GYFG here checking in for the January monthly financial report. If you have been reading these reports for a while you will notice that I introduce each month with the same intro month after month. I do this for two reasons; a) for the newbies to the site (which make up about 50% of the sites traffic); and b) to remind everyone what these reports are all about. By all means if you have read the intro at least once, then please feel free to skip down to the “Summary of January 2017” section where the new content begins (click the orange link to be taken there automatically).

For those of you that are new around this corner of the internet, I wanted to fill you in as to what these reports are all about. These monthly reports are about full transparency. They are just as much for me as they are for you. It’s a hard decision to make all of your financial details public, but it’s also a very motivating one. It’s not just the post, but the process of putting this post together that really benefits me.

My sincere hope is that my transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom, if they are willing to do things differently. If you earn an average salary and have an average savings rate, then you can expect an average result! That means you will likely have to work at a job you may or may not enjoy until you’re 65 and then maybe you can retire IF you’re lucky.

Hey, there is nothing wrong with average. If you’re happy with average, then by all means keep doing what everyone else is doing. Not sure how you feel about that, but I have no interest in living an average life. I want EXTRAORDINARY.

Most people don’t want to live below their means in order to reach FINANCIAL FREEDOM, because that’s painful. They think it involves cutting out all the joy in life. You know what I’m talking about, those financial gurus that tell you that in order to get rich you need to cut out the $5 lattes and stop going out to eat. Then after 40 years of diligent and above average savings and super low spending, you will be a millionaire. Basically, you have to live like a college student and suppress all the things you want to do in life and then when you’re old you will be rich.

Okay, that doesn’t sound like the plan for me either.

The good news is there is another way. This site and these reports are here to show you the OTHER path to financial freedom. There is a way where you can have your cake and eat it too. I believe and hope that over time I will be able to convince you of the following:

In order to reach financial freedom you can choose to live below your means by cutting expenses to the bone and living in a state of scarcity or you can expand your means and live in a state of abundance by increasing your income and enjoying the $5 latte or other indulgence of your choice.

Not only that, but if you’re diligent you can reach financial freedom a lot sooner than anyone has ever led you to believe.

Our Mission Statement:

To Humanize Finance, Build Wealth, and Reach Financial Freedom.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (because not that many finance blogs or people giving financial advice do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, but I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere.

