I have that feeling again – like something bad is going to happen. Around this time last year, I wrote about how things were going too well and contemplated what would happen when the music stops (everyone should have a back up plan). When I wrote that post our net worth had just reached $551,510 and our trailing twelve months (TTM) income was $347,539. Things have only continued to surpass my wildest expectations. Our net worth has increased $249,860 since then and our TTM income finished May at $417,214. Mind blowing!!!

As you will see below, we are deploying capital at a very aggressive pace. In the long run we will be thankful we did, but I get the sense that it’s going to make that next recession a bit more painful. I have read from other bloggers that during the Great Financial Recession they stopped looking at their net worth on a monthly basis until the market (and their investments) had shown signs of significant recovery. I’m not going to lie, it’s going to be a very difficult exercise updating these monthly reports when net worth is declining month after month.

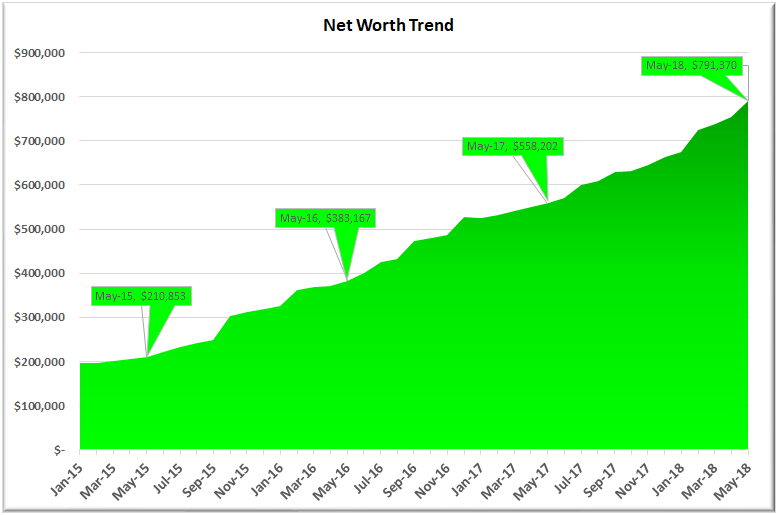

To put things in perspective, of the 41 reports published (including this one), I have only had one month of decline. That’s right, 40 out of 41 months delivered net worth growth (to the tune of $610,007)!

It’s a good idea to prepare yourself emotionally for the inevitable. Although it will hurt, I’m ready for the next recession, whether it comes next month or three years for now. No, I’m not going to go into some deep depression and turn into a negative Nancy. I would never bet against the American economy, especially when I remind myself of a Warren Buffet quote from his 2015 letter to shareholders:

“For 240 years it’s been a terrible mistake to bet against America, and now is no time to start. America’s golden goose of commerce and innovation will continue to lay more and larger eggs. America’s social security promises will be honored and perhaps made more generous. And, yes, America’s kids will live far better than their parents did.

Moreover, investors who diversify widely and simply sit tight with their holdings are certain to prosper: In America, gains from winning investments have always far more than offset the losses from clunkers. (During the 20th Century, the Dow Jones Industrial Average – an index fund of sorts – soared from 66 to 11,497, with its component companies all the while paying ever-increasing dividends.)” – Warren Buffett

Doesn’t that give you so much confidence? It fires me up! So much so that I think I will print this out and hang it over my desk as a daily reminder when the market eventually turns sour for a period of time. This will be a reminder to buy assets on sale in bulk and as often as possible.

Now that I got that out of my system, let’s move on to this month’s financial update.

If you’re a regular reader and only want to read the new content, feel free to just skip the intro below (no harm, no foul). If you are new or haven’t read many of these reports, I encourage you to take two minutes to read the intro below, which will change periodically.

Intro

Mission Statement: To Humanize Finance, Build Wealth, and Reach Financial Freedom.

For those of you new around this corner of the internet, these monthly reports are about full transparency. They are just as much for me as they are for you. It was a hard decision to make all of my financial details public, but it has proved to be a very motivating one. The process I go through every month to produce these reports has been enlightening and life-changing. I published my first “income and net worth report” for January of 2015 when our net worth was only $195,141, and our gross income was on pace to hit $178,000 that year.

