There is blood in the streets and it’s coming from the GYFG house. We burned through a big chunk of cash this month in order to make our backyard look like the pictures below. We added two covered patios and restarted the landscaping and irrigation from scratch. These new additions go well with the outdoor BBQ and kitchen area we put in a few years ago. The new backyard set us back about $30,000 but it is now a place to chill and is more conducive to being outside year-round. We recently paid off our mortgage in May, and I look at this $30,000 enhancement as an investment that will allow us to stay here for another 3-5 years before we turn it into an investment and trade-up ONE final time to our dream house.

I say there is blood in the streets because this is only the second time in 56 consecutive months of publishing these reports that we had a negative savings rate for the month. Yep, we spent more money than we took home after taxes. The silver lining is that although our savings rate was negative we still managed to grow our net worth by almost $15K in August. This allowed us to cross the $1.3M mark that we just barely missed in July.

The new business has become a very powerful driver in increasing our net worth due to the income it is generating. I’m not currently holding any sort of value for the business itself; the only thing I include in our net worth figures is the undistributed profits and income payable to me for my billable work. It shows up in the “Cash” category of our net worth split below. I hold it in cash as it will/can be converted to cash in less than 12 months. The income the business pays me for my billable work happens monthly, and the profit distribution is planned for year-end.

I haven’t decided yet how I will value the business in terms of net worth. I feel it is still too new to include any value yet, but in 2020 I might start including a value for the business at 1-2X the bottom line. I welcome any thoughts or feedback from you readers.

With that, let’s dive into the nuts and bolts.

If you’re a regular reader and only want to read the new content, feel free to just skip the intro below, and head to Net Worth. If you are new or haven’t read many of these reports, I encourage you to take two minutes to read the intro below, which does change periodically.

Why I Share These Monthly Reports

Mission Statement: To Humanize Finance, Build Wealth, and Reach Financial Freedom.

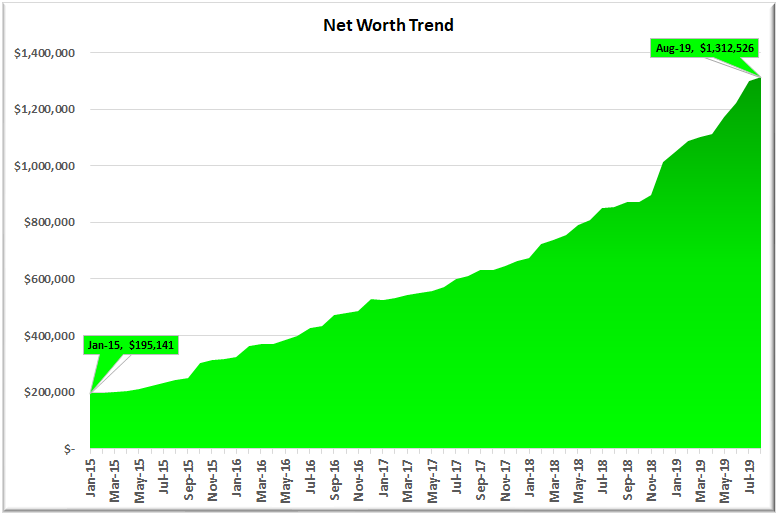

For those of you new around this corner of the internet, these monthly reports are about full transparency. And, they are just as much for me as they are for you. It was a hard decision to make all of my financial details public, but it has proved to be a very motivating one. The process I go through every month to produce these reports has been enlightening and life-changing. I published my first “income and net worth report” for January of 2015 when our net worth was only $195,141, and our gross income was on pace to hit $178,000 that year.

Four and a half years later, our net worth currently clocks in at $1,312,526 with a gross income over the trailing twelve months of $562,377 (new all-time-high).

- That’s a 6.7X increase in net worth due to a compound annual growth rate of roughly 50% for the past four years.

- At the same time, income has increased 3.2X, which translates to a compound annual growth rate of roughly 28%.

Honestly, I don’t think the GYFG household would have experienced these kinds of results without the existence of this blog and the accountability it brings. Knowing that I will share our results with you readers every month keeps me very focused and intentional with all things related to our financial well being. For that, I THANK YOU for taking the time to read and interact with me on this blog.

Above and beyond this benefit to my own household, my sincere hope is that my policy of full transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom if he or she is willing to do things differently than the pack. If you’re after average results, then you’ve landed on the wrong site. There’s nothing wrong with average, but the kind of results I preach are EXTRAORDINARY. Sure, the “get rich slow” method is proven, but there is an alternative, which is to “get rich fast.” Look, I have no interest in living like a starving college student until I am old and brittle to only then have the means to check off bucket-list items when my body might no longer be physically capable of doing them. And I don’t want that for you either!