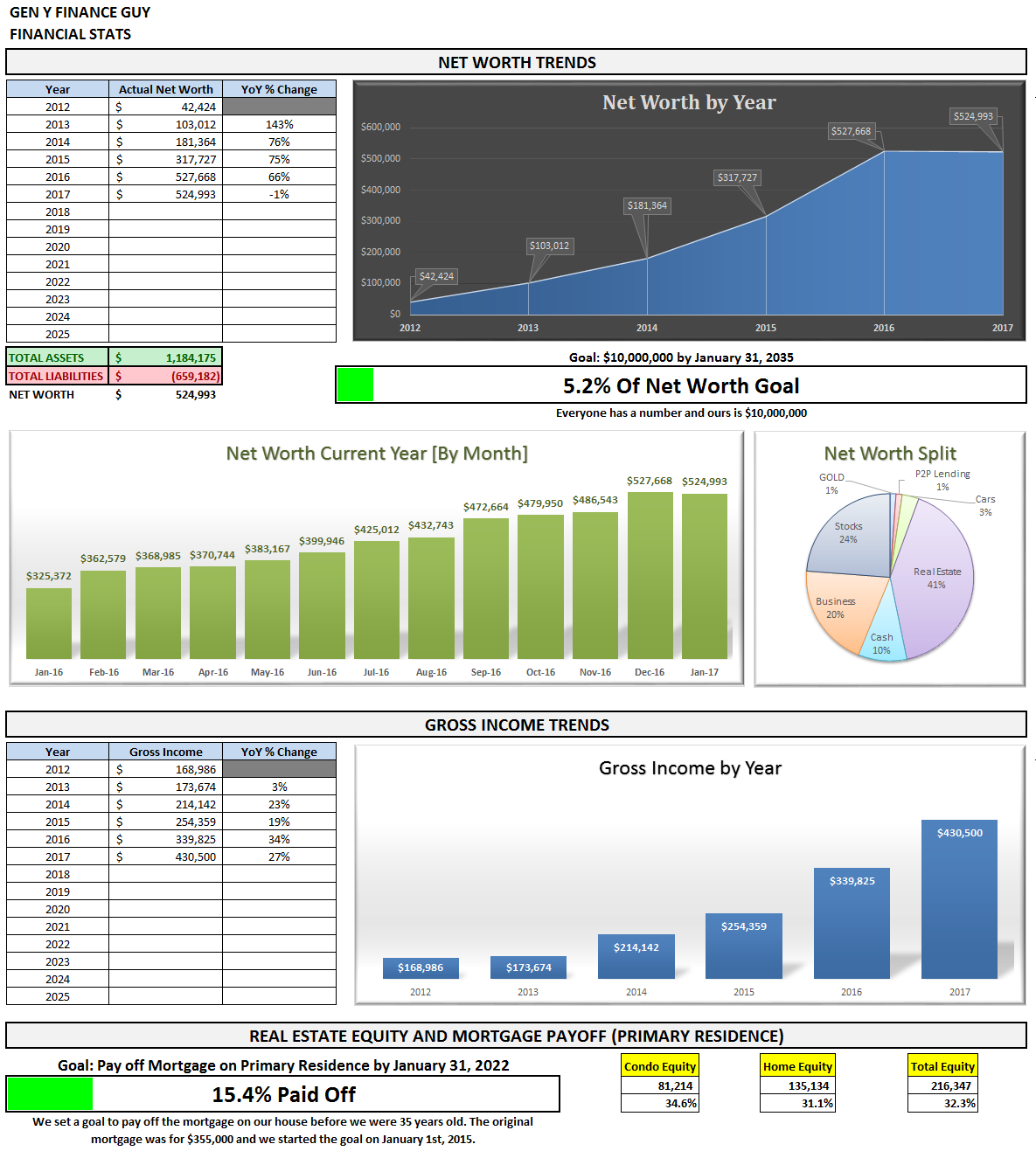

As always, you can find all my previous reports on the Financial Stats page (as well as annual trends and a few other financial metrics not found on this report). In these monthly reports the plan is to give you a month over month update on Gross Income, Assets, Liabilities, Net Worth, Expenses, Contributions, Savings Rate, and progress on the mortgage pay down goal.

Summary of January 2017

Wonder how I pull all this information together every month?

Note: You may be wondering why I don’t use a bunch of screenshots from personal capital in these reports, and that is a fantastic question. As many of the other bloggers out there who use personal capital, post nothing but the graphics from within the application. I personally only use it as an aggregation that feeds into my own database that creates all the graphics you see in this post. The tool is fantastic, but I personally think the graphics are a bit limited, and prefer my visualizations.

We use Personal Capital to aggregate and consolidate our transactions from across all of our financial accounts (checking, savings, retirement, credit cards, mortgages, HSA, and other investment accounts). At the end of the month I export that information into my financial stats spreadsheet in order to produce this (beautiful) monthly report.

Tracking your finances is, in my opinion, the best way to stay on top of your finances. You can’t optimize what you don’t measure. You can’t make informed decisions if you don’t know what you having coming in vs. going out. Without a holistic view of how much you spend every month, there’s no way to set savings, debt repayment, or investment goals. It’s a financial freedom must!

If you don’t already have a FREE account with Personal Capital, stop reading and go sign up for your account right now! (Seriously, this financial update will be here when your done. There’s no time like the present to take action. You will thank me later!)

