Summer officially ended September 22nd but you wouldn’t know that based on the weather. I read it somewhere that September was a record-setting hot month. I’m typing this on October 3rd and it is 100 degrees outside – ugh!

I’m not really a fan of the hot weather and look forward to cooler days and nights ahead. I always tell people that the weather is perfect about seven months out of the year where I live but the other five are…well, less than perfect. I can’t wait to open up the house and let some fresh air inside instead of running the AC 24/7.

The weather wasn’t the only thing that was hot in September. My business set another new record with $202,000 in revenue for the month. The financial results have been great but managing the growth has become painful for several reasons:

(1) I’m in dire need of a vacation! Yes, I’m counting down, there are 28 days standing between me and the beach house we rented for November. I can’t wait to turn my email and phone off for an entire seven days before checking back in – neither can Mrs. GYFG.

(2) Scaling is hard! We are at a critical inflection point where we either decide to remain small and create a ceiling of about $2M to $2.5M per year or we invest in the business to take it to the next level. I’m opting to continue growing the business but I need help to do it from here. That is why I’ve hired someone (effective 10/1) to help me with the consulting operations and a business coach (starting 12/1) that has been in my shoes (he started, grew, and exited a tech services business).

Mrs. GYFG is still dealing with a super hot real estate market, particularly on the refinance side of the business due to the ultra-low rates. Her office is getting to the point where they are contemplating turning business away, that is how overwhelmed they are. They got some relief at the end of September when a member of the team came back after recovering from a medical procedure. Let’s just say that Mrs. GYFG is on track to have her best income year on record.

Baby GYFG is growing so fast and will be two in October – crazy! We got to take him and our niece to the wild animal park and besides the occasional meltdown, it was a fun experience.

I have to admit that these past couple months have been some of the hardest I’ve ever experienced but I know there is relief coming. Don’t take this the wrong way – I have nothing to complain about, as from the outside looking in, everything is going swimmingly well. I just need a break from the crazy pace.

Let’s dive into the details!

Financial Dashboard

Note: The income figure you see in the chart above for 2020 is our current projection for the calendar year, which is different than our TTM income figure that clocked in at $1.384M this month.

Net Worth:

Current Net Worth: $2,208,859 (up $538,538 or +32.2% for 2020)

Previous month: $2,127,140

Difference: +$81,719

Note: I’m still not holding a value for my business in my net worth. Depending on the multiple you use, that could add anywhere from $350,000 (1X) to $1,800,000 (5X) based on 70% ownership I’ve retained.

Net Worth Break Down:

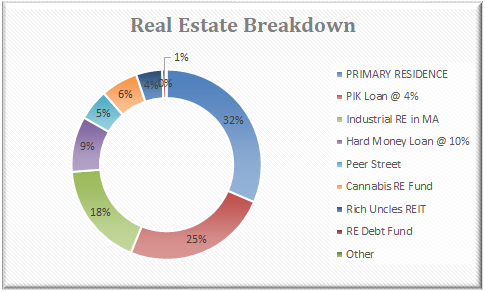

Real Estate (72%) – This category includes the equity in our primary residence, a hard money loan at a 10% interest rate, our investment in the Rich Uncles commercial REIT, and our hard money loans through the PeerStreet platform. This also includes a 4% PIK loan that will be converted to an equity position in 2022. We will be reducing our concentration in the real estate category in the near future once our $300,000 cash-out refinance closes in September October (this has been a long process but we are scheduled to close on 10/5/20). In the chart below you can see that our primary residence makes up the largest chunk (at 32% of the real estate category and 23% of total net worth), but that will substantially decrease by the time I publish the September October report (Real Estate will make up ~60%).

Net Cash (18%) – We plan to see an increase of $300,000 in cash in September October, which will boost this to a ~32% allocation of net worth. That’s because, after being mortgage-free for 17 months, we have decided to put a mortgage back on our house with a cash-out refinance. This will help us reduce our concentration in the real estate category, while also taking advantage of the lowest mortgage rates in history. We were able to lock in 2.865% for a 30-year mortgage.

Alternatives (7%) – This is a new catch-all category that captures our investments in the following: life settlements, a special purpose acquisition company (SPAC), and a private investment in the Robinhood trading platform.

Stocks (3%) – In September I opened up an account with Betterment and have set up a $500 weekly investment. What I love about this robo-advisor is not only the very low management fee but also the automated tax-loss harvesting. I’ve been reading about other bloggers building up substantial “losses” that accumulate over time, all while avoiding the “wash sale” rule. I think this will be very handy in the years to come as a way to start accumulating a tax shield for realizing future gains all while not losing any exposure to the market. I encourage you all to take a look at the white paper on tax-loss harvesting that Betterment published to learn more.

Total Projected Income in 2020: We are currently on pace to earn $1,268,797. Keep in mind that ~$415,000 of that is from a realized gain from selling the stock I owned in my previous employer. My big goal right now as it has been in previous years is to create enough momentum that we can not only match this income level but surpass it in 2021 (not an easy task with a big $415,000 hole to fill).

Total Capital Deployed in 2020:

This month was much lighter in terms of capital deployments. You’ll notice $2,000 was deployed for additional Solar and Tesla Powerwalls, which is related to improvements we are making to our new house before moving in over the next 12-15 months. Like our current house, we want to be producing our own energy from the power of the sun. I consider these particular improvements as investments as they generate a return based on the savings from eliminating our electrical bill (I estimate this return at 10-12% annually).

I also deployed $1,500 into the new Betterment account mentioned above and another $10,000 into a real estate debt fund paying 6%. The real estate debt fund has a tiered interest rate, which jumps up to 8% once over $250,000 (on the entire balance). I plan to increase my allocation to $250,000 into this fund sometime in 2021. I will share more details in a future post.