Here at GYFG, we approach the pursuit of FINANCIAL FREEDOM with an abundance mindset, so you won’t hear me telling you to cut out those $5 lattes. Choose to spend on what is meaningful to you. I spend a lot, but I also strategically earn a lot, save a lot and invest a lot.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. Keep this famous Jim Rohn quote in mind:

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!”

You must be intentional with your finances if you ever want a fighting chance to make it to financial freedom. But it does not have to take 40-50 years of slaving away for “The Man” before you have the option to retire. I think 10-20 years is all you need, with the most aggressive folks probably able to reach financial freedom in 10 years or less. A high income paired with a high savings rate are two of the vital components of a good recipe for the 10-year track.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (not so many people giving financial advice actually do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, and I think real life examples and numbers can help slice through the complexities (and the BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere, so I always intended to share my own.

You can find all my previous reports on the Financial Stats page.

Financial Stats Dashboard

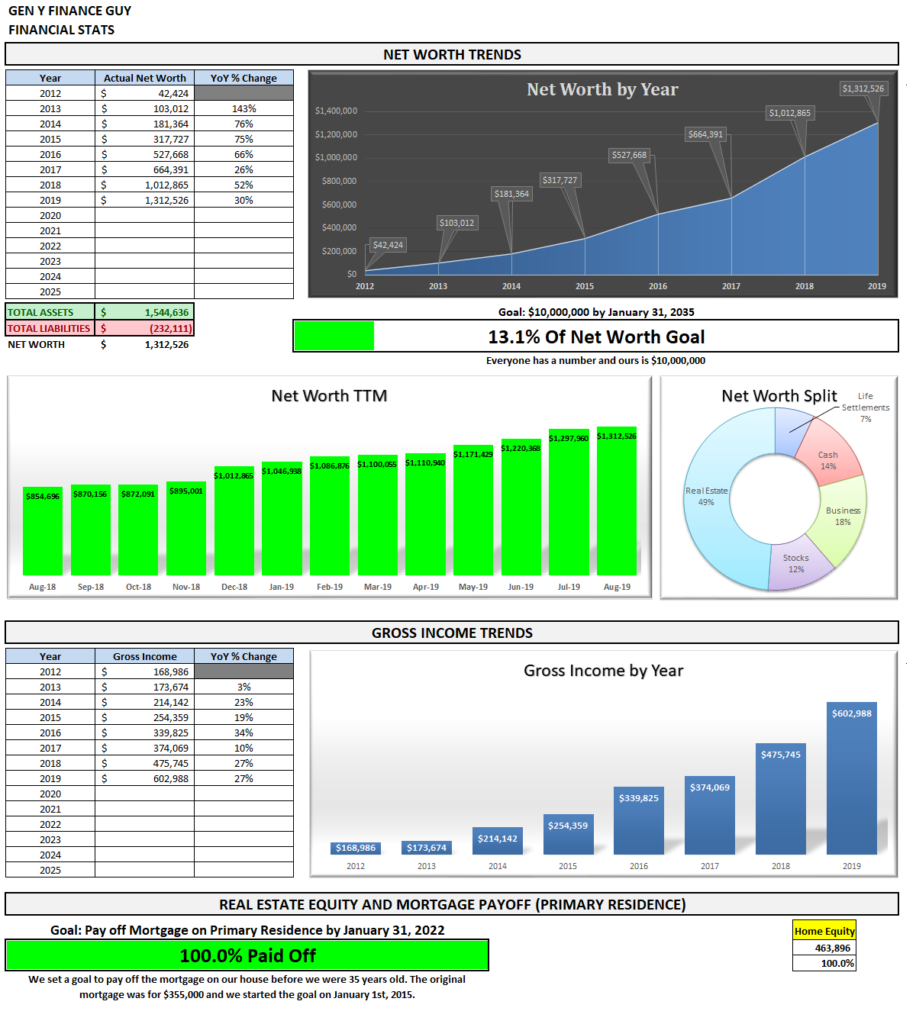

At the end of every month, I download a .csv file from my Personal Capital account and drop it into my custom built excel workbook in order to update the dashboard you see below. I’m blown away every month by the progress we have made in a relatively short period of time.The only number below that is not an actual number and instead is a forecast is the current year projected income of $571,027 in the gross income chart below.

Now that we have seen the overall, let’s take a closer look at a few of the items below.