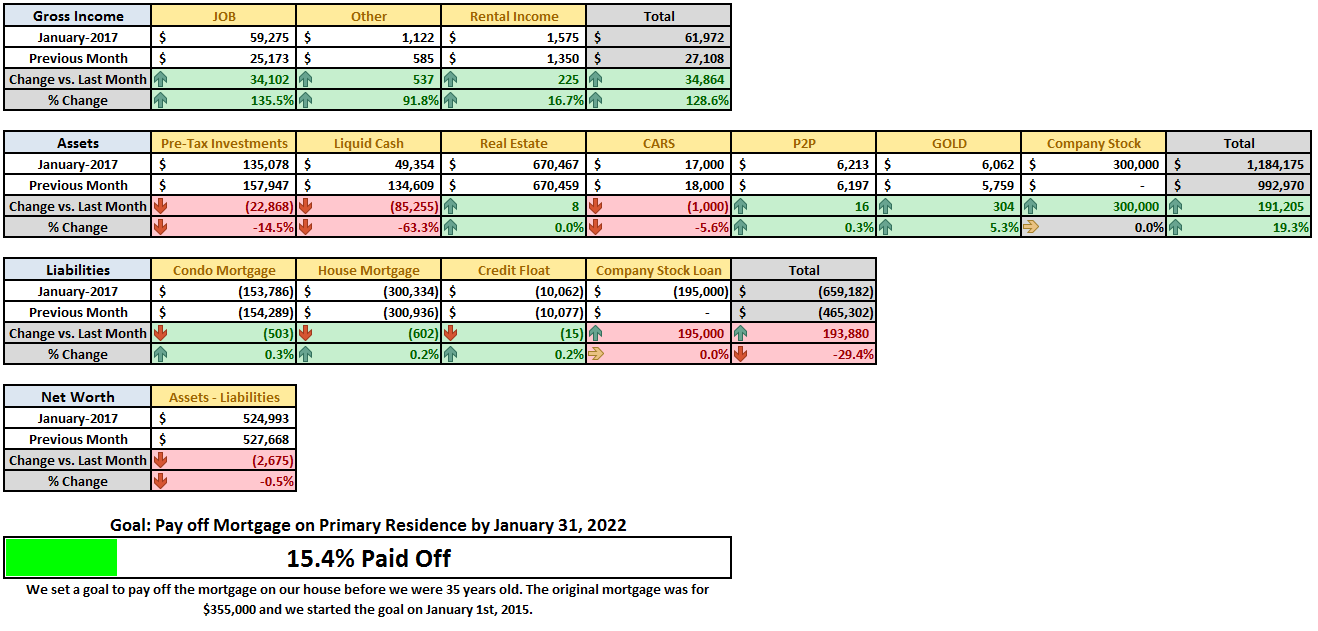

Month Over Month Financial Summary

Just three things to point out in case you missed it:

- Gross Income was up 128.6% and is a new record month. This is largely due to my year end bonus hitting.

- Cash is down $85,255 or -63.3%. We actually had about $145,000 leave our accounts: (1) to fund the $105,000 investment I told you guys about, (2) to fund part of a $12,000 home improvement project, and (3) to check my brother into rehab, which costs $33,000.

- Our Pre-Tax investment accounts took a hit of $22,868 due to a loan I took from my 401K. I didn’t talk about it much in my post about checking my brother into rehab, but from a cash flow perspective the timing was not great, so I took a short term loan of the idle cash I had sitting around. The plan is to pay it back fully over the next 6 months.

Note: In December I was actually expecting to see a large increase to net worth in January due to my bonus hitting. But I did not foresee the events that would unfold with my brother and checking him into rehab in order to save his life.

INCOME; What went down in January?