Fast forward three years: our net worth finished 2017 at $664,391 with a gross income of $372,477 (and as you will see below both are still growing exponentially).

- That’s a 3.4X increase in net worth due to a compound annual growth rate of 50% for the past three years.

- At the same time, income has increased 2.1X, which translates to a compound annual growth rate of 28%.

Honestly, I don’t think the GYFG household would have experienced these kinds of results without the existence of this blog and the accountability it brings. Knowing that I will need to share our results with my readers every month keeps me very focused and intentional with all things related to our financial well being. For that, I THANK YOU for taking the time to read and interact with me on this blog.

Above and beyond this benefit to my own household, my sincere hope is that my policy of full transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom if he or she is willing to do things differently than the pack. If you’re after average results, then you’ve landed on the wrong site. There’s nothing wrong with average, but the kind of results I preach are EXTRAORDINARY. Sure, the “get rich slow” method is proven, but there is an alternative, which is to “Get Rich Fast.” Look, I have no interest in living like a starving college student until I am old and brittle to only then have the means to check off bucket-list items when my body might no longer be physically capable of doing them. And I don’t want that for you either!

Here at GYFG, we approach the pursuit of FINANCIAL FREEDOM with an abundance mindset, so you won’t hear me telling you to cut out those $5 lattes. I spend a lot, but I also strategically earn a lot, save a lot and invest a lot.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!”

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. Nor does it have to take 40-50 years of slaving away for The Man before you have the option to retire. I think that 10-20 years is all you need, with the most aggressive folks probably able to reach financial freedom in 10 years or less. A high income paired with a high savings rate are two vital components of a good recipe for the 10 year track.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (not that many people giving financial advice actually do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

As always, you can find all my previous reports on the Financial Stats page.

Net Worth

Our net worth was up $37,186 in May vs. April. Compared to last May, our net worth is up $233,168 year-over-year (or +37%).

Last three year-over-year increases:

May 2016 – $172,314 (+82%)

May 2017 – $175,035 (+46%)

May 2018 – $233,168 (+42%)

That is insane to me; an increase of $580,518 in three years. Even more mind-blowing is to look even further back to where we were in the depths of the Great Recession in March of 2009: we were negative ~$300,000 – meaning we have had a seven-figure upward reversal of $1,091,370 in nine years. As I look towards the end of 2018, I’m currently projecting our net worth to finish at around $860,000 before any gains (appreciation, dividends, or interest).

May Net Worth $791,370 (up +19.1% for 2018)

- Previous month: $754,204

- Difference: +$37,186

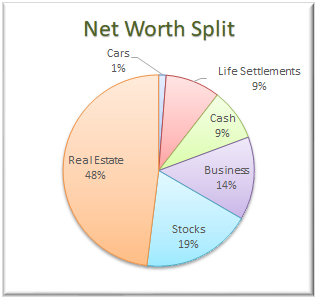

Net Worth Break Down:

– The Real Estate category slipped from 50% to 48%. Keep in mind that this category includes the equity in our primary residence ($222,945), our investment in the Rich Uncles commercial REIT ($54,060), and our hard money loans through the PeerStreet ($103,069) platform.

– The Real Estate category slipped from 50% to 48%. Keep in mind that this category includes the equity in our primary residence ($222,945), our investment in the Rich Uncles commercial REIT ($54,060), and our hard money loans through the PeerStreet ($103,069) platform.

– Cash increased from 7% to 9%. We are currently holding $69,770 in cold hard cash (what I like to call dry powder). This is net of our credit card balances of almost $8,000, which we pay in full every month based on the statement due date. I suspect “cash” to continue increasing to well over $100,000 by the end of summer.

– As a clarification for newer readers, the Business category (at 14%) represents the ownership I have in the private company that I work for.

– Life Settlements decreased from 10% to 9%. We currently have investments in seven policies at $10,000 each. I would like to build this up to $100,000 before 2018 is up. As planned, we invested in two additional policies in April.

– The Stocks category (at 19%) represents the cumulative value of our brokerage accounts (retirement accounts and after-tax account) that are invested in stocks. However, it is not all of our retirement money, as the majority of our PeerStreet investments are made through a self-directed IRA (worth about $75,000 and are counted in the Real Estate category of the pie chart).

