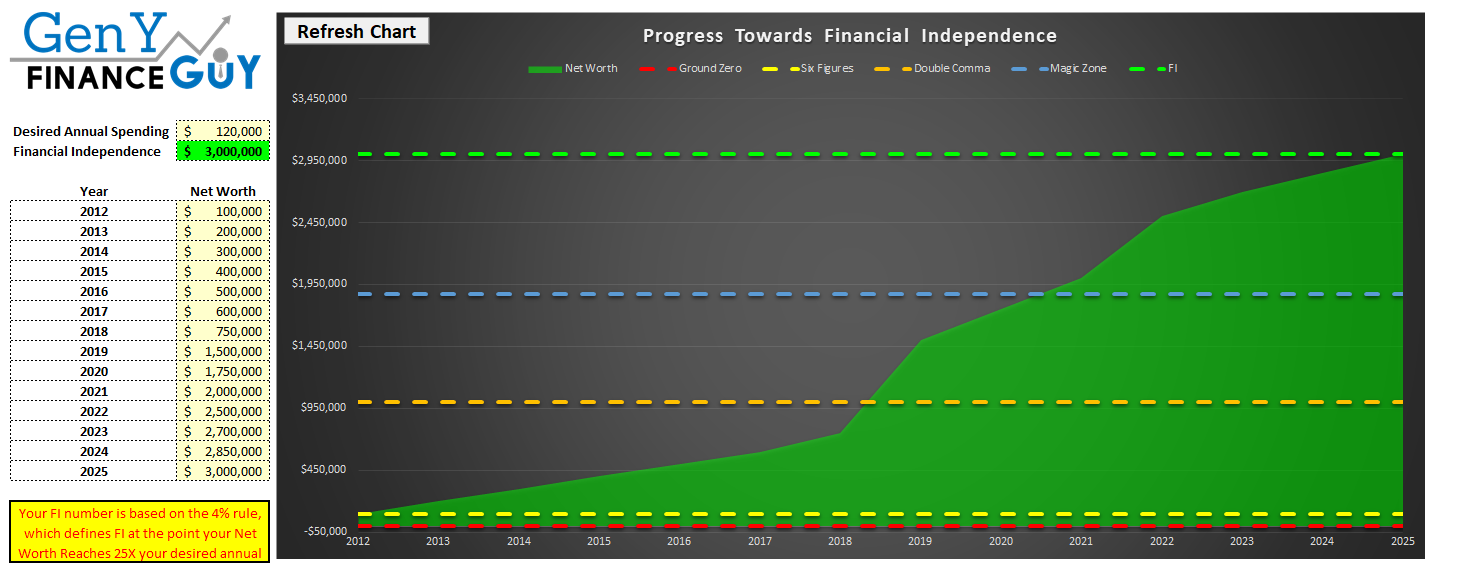

– We increased our net worth from $181,364 to $1,670,321 (a increase of $1,488,957 or an average monthly increase of $24,816 – for 60 straight months).

– Our Net Worth Conversion ratio over the last five years was ~68% (with a target 50% after-tax savings rate, this shows that our investments have been very good to us).

– We paid off our mortgage in less than five years vs. an original goal of seven and some change.

– We got the opportunity to buy equity in a private company that has provided a nice boost to our net worth. The investment has been illiquid since 2016 but I’m scheduled to get paid out in early 2020. My original $105,000 investment has turned into $550,000 for a return of 5.2X on my money in about three years.

– I started my own business in 2019 and it grossed $428,544. Of that, I got to keep $236,432 after all expenses (this portion is what is included in the $747,427 figured shared above). This business is likely to act as a wealth accelerator in 2020 and beyond (I believe it will produce a minimum of $1.25M in 2020).

From the outside looking in it may have appeared that I was being too conservative at times in my moves and choices, but the results speak for themselves (56% Compound Annual Growth Rate). Yes, I could have been more aggressive and most likely compounded our wealth to even greater heights these past five years, but I stuck with a disciplined approach of looking through a lens of risk mitigation first (return of capital) and potential reward last (return on capital). I didn’t use leverage (i.e., debt) as aggressively as I could have or as I’ve seen others do successfully, optimizing instead for peace of mind rather than the highest potential return. Instead, I focused on building a fortress of security (a paid-off house) and hit the income side of the equation aggressively (C-Suite by 30 and starting a business on track to make over $1M in 2020).