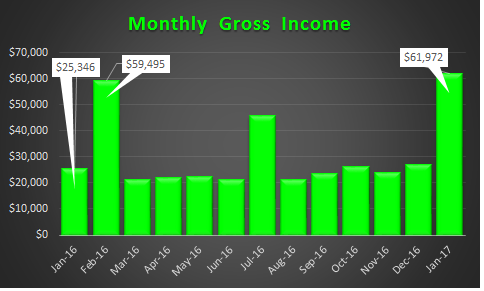

January Income = $61,972

- Previous Month: $26,944

- Difference: +$34,864

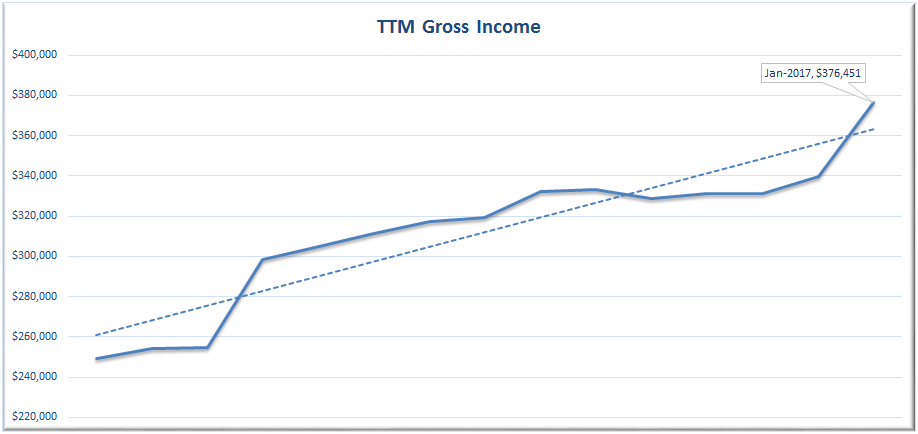

The GYFG household started 2017 strong with a new record high for income in a month. The big increase is largely due to my year end bonus hitting this month. When looking at the chart below, it makes more sense to compare this months income vs. February of 2016 (since my bonus payout slipped a month last year).

Here is a look at the trend for the last 13 months:

For those of you not familiar with the TTM acronym, it is short for ‘Trailing Twelve Months’. The month marks a NEW all-time high of $376,451.

Now where did all that money go?

I have come to the realization that there are always going to be unplanned expenses. Our goal is to save 50% of our income and live off and enjoy the difference guilt free. With that type of rule governing our financial life, it is a free pass to inflate our lifestyle, but only proportional to our income. You can see prior financial reports here. We do however try to line up expenses with expected income as much as possible.

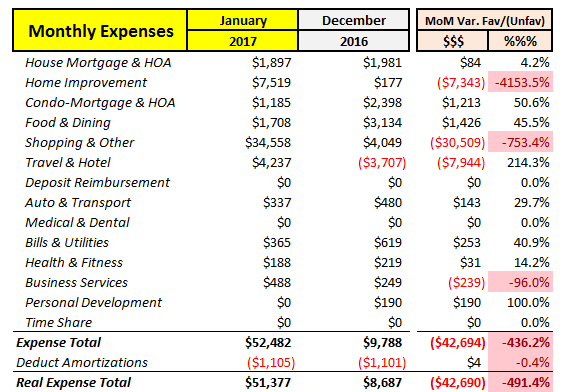

Yikes! January was unexpectedly high to the tune of $33,000. As I mentioned earlier in the post and wrote about specifically here, we had to check my brother into rehab in order to save his life.

I had thought about excluding it from the report all together, but it was real money spent, so I decided to leave it in. Obviously this had a huge impact on both our savings rate for the month and our net worth. There is a chance that we eventually get paid back, I am not holding it as an asset on our balance sheet, since I have no idea as to the probability of getting paid back.

This explains the HUGE increase in the “Shopping & Other” category, but what about “Home Improvement” and “Travel & Hotel”? On the home improvement front, we had planned to get wood tile put in throughout the bottom floor of our house, so although a big month over month increase, it was expected. The $7,519 expense in January is for the cost of all the material and in February we will have another $6,000 related to the labor expense of getting it installed.

We typically plan for home improvement projects at the beginning of the year due to the timing of cash flows with my bonus.

On the travel side of things, December was a big credit due to reimbursements from work for all the business travel I did in November and December.

Another point to note is that our spending in the “Food & Dining” category took a sizable dip in January and this is true even though some of our expenses from our St. Thomas trip are still in the numbers. We plan to be very frugal in this area over the next few months as we try to cook at home more.

Lastly, the “Travel & Hotel” category will drop significantly and will likely be negative in February due to about $3,000 in reimbursements for work related travel that is coming my way.

January was not an ideal month and reflects substantially more than we normally spend, but it also shows you that we are human, and we have to deal with unexpected financial issues as they arise. We are fortunate to be in a position that we were not only able to help my brother out, but we still had the means to move forward with our home improvement project, which we had been looking forward to all of 2016.

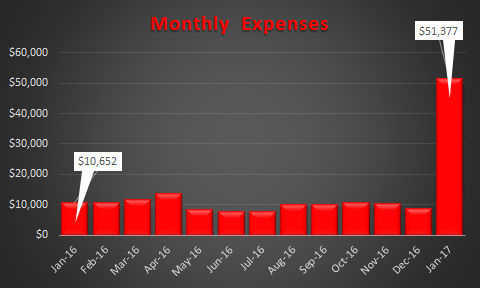

Here is the trend for the last 13 months:

Note: I have now changed the chart to reflect the add-back of loan amortizations to reflect what I call “real spending” above. This is done because amortizations are really just a balance sheet transfer from cash to pay down liabilities, it has no impact to net worth.