– That leaves the Cars category at 1%. I include our cars because the goal is to keep the value of our cars as a percentage of the overall net worth pie as small as possible. By including them, it keeps me conscious of the opportunity cost of sinking too much capital into the machines that are only meant to get us from point A to point B. The combined value for our cars is currently being held at $10,000 based on current Kelly Blue Book. However, now that our cars make up a minuscule portion of our net worth, I am seriously considering removing that category from net worth altogether (which I have been saying for several months now).

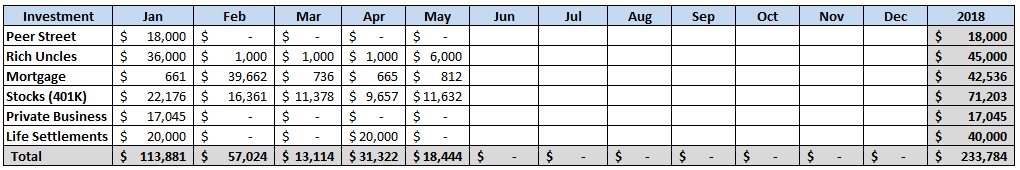

Total Capital Deployed in 2018 (YTD):

I am actually borrowing this idea from Sam over at Financial Samurai, who started sharing his own capital deployments in a similar form last year. One item not captured in the table below is the capital deployed due to automatic reinvestment of dividends and interest, but I do plan to include that total at the end of the year. I estimate that we will deploy somewhere between $250,000 to $300,000 for the year. This will make for a very easy way to see where and when it was deployed.

About $80,000 of the 2018 total anticipated deployments is from idle cash that was sitting in my 401K (for way too long).

I can’t believe that we have already deployed $233,784 in the first five months of the year. I officially maxed out my 401K in April and my wife is set to have hers maxed out by July. I anticipate deploying about $15,000 in the month of June. I anticipate a slow down of capital deployment starting in July as we work to build up the cash reserves.

Gross Income

May was up slightly at $34,208 vs. April of $33,587. June’s income will be significantly higher (~$45,000) for two reasons: (1) A three pay period month for me and (2) Mrs. GYFG is killing it on commissions. July will be at least the same if not higher due to my mid-year bonus (potentially a $50,000 month).

In the second chart above, I also track our income on a trailing twelve months, and we set another record in May at $417,214. Can someone pinch me to make sure I’m not dreaming???

Savings Rate

Below is how we actually did vs. our goal of saving 50% of our after-tax income.

We managed to save 33% in May! This was a bit lower than projected but we are still tracking to an annual savings rate of 61%.

Speaking of savings rate, go check out my post where I mathematically prove the importance of your savings rate as a higher priority in achieving financial independence than your compound return! If you’re trying to build wealth quickly, then you have to read this post.

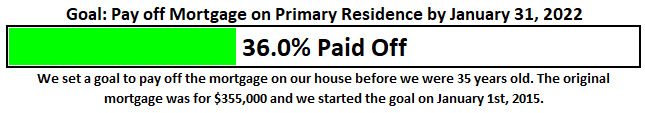

Mortgage Early Payoff Goal

Read about our strategy to pay off our mortgage in seven years (and three months). After several refinances we currently have a 3/1 ARM at 2.25% and we currently owe $227,055.

We are still committed to this goal. Equity in our primary residence currently accounts for 28.2% (down from 29.5% last month) of our net worth, and will continue to increase in absolute dollars but should be diluted throughout the rest of 2018 as we continue to grow our net worth pie with additional savings and investments. Based on my most recent projections, we should be able to dilute this concentration from down to 25% by the end of 2018.

We would like to see this closer to 20% in the short term and far less in the long term (like less than 10% over the next ten years). The reasons are as follows:

(1) Concentration Risk – Although I am confident we will accomplish this goal on time, you never know what may happen unexpectedly. What if we both lost our jobs and couldn’t make our mortgage payment? The bank is going to foreclose on a house with 50% equity a lot faster than one with 5% equity. Until we have the house completely paid off, this will always be a concern and risk to manage.