I’m very pleased with the results of the last five years and excited to see what the next five years have in store. I intuitively know that we will eventually have a market slowdown but my guess is as good as anyone else as to when that might happen. I sleep well at night knowing that we are entering 2020 with tons of liquidity: $420,000 HELOC, zero debt, and by the end of January we should have well over $500,000 in cash sitting in the bank!

If you’re a regular reader and only want to read the new content, feel free to just skip the intro below, and head to Net Worth. If you are new or haven’t read many of these reports, I encourage you to take two minutes to read the intro below, which does change periodically.

Why I Share These Monthly Reports

Mission Statement: To Humanize Finance, Build Wealth, and Reach Financial Freedom.

For those of you new around this corner of the internet, these monthly reports are about full transparency. And, they are just as much for me as they are for you. It was a hard decision to make all of my financial details public, but it has proved to be a very motivating one. The process I go through every month to produce these reports has been enlightening and life-changing. I published my first “income and net worth report” for January of 2015 when our net worth was only $195,141 (we entered 2015 with a net worth of $181,364) and our gross income was on pace to hit $178,000 that year.

Four years and eleven months later, our net worth currently clocks in at $1,670,321 with a gross income over the trailing twelve months of $746,177.

- That’s a 9.2X increase in net worth due to a compound annual growth rate of roughly 56% for the past five years.

- At the same time, income has increased 4.2X, which translates to a compound annual growth rate of roughly 33.2%.

Honestly, I don’t think the GYFG household would have experienced these kinds of results without the existence of this blog and the accountability it brings. Knowing that I will share our results with you readers every month keeps me very focused and intentional with all things related to our financial well being. For that, I THANK YOU for taking the time to read and interact with me on this blog.

Above and beyond this benefit to my own household, my sincere hope is that my policy of full transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom if he or she is willing to do things differently than the pack does. If you’re after average results, then you’ve landed on the wrong site. There’s nothing wrong with average, but the kind of results I preach are EXTRAORDINARY. Sure, the “get rich slow” method is proven, but there is an alternative, which is to “get rich fast.” Look, I have no interest in living like a starving college student until I am old and brittle to only then have the means to check off bucket-list items when my body might no longer be physically capable of doing them. And I don’t want that for you either!

Here at GYFG, we approach the pursuit of FINANCIAL FREEDOM with an abundance mindset, so you won’t hear me telling you to cut out those $5 lattes. Choose to spend on what is meaningful to you. I spend a lot, but I also strategically earn a lot, save a lot and invest a lot.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. Keep this famous Jim Rohn quote in mind:

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!“

You must be intentional with your finances if you ever want a fighting chance to make it to financial freedom. But it does not have to take 40-50 years of slaving away for “The Man” before you have the option to retire. I think 10-20 years is all you need, with the most aggressive folks probably able to reach financial freedom in 10 years or less. A high income paired with a high savings rate are two of the vital components of a good recipe for the 10-year track.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (not so many people giving financial advice actually do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, and I think real life examples and numbers can help slice through the complexities (and the BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere, so I always intended to share my own.

You can find all my previous reports on the Financial Stats page.