That spike is going to haunt me for the next 12 months, but it is also going to be a constant reminder to keep spending in check for the remainder of the year in order to achieve our savings and net worth goals.

CALL OUT: It is crazy how slippery money can be. Because of this I totally recommend you automate as much of your finances as possible, especially the saving and investing piece. We set our financial goals at the beginning of the year and then automate the process of reaching them.

Examples:

Our mortgage payment is automatically set up to pay $1,600 in additional principal.This will be put on hold until April 2017- My 401K contribution is automatically deducted at a rate that will ensure I max out by year end ($18,000)

- My HSA contribution is automatically deducted at a rate that will ensure I max out by year end ($6,750)

- In 2017 we will be adding additional automated savings (more to come soon)

All of these things take priority over any spending that we do in a given month. We monitor expenses but don’t really manage them. Instead we manage savings and investments and let the expenses work themselves out.

Savings Rate

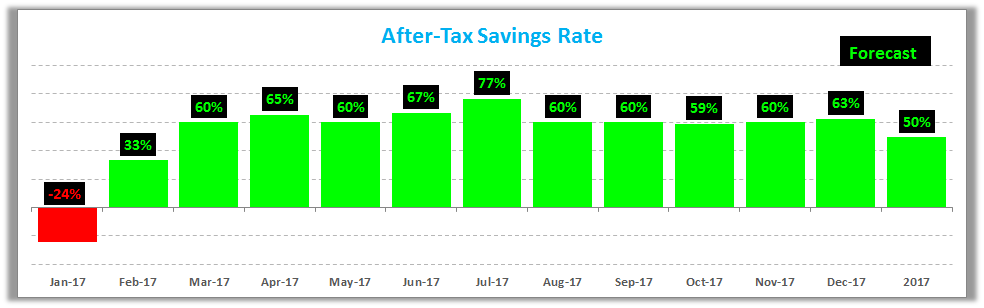

Below is how we did vs. our goal of saving 50% of our after tax income.

You can see that although our goal for the year is 50%, we bounce all over the place on a monthly basis.

This is not exactly how we wanted to start the year, in 2017 we were projecting a 63% after tax, but that was based on a savings rate of 83% in January 2017 (saving a large portion of my bonus).

I have not adjusted the full year expense forecast for 2017 just yet, so we will likely still exceed 50%, but 63% is going to be a bit out of reach as far as I can see right this moment. This is the first time in the last couple of years that we have had more money going out the door than coming in.

Speaking of savings rate, have you checked out my post where I mathematically prove the importance of your savings rate as a higher priority than the compound return? If you’re trying to build wealth quickly, then you have to read this post.

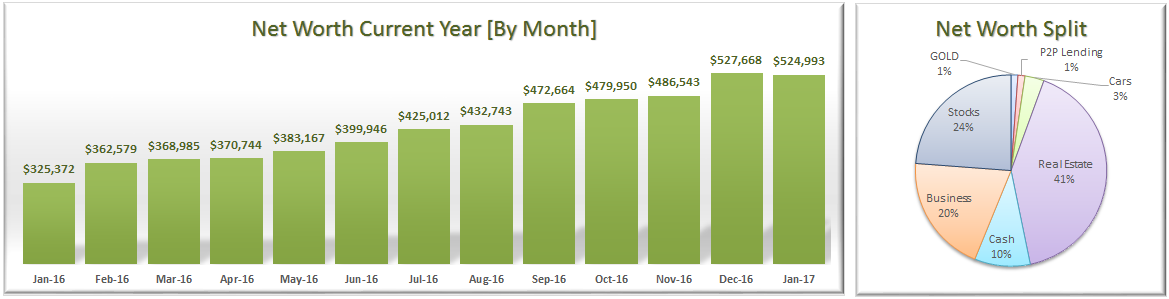

Net Worth and Mortgage Pay Down Update

My ultimate goal is to build up a Net Worth of $10M returning 6% a year or $50,000/month in gross income. Don’t freak out, this is only about $5.5M in today’s dollars when you take into account a 3% inflation rate. If you want to see how I plan to get there you can read all about it here.