Net Worth

As I mentioned in the intro, our spending this month put a significant drag on our net worth growth this month. Although we had a negative savings month, we were still able to manage almost a $15,000 increase in net worth (even after spending almost $45,000 in July). We had planned to do our backyard remodel project in Q1 of 2020 when I received the remaining portion of my annual bonus. However, as income has exceeded all of my projections, we decided we could afford to do it earlier, giving us the opportunity to enjoy it six months earlier and in time for baby GYFG’s 1st birthday in October.

I’ve been doing some “back of the napkin” math to get a better idea of our potential net worth by the end of the year and have calculated a potential $1.5M upside value. The two major drivers between now and the end of the year are the continued performance of the business and the annual valuation update to the stock I own in the company I’m still employed by.

August Net Worth $1,312,526 (up $299,661 or +29.6% for 2019)

- Previous month: $1,297,960

- Difference: +$14,526

Net Worth Break Down (MoM):

The Real Estate ($639,958) category remained flat at 49%. This category includes the equity in our primary residence ($463,896), our investment in the Rich Uncles commercial REIT ($74,675), and our hard money loans through the PeerStreet ($101,388) platform. I have been taking capital as it’s freed up from our after-tax PeerStreet account and using it to fund Rich Uncles as we work the RU account value up to $100,000 (which is why the PeerStreet value hasn’t been changing much MoM).

The Real Estate ($639,958) category remained flat at 49%. This category includes the equity in our primary residence ($463,896), our investment in the Rich Uncles commercial REIT ($74,675), and our hard money loans through the PeerStreet ($101,388) platform. I have been taking capital as it’s freed up from our after-tax PeerStreet account and using it to fund Rich Uncles as we work the RU account value up to $100,000 (which is why the PeerStreet value hasn’t been changing much MoM).

Net Cash ($180,006) increased from 13% to 14%. We actually have $200,116 in cash but net cash is only $171,273 after you adjust for our current credit card balance of $20,111, which we pay in full every month based on the statement due date. Keep in mind that of that $200,116 a portion (~$80K) is related to what my business owes and will distribute to me within 30 days for billable work and in less than 12 months for profit distribution (working with a CPA to optimize this from a tax perspective).

The Business ($234,962) category remained flat at18%. This represents the ownership I have in the private company that I work for. This is an illiquid investment that only gets an update to its value one time per year. I net the company stock asset value of $446,962 against the company stock loan of -$212,000 to arrive at the $234,962.

Life Settlements ($91,900) remained flat at 7%. We currently have investments in seven policies at $10,000 each. They are accreting in value by about $1,000 per month. For anyone familiar with options, I liken the fixed return of life settlements to the theta of a short option. In this case, the accreted value is like the theta decay of an option you’ve sold. In more simple terms, with this fixed return you are amortizing (realizing) that value with the passing of time.

The Stocks ($165,700) category decreased from 13% to 12% and represents the cumulative value of our brokerage accounts (retirement accounts) that are invested in stocks. However, this is not all of our retirement money, as the majority of our PeerStreet investments are made through a self-directed IRA (worth about $82,000 and counted in the Real Estate category of the pie chart).

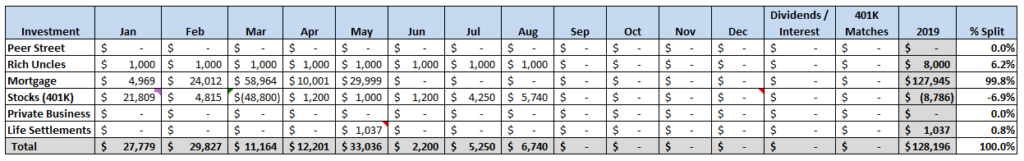

Total Capital Deployed in 2019:

I anticipate deploying about $182,000 in new capital this year (of which 66.7% has already been deployed). Although a healthy sum, this is down significantly from the $414,692 that we were able to deploy in 2018. Going forward I expect there to be a lot more month-to-month variability in the capital deployed. About 65% of the 2019 total deployed will have gone towards putting the mortgage to bed (which officially happened in May).

The only consistent monthly deployments we are making are the $1,000/month to Rich Uncles and the contributions to Mrs. GYFG’s 401K. We are currently just letting cash build up but I do plan to deploy an additional $25,500 to Rich Uncles in order to get the account up to $100K before the end of the year. That is all I currently have on my radar for future deployments. I am paying back the 401K loan at about $450 per month but it’s not reflected in the above table as I plan to just update it at the end of the year (I currently owe $46,703 of the original $50,000 loan). We have plenty of cash sitting around to put the loan to bed at any time, but I’m not interested in doing so at all-time-highs in the market. The Fed did just lower interest rates for the first time in a decade and that usually is followed by a recession at some point, so I don’t feel a sense of urgency to pay off the loan any time soon. The other item not captured in the table above is the $60,000 that I’ve sent (through August) to my high yield savings account at CIT bank currently yielding 2.3%.