Financial Stats Dashboard

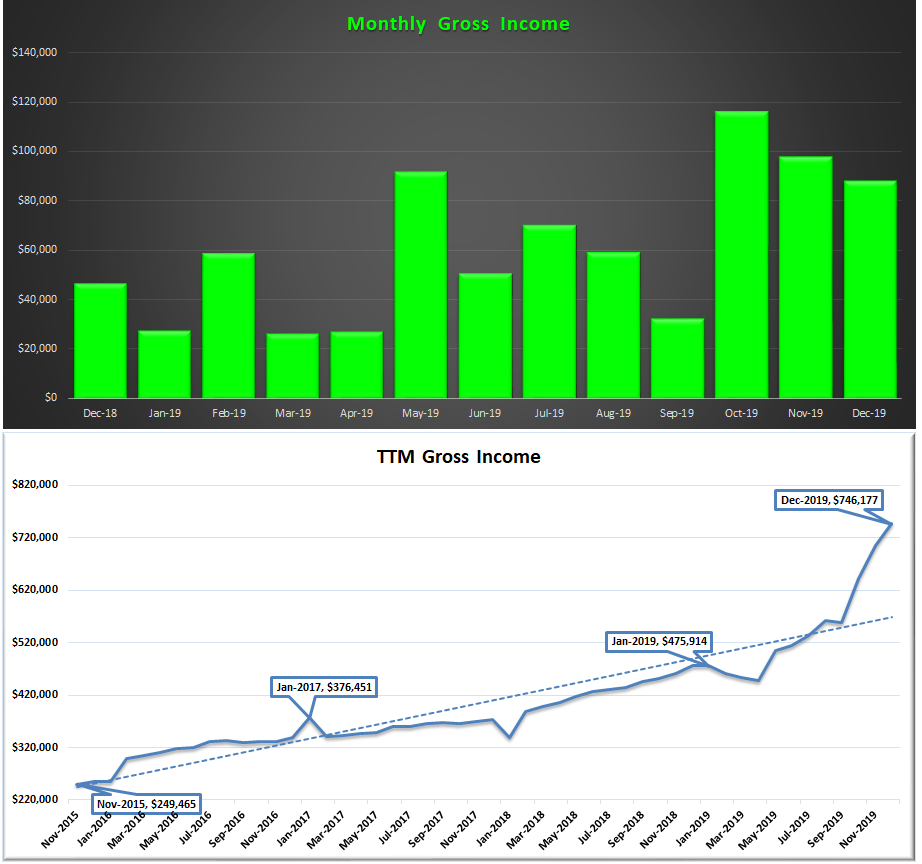

At the end of each month, I download a .csv file from my Personal Capital account and drop it into my custom built Excel workbook in order to update the dashboard you see below. I’m blown away every month by the progress we have made in a relatively short period of time.The only number below that is not an actual number and instead is a forecast is the current year projected income of $747,424 (up from $666,992 last month) in the gross income chart below.

Now that we have seen the overall, let’s take a closer look at a few of the items below.

Net Worth

As I type, I realize that I forgot to capture the cash value of the whole life insurance policy that I picked up in October for Baby GYFG (now three months in a row). Regardless, we still racked up a $657,456 increase in net worth for the year – only $90,000 shy of our gross income for the year.

We will be gunning for $2,000,000 during the first six months of 2020, which will catapult us to the fourth milestone of The Five Major Milestones to Financial Independence.

December Net Worth $1,670,321 (up $657,456 or +64.9% for 2019)

- Previous month: $1,374,308

- Difference: $296,013

Net Worth Break Down (MoM):

The Real Estate ($791,817) category decreased from 56% to 47%. This category includes the equity in our primary residence ($463,896), a hard money loan ($150,000) at a 10% interest rate, our investment in the Rich Uncles commercial REIT ($76,672), and our hard money loans through the PeerStreet ($101,249) platform. There was no increase in Rich Uncles as they have put a freeze on reinvestment and new investment until January. PeerStreet has come down as I withdraw funds from the after-tax lending account, that will eventually make their way to Rich Uncles until it hits a six-figure balance.

The Real Estate ($791,817) category decreased from 56% to 47%. This category includes the equity in our primary residence ($463,896), a hard money loan ($150,000) at a 10% interest rate, our investment in the Rich Uncles commercial REIT ($76,672), and our hard money loans through the PeerStreet ($101,249) platform. There was no increase in Rich Uncles as they have put a freeze on reinvestment and new investment until January. PeerStreet has come down as I withdraw funds from the after-tax lending account, that will eventually make their way to Rich Uncles until it hits a six-figure balance.

Net Cash ($82,423) decreased from 6% to 5%. We actually have $95,129 in cash but net cash is only $82,423 after you adjust for our current credit card balance of $12,706, which we pay in full every month based on the statement due date. Keep in mind that of that $82,423 a portion (~$30K) is related to what my business owes me (a combination of my direct billable work and the profits of the business).

The Business ($513,805) category increased from 17% to 31%. This represents the ownership I have in the private company that I work for. This is an illiquid investment that only gets an update to its value one time per year (and this was the lucky month). We will be having a huge influx of liquidity as I get cashed out of my stock in January and my options in February – leading to a $500,000+ liquidity event.

Life Settlements ($96,250) decreased from 7% to 6%. We currently have investments in seven policies at $10,000 each. They are accreting in value by about $1,000 per month. For anyone familiar with options, I liken the fixed return of life settlements to the theta of a short option. In this case, the accreted value is like the theta decay of an option you’ve sold. In more simple terms, with this fixed return you are amortizing (realizing) that value with the passing of time.