I am pretty bummed out that we not only did hit a new high, but we actually lost -0.5% in January.

January Net Worth $524,993 (down -0.5% for 2017 YTD)

- Previous month: $527,668

- Difference: -$2,675

This month broke our streak of 24 consecutive months of positive net worth growth. I knew a day like this would eventually come, but at the same time I was hoping it would not. It’s okay, we will be back to positive net worth gains in February and through the rest of the year.

Net Worth is up 1,137% since 2012 (More than 10X in 4 years; so I can hardly complain)!

Net Worth Component Break Down:

This month I added a new “Business” category that reflects our recent $105K equity investment.

You will also notice that I consolidated the split out of our primary residence and just lumped it all into the “Real Estate” category. However, we are still tracking this, I just wanted to keep the pie chart clean and easy to read. Our primary residence is currently sitting at 25.7% of our net worth.

Note: I think people tend to glaze over the fact that the savings rate plays a much bigger role in increasing your net worth than the rate of return on your investments (in the early days of your journey). In the short term, savings rate has a bigger impact on net worth. The goal is to eventually build a big enough asset base that the gains from compounding will eventually outpace the gains from savings. Actually, check out the post I recently wrote: Savings Rate – The Most Important Variable to Wealth Building [and the math to prove it]

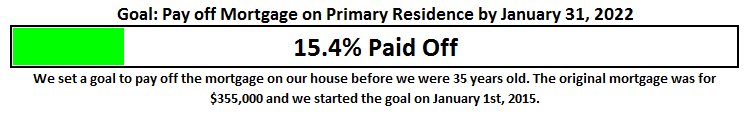

Progress On Our Mortgage Payoff Goal

You can read about our strategy to pay off our mortgage in 7 years (and 3 months). After several refinances we currently have a 3/1 ARM at 2.25% and we currently owe $300,344.

The progress chart above shows how much of our goal we have completed. The goal completion percentage is up 0.2% vs. December. We will begin making more rapid progress on this goal starting in April 2017. We had put the extra payments on hold for two reasons:

- Because the last cash-in refinance we did had us bring in a good chunk of cash that put us ahead of schedule to the 7-year plan. Meaning we were not scheduled to make another extra payment until April of 2017.

- The other reason was due to the concentration here. By April we will still have a decent amount of concentration, but we are going to continue moving forward with our goal anyways, setting the new max at 30% of net worth.

The End

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. There is a famous Jim Rohn quote that I think everyone should keep in mind:

If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!

You have to be intentional with your finances if you ever want a fighting chance to make it to financial freedom. It doesn’t have to take 40-50 years of slaving away for the man before you have the option to retire. I personally think that 15-20 years is really all you need, and for the folks that are more aggressive (i.e. extremely frugal, not us) or very high earners you can probably reach financial independence in 10 years or less (maybe us, it’s yet to be seen but income is our focus vs. expenses).

I am looking forward to chatting with you all in the comments below. How was your month? Also, if you have a blog, I encourage you to write a monthly financial report and come back here and share the link. I would love to be part of your support and accountability.

One last thing before we go. If you are new or even if you’re not new and you have been wanting a more guided tour of the blog, I finally launched a “Start Here” page. I highly recommend you check it out.

Cheers!

– Gen Y Finance Guy

Oh, you’re still reading.

Do you want to help keep our lights on? You’re under no obligation, but if you were already thinking about it or were a little bit curious, why not help us out?

Here are a few ways you can help us out:

- Personal Capital – You know how big I am on tracking my finances, that’s why I totally recommend Personal Capital’s FREE software that helps you see all your financial accounts in one secure and convenient place (checking, savings, investments, and retirement accounts). Without a tool like Personal Capital, these reports would take 2-3 times as long to complete. You want to track your income? Your expenses? How about your Net Worth (who doesn’t like watching that bad boy climb). Just sign up and link your accounts today. Absolutely FREE to you!