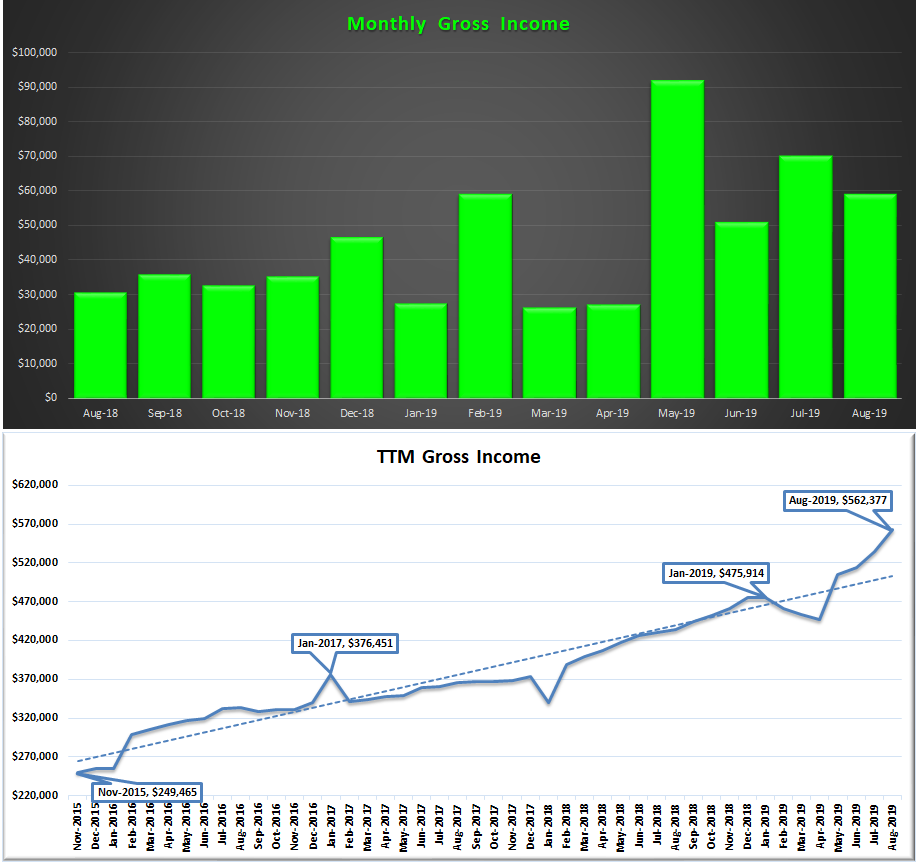

Gross Income

Income for the month of July was $59,115 vs. $70,107 in July. On a cumulative basis, we have earned $411,796 through August of 2019. On the business front, I have a new hire starting in September and due to this, I expect to take a dip in income next month as I delay receiving my August payment for my billable work in order to keep the business self-funded and to avoid tapping my line of credit. This may change depending on the timing of collecting my accounts receivables (currently valued at $89,542 – all current and due in 30 days from 9/2/19). It’s important that I prioritize paying my team before I take payment!

In the second chart above, I also track our income on a trailing twelve months, and as expected the TTM rose to a new all-time high of over $562 (up from $534K at the end of July). We are currently tracking to earn just over $600,000 in 2019 (right on schedule with the goal I set in September of 2016).

Savings Rate

Below is how we actually did towards our goal of saving 50% of our after-tax income. In the chart below, the green bars represent our actual savings rate for the month, the orange bars are what we anticipate based on our 2019 budget, and the blue bar is the projected savings rate for all of 2019.

Our savings rate came in at negative 13%. August is the last month that my business expenses will be comingled with my personal expenses, which has distorted/diluted the savings rate these past few months. The reason is that I’ve been spending a lot more on business travel, which is completely reimbursed by the client, but on my personal P&L it shows up in the revenue line for the reimbursement and the expense line for the actual expenses (a 0% savings rate, bringing my actual savings rate down). I finally received the credit increase I requested on my business credit card.

Do you want to calculate your own savings rate? I’ve made it super easy for you with the savings rate calculator included in the free GYFG FI Toolkit that you can download instantly by clicking the link below. Here’s a peek below. Did I mention it’s free? You have nothing to lose and everything to gain, Freedom Fighter! Remember, what gets measured gets managed.