The Stocks ($186,026) category decreased from 14% to 11% and represents the cumulative value of our brokerage accounts (retirement accounts) that are invested in stocks. However, this is not all of our retirement money, as the majority of our PeerStreet investments are made through a self-directed IRA (worth about $83,000 and counted in the Real Estate category of the pie chart). This will be increasing substantially in January when I pay back the 401K loan, which is currently at $44,006 (down from the original $50,000). I will be getting my year-end bonus payout in January or February for the 2019 calendar year and I have set my 401K contributions to max out as soon as that hits (I’ve done the same for my HSA). As I prepare for my departure from W-2 employment I have liquidated my stock positions (as of 11/14) and the account is sitting all in cash until I roll it over to another brokerage account that I have early next year.

Total Capital Deployed in 2019:

Our original goal was to deploy about $182,000 in capital and we ended up deploying $384,895, mostly due to the additional free cash flow generated by my new business.

Gross Income

We came pretty darn close to my projection last month of $747,424 as we finished the year at $747,427 (I got lucky). At this point I’m speechless at the kind of income we generate and have generated over the last 12 months. And I see the trend only continuing into next year when we are currently projecting an income over $1M (keep in mind that this includes the gain on the stock I’m getting cashed out of in January).

In the second chart above, I also track our income on a trailing twelve months. We recorded a new all-time record in TTM income at $746,177 (up from the TTM of $704,553 last month).

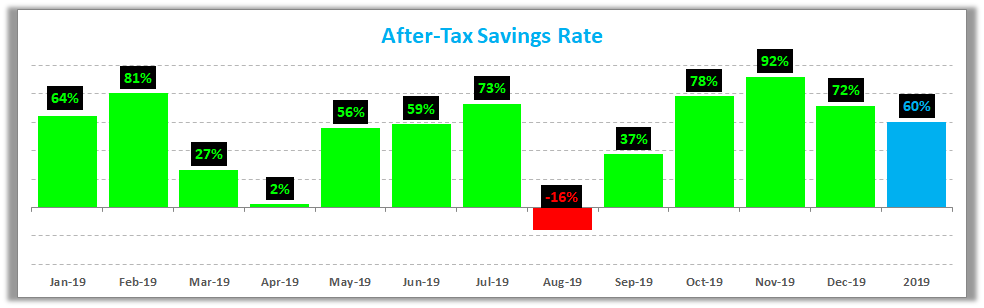

Savings Rate

Below is how we actually did towards our goal of saving 50% of our after-tax income. In the chart below, the green bars represent our actual savings rate for the month, the orange bars are what we anticipate based on our 2019 budget, and the blue bar is the projected savings rate for all of 2019.

We hit 60% for the year – our best savings year ever!!!

Do you want to calculate your own savings rate? I’ve made it super easy for you with the savings rate calculator included in the free GYFG FI Toolkit that you can download instantly by clicking the link below. Here’s a peek. Did I mention it’s free? You have nothing to lose and everything to gain, Freedom Fighter! Remember, what gets measured gets managed.

Speaking of savings rate, go check out my post where I mathematically prove the importance of your savings rate as a higher priority in achieving financial independence than your compound return. If you’re trying to build wealth quickly, then you have to read this post.

Closing Thoughts

Vacation is over and it’s now time to put my foot back on the accelerator for 2020. I have some big goals for my new business.

That said, I have found it increasingly more difficult to carve out time to write on the blog as often as I would like with the addition of Baby GYFG and running my new business. Nonetheless, I have a laundry list of topics (56 to be exact) I want to write about and I will get to them – just slower than I would like to. I guess what I’m getting at is that my posts may be less frequent than every week in 2020 (my backlog is currently empty for the first time in five years). I will also be doing away with guest posting in 2020 as I have found the quality to be hit or miss.

I hope you all enjoyed the holiday season and I wish you all a happy new year.

– Gen Y Finance Guy

p.s. Personal Capital now offers a 1.55% high yield savings account that is FDIC insured.

15 Responses

Crushing it as always Dom. Love seeing these income reports and the motivation it provides. Congratulations on 2019 and looking forward to an even better 2020!

Hey Josh,

I hope 2019 has been good to you and your family. How is fatherhood? I’m no longer on monthly voyages out to New York but we should catch up in early 2020 even if it’s just over the phone. I would love to here whats new with you.