- TD Ameritrade – They are hands down the best broker for the retail investor. TD Ameritrade provides a number of investing platforms that are more robust than any other platform I have ever used. My particular favorite is the “Think or Swim” platform. Oh, and did I mention that they have over 100 ETFs that you can trade commission FREE?

- Blue Host – Have we inspired you to create your own blog? Well let me save you some money. This is the hosting company that I use for this blog. It is stupid cheap and the customer service is amazing. The normal price is $5.99/month, but if you use this link you will get a 34% discount (only $3.99/month). It took me less than 5 minutes to buy my domain, install wordpress, and get the first version of this site up and running.

OR you can check out our Recommended Products and Resources page.

15 Responses

Hey Dom,

I can’t imagine having 59k hit the bank account in a given month, congrats to you on hitting a record month!

What are your thoughts on your 401k loan? You were sitting in cash anyway, plus now you will just be paying yourself interest each paycheck… I think borrowing from your 401k can be useful contrary to other opinions out there.

Erik – To be honest I don’t have any issue with taking a 401K loan and paying myself interest. I look at it as just another bucket of capital to pull from. I know from the report the cash position actually looks high, but there were several other expenses and transfers that were right around the corner in February:

1 – We had another $6,000 that we needed to pay our contractor to complete our flooring job.

2 – We had our credit card due in the amount of $10,000.

3 – I had already planned to send $5,000 to my Rich Uncles Investment account.

4 – And I opened a new investment account with Peer Street that I funded with $3,000

So, $24,000 has left the cash balance since January 31st, in addition to the $105,000 and $33,000 that left in January for the equity investment and my brothers rehab.

I also wasn’t sure on the timing of my bonus, as last year it didn’t hit until February.

All that to say that I borrowed from it to manage cash flow. We will pay it back sometime in the next 6 months, and until then we will pay oursleves 4.5% interest or about $100/month. In the grand scheme of things this is not a big deal.

Oh, and the other thing I forgot to mention is that we have also initiated a refinance on our investment condo in order to free up about $300 to $400 a month in cash flow. So, we also wanted to have a good amount of cash sitting in our checking to ensure a smooth refinance process.

Cheers,

Dom

Yay for that bonus! 🙂

Ouch, it does suck to spend that much money, but I think you’re doing the right thing for your brother. Family comes first, and I’m glad he has someone like you in his life to lend a hand.

No regrets here, it’s onward and upward. I have another 11 shots at increasing net worth over the course of 2017. Also, although net worth didn’t grow, we have put a significant amount of new capital to work 🙂

Thanks for the kind words.

Don’t feel bad about not making the projected net worth for January. You’re doing so well and you’ll keep going forward and do well the rest of the year. What you did for your brother is worth so much.

Totally agree RocDoc!!!

Yep! You should be really proud of being able to help your brother in the way you are doing. It’s well worth it. I’m keeping my fingers crossed for your family.

Glad to hear you are able to let a down month roll off like water on a duck’s back. The main reason I don’t track things monthly is I am not as confident in my ability to keep perspective with the inevitable down months. It took a down month for you to prove you are!

Brian – I knew a down month would eventually come and was actually surprised that it took 25 months to happen. Now it’s time to see how many growth months I can stack up before the next decline.

We should be able to increase our net worth by $10K+ a month through the end of the year with a larger increase in July due to my mid-year bonus. So, still lots of positive to look forward to. As you mentioned in a previous comment, the unexpected expense for my brother is kind of the reason we work so hard to build our freedom funds right?

Cheers,

Dom

The numbers look red, that is not nice. The cause is known and very positive!

Thanks for the update! I’ve been searching for a better way to display all my information (previously I felt like I was just doing a data dump) and really like the simplicity of your Month over Month table. It conveys plenty of information without overloading. Do you mind if I borrow that table from yiu? Appropriate references will be given, of course 🙂

CentsOK – you are more then welcome to copy my table format!!!

They say imitation is the best form of flattery 🙂

Just started following your blog, great job tracking your path towards your retirement goals! Are you willing to share your financial tracking spreadsheet (is there a template others can use)?

Brian – My spreadsheet is very custom, but it is all sourced from Personal Capital, which is where I recommend everyone start with tracking all things financial.

However, I do have a much earlier version of my financial spreadsheet that you can download when you join my email list.

Cheers