Speaking of savings rate, go check out my post where I mathematically prove the importance of your savings rate as a higher priority in achieving financial independence than your compound return. If you’re trying to build wealth quickly, then you have to read this post.

Closing Thoughts

Summer has gone by way too fast this year! Then again, I think I say that every year. It’s been a very productive eight months but I’m ready for a vacation (only 40 days until Hawaii as I type). I expect September to be an inflection point for the business as I continue to onboard the new team members I’ve hired in the last month.

I really started to notice a change towards the tail-end of August as I was able to delegate and offload more tasks from my own plate. With additional resources available to me, I expect to delegate more through the end of the year and to take my foot off the accelerator a bit. I’d like to preserve more time to enjoy the holidays this year and rest up for another big push in Q1 of 2020, when my new business becomes my sole work focus.

The business has been compounding at 90%+ MoM for the past six months, going from $3,000 in March to over $70,000 in revenue in August. I’d like to make a run at our first $100,000 month in Q1. The only other item of note is that Mrs. GYFG and I will be checking out a potential investment property in the mountains this month. More to come if anything materializes.

I hope you had an Amazing August!

– Gen Y Finance Guy

p.s. Personal Capital now offers a 2.05% high yield savings account that is FDIC insured.

6 Responses

GYFG! Your backyard looks like an oasis! Quality-of-life is a high-return investment, even if I can’t see it on the pie-chart! Am loving the al fresco dining space in the shady back porch, and separate conversation-pit. It is perfect!

Big momentum to finish 2019, and am looking forward to reading about you and Mrs. GYFG’s assessment of mountain investment property! Realizing you are ‘exaggerating to clarify’ – © Otto & George regarding the ‘blood in the streets’ assessment, but also respect that a landscaping bill like that one hurts a bit. Well done, once again!

Thanks, JayCeezy!

We have already been enjoying the new space and eating dinner out there almost every night now. I just had a technician come to re-connect our hot tub, so that will be getting some serious use in the coming nights.

Dom

Quick question about your business allocation in your net worth breakdown. I’m assuming that’s the valuation of your shares in your previous company, right?

Do you have a plan for how to value your new business? Maybe something like 15x profits or some multiple of sales or something like that?

Hey MC – Yes, the business allocation in my net worth is related to the investment I have in my soon to be previous employer. It’s a combination of the stock I own and the options I have that are vested. However, 99% of the value is related to the stock I own as I’m very conservative in pricing the options. I use a multiple of EBITDA to estimate the value and that multiple is based on the last liquidity event we had in 2016. The current consensus with our private equity investors and investment bankers is that in our next liquidity event we should be able to get that multiple or likely higher.

The only value I hold for my own business is the A/R and deferred comp/distributions that the company owes me. I have thought about how I might hold the value of the business in my net worth but I haven’t decided when or if I will actually add it to net worth – at least not until it is more mature. For a business like mine, I wouldn’t do more than a 2-3X multiple of the bottom line until it’s much bigger. Based on the results of the first six months of the business that would value the business at $400K to $600K (maybe more as owner adjusted earnings would increase the bottom line).

That seem reasonable. It’s always tricky to value a brand new business, and the proper valuation would obviously depend on things like growth rate, your value to the company, etc.

I see this all the time when working with my financial planning clients – they don’t understand the difference between owning a business and owning a job. If the company can’t function without you then you own a job. If you could walk away and things could continue to fun, then you own a business.

It sounds like you’re working hard to build a business, which is where the big valuations are and where the big money is made.

One huge factor in your favor – building recurring revenue will result in higher valuation for your company. I’ve seen companies with steady income be valued at significantly higher multiples than companies with almost identical one-item revenue.

Agreed. I was very intentional from the start that I wanted a business, not a job. I already had a great job but I wanted more leverage, more upside, and more autonomy. I peaked at being billable at almost 200 billable hours last month (just for myself) and this month I will be at maybe 125. As my team continues to ramp I expect to be billable only 80 hours a month or so, which is what I want. But I also expect by Q1 of 2021 that I can choose to be billable or not. The greatest feelings I have right now are:

(1) I’m going on vacation to Hawaii in about two weeks and I will still be earning money while I’m gone not working.

(2) I already know that even if I do no work next year, I already have about $60K in recurring revenue next year.

I just introduced a new recurring revenue stream for a managed service that provides up to a certain amount of support hours that are “use it or lose it.” This could add up to $15,000/month in recurring revenue if it goes as planned. Only time will tell. I’m currently offering 3, 6, and 12 month terms to test the offer.

Dom