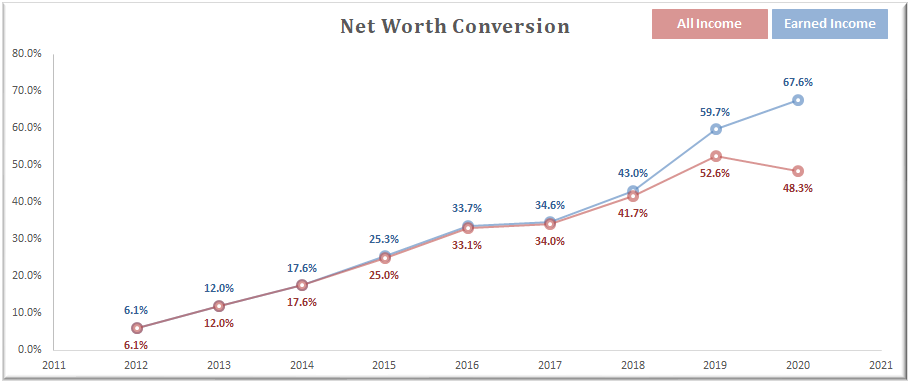

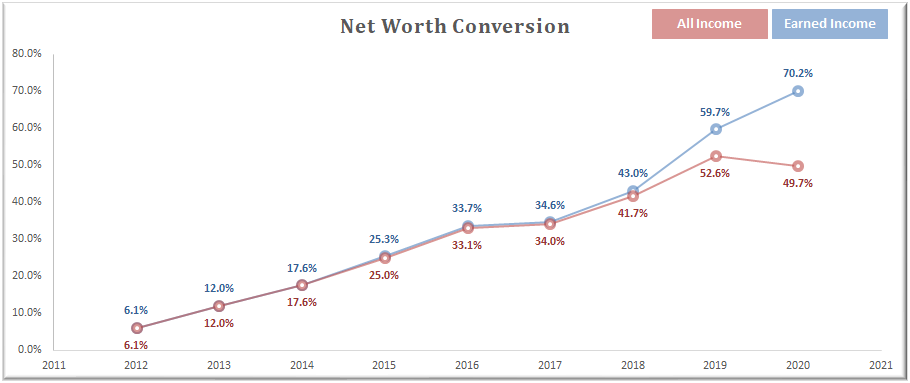

Net Worth Conversion Ratio

Definition: The Net Worth Conversion Ratio measures an earner’s ability to convert earned income into wealth (net worth). It excludes passive income since passive income is dependent on the earner’s decision of putting earned income to work or spending on consumption.

This is a new metric I will be updating and sharing monthly. Now that “the machine” is in full production, it is time to not only bring back the net worth conversion metric but to make it a star of the show. I once wrote that financial nirvana is reached once this metric exceeds 100%. When I first calculated this back in early 2016 the GYFG ratio clocked in at 25.3%. Since then we have significantly increased our savings rate and the gravitational pull of increasing both our savings rate and income helped us significantly improve the performance of this metric, which now clocks in at 70.2% (up from 67.6% last month).

You will notice that I have shared the metric based on ‘earned income’ and ‘all income’ but I’m most interested in the earned income calculation (per the definition above).

Last Month

This Month

The goal the past five years since adopting this metric was to focus on increasing our earned income while simultaneously saving at least 50% of our after-tax income in order to create excess capital for investing. I should note that I’ve excluded from the earned income calculation any income that’s derived passively from investments and more recently profit distributions from my business (I do include the W-2 income I earn as an employee of the business).

The end goal is to get to a point where net worth is 100% or greater than earned income – bonus points if you can accomplish the same thing based on all income sources. I expect our net worth conversion (blue line) to finish the year somewhere between 70% and 75%.

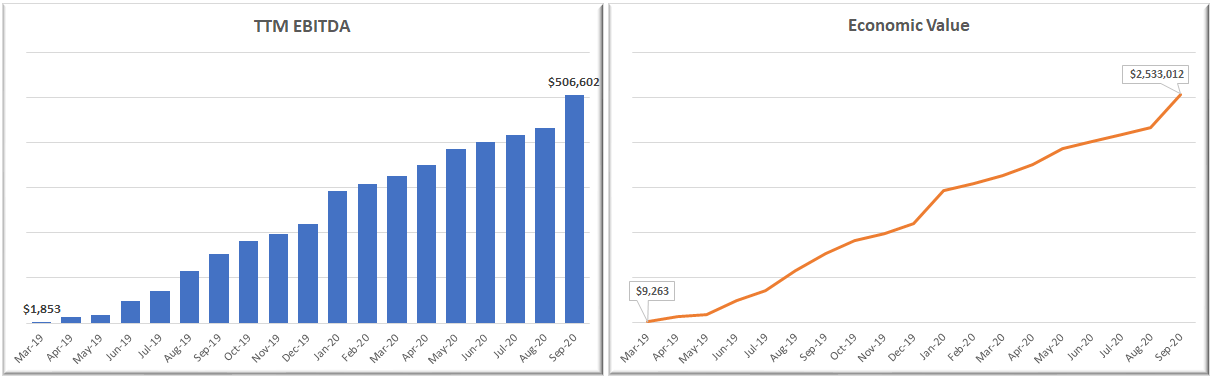

Business Spotlight – Valuation

When I set out to start this business, I did it with the clear intention of an eventual exit. I also promised myself that I would build a business and not a job. If any of you are familiar with the Cash Flow