Cheers,

Dom

I love to see all the progress you and your family are making! Cheers to a new year with new milestones!

Thanks, Keenan!

I wish you a very prosperous new year!

Dom

“Choose to spend on what is meaningful to you.” – GYFG

That’s right, I’m quoting YOU! Wise words, GYFG, thank you for reminding us. So many good things happening for the GYFG family in 2019, and wishing you and all your readers a great-and-happy 2020.

2019 is the first year we’ve cracked $3mm NW, in the Ceezy household. By way of comparison, (the first time…) $2mm NW occurred in 2006, and $1mm in 2003. Hope to hit $4mm in 2025.

In 2019, I read 88 books and enjoyed 57 of them (scoring 5 or more on a 10-scale). That’s it for my metric-keeping.;-)

Looking forward to your post on goal setting and progress, and this year I am finally going to do the same (after years of slacking, which was a goal in itself!). Be well, sir, more good things coming your way this year!

Thanks, JayCeezy!

My most loyal of readers. I can’t believe you have been with me on this journey since February of 2015 when you first came to my defense in the comment string of financial samurai. I think I am much more in line with that lady’s definition of expectation of a six-figure income being much closer to a seven-figure income.

Life is far better than my wildest expectations and I’m grateful every day. Congrats on cracking the $3M mark!

Your reading game is strong at 88 books. My has been lagging with the addition of baby GYFG and running my business. But I still managed to read 15 books (down from my historical average of about 50 per year).

I wish you and your family a fulfilling and prosperous year ahead.

Cheers,

Dom

Happy New Year to you! I enjoy reading about your amazing progress. I had hoped to read more from your LateFIRE writer, as we’re of a similar age and both “late to the party” concerning financial planning. However, things change and I need to be more of a participant and less of a financial voyeur in the new year.. Cheers to you!

Hey B,

The write of the LateFIRE series is also the editor of this blog. She is doing well and it is not for the lack of wanting to write the series but there are a number of big things she is working on to solidify her own financial foundation that time is limited.

I wish you much success and progress in your own financial journey. Come back to the comments from time to time and share some of your own victories.

Dom

Wow, that income is huge! Can you share more about how you got to $97,712 for the month?

I plan to try and make more money again. I got a family to feed!

HNY!

Sam

Hey Sam,

I’m happy to break down the income for you. First, I realized when I went to break it down that I had left November’s income figure in the post title of ($97,712) for the month. The income for December was $89,407. So, for that I will give you a twofer and break down both November and December (since corrected).

November Income ($97,712):

Mr. GYFG Day Job Income = $31,731 (I’m still on full-time payroll until Feb-2020)

Mrs. GYFG Day Job Income = $12,204

Mrs. GYFG Side Biz Income = $403

Hard Money Lending Income = $1,250

Business Income = $52,124 (taking my billable income and profit distribution)

December Income ($89,407):

Mr. GYFG Day Job Income = $21,154 (I’m still on full-time payroll until Feb-2020)

Mrs. GYFG Day Job Income = $17,924

Mrs. GYFG Side Biz Income = $945

Hard Money Lending Income = $1,250

Business Income = $26,316 (taking my billable income and profit distribution)

Income from Investments = $21,818 (PeerStreet, Rich Uncles, Dividends, other Interest – I only count this up once a year in December)

You will notice that the business income fluctuates from month to month as I pull money out at discretion for distributions of profits. Even my day job income fluctuates due to a bi-weekly pay schedule and November had three pay periods vs. two in December. And my wife’s income fluctuates as she is on a fixed salary plus monthly commissions depending on performance of her unit.

Cheers,

Dom

I love all the charts!! Nice year of income. Almost broke the six figure barrier!

Thanks, Jay!

We will be aiming to officially break that six-figure barrier in 2020.

Cheers,

Dom

Incredible. A couple of years ago our numbers matched and now you’ve pulled so far ahead… to an income level beyond anything I’ve thought possible for myself. Stoked for you and your family. So impressed by how you’ve pushed the envelope and appreciate your content–I’ve learned a lot here over the years.

Hi Jenny,

I’m stoked that you have gotten value out of the content I’ve produced over the years. I appreciate your reading along for so many years. I wish you and your family a fulfilling and prosperous year in 2020.

Dom