(2) Diversification – We don’t want our entire net worth tied up in our house. That would be poor risk management.

With these factors in mind, in February we decided to add an element to our mortgage pay-off strategy, making a pivot to set up a home equity line of credit (HELOC) as a risk mitigant to my concerns above (this closed in March and we now have a $127,000 revolving line of credit in place). We now feel satisfied that we can both pay off the mortgage early, and still access our home’s equity as we need to.

The original philosophy of this plan to pay off the mortgage was to accomplish this goal while avoiding any austerity to our lifestyle. I coined it the “pay more tomorrow” plan. In keeping with the GYFG emphasis on the income side of our financial equation, I decided that we could easily increase our income (after tax) by at least $9,600/year and dedicate that additional income to fund the goal effortlessly. It has played out as planned, and we have used the cumulative increases in income thus far to execute this goal flawlessly. Since setting this goal in January of 2015, we have paid down an additional $96,600 (Year 1: $9,600, Year 2: $19,200, Year 3: $28,800, Year 4: $39,000).

This goal is now 36% complete! And with the addition of our HELOC, I feel we now have an even more nuanced and powerful strategy here.

RELATED: Our Mortgage Will Be Gone In Four More Years

Closing Thoughts

We get 365 opportunities every year to turn our dreams into reality (366 during a leap year). Are you taking advantage of each and every opportunity? Are you doing the work to reach your wealth goals? Don’t be discouraged when progress is slower to materialize than you expected. With enough time and consistency, one day you will look back and be blown away by the progress you have made (over a five or ten year period). You have to be persistent and rely on grit to get you through the grind it takes before the momentum really starts rolling.

Time + Consistency = Success

Make sure you celebrate the significant milestones along the way. The GYFG household has already celebrated two of the five major milestones on our way to Financial Independence. We are now grinding our way towards milestone number three – The Double Comma Club. Although I’m currently only projecting our end-of-year net worth at $860,000, which is conservative, we are making a run at $1,000,000 by the end of 2018. You better believe we are going to pause and celebrate before soldiering on.

Your turn! What stage in your pursuit of FI are you in? Are you fighting to get to Ground Zero? Maybe Six Figures? What would you do to celebrate hitting a seven-figure net worth? Or what did you do to celebrate if you have already hit this milestone?

Cheers!

– Gen Y Finance Guy

P.S. I recently had another opportunity to do a podcast interview. This time it was with Gwen and J from the FIRE Drill podcast. In this conversation, we talk about career hacking your way up the ladder, ambitious net worth goals (like my crazy $10M goal), putting up big income numbers, and the importance of high savings rates. My parting line was “if you’re not happy and healthy, then what is the point of being wealthy?”

Career Hacking Lessons from a 31 Year Old Executive | Dom from GenY Finance Guy

P.P.S. If you haven’t already, be sure to check out my interview with Erik from The Mastermind Within. The conversation we had was fun, informative, and unpacked many great nuggets of wisdom that have shaped my life. It was deeply gratifying that Erik reached out to have me on the podcast, as the greatest compliment I could ever receive is knowing that I’ve had a positive impact on someone else. Plus, revisiting The Slight Edge is always great – it’s the book that’s had the most impact on my life!

Practicing Simple Daily Disciplines to the C-Suite with Gen Y Finance Guy

4 Responses

This guy is so inspiring! It’s funny how some people act like people that make this much money are unicorns or only on wall street or doctors or something… But coming here, makes us know it’s possible. Yes we have to do some things differently, but it is possible!

Good stuff man, you guys are killing it….You should hit $1 Mil before this time next year. Awesome!

Thanks, HLT!

People have a tendency to place artificial ceilings on their own potential. If you go back to the dialogue we were having on your blog, this is why I think it is so important to associate yourself with people that are far more successful than yourself. If nothing more than to be exposed to possibilities you didn’t know existed. To see beyond conventional paths and wisdom.

Finally have managed to get hold of a copy of the Slight Edge. As they say ‘knowledge is power’ so hopefully reading the book will be one more step on the journey to FI.

HH

HH – I really hope you enjoy the Slight Edge and get as much out of it as I have over the years.

Cheers,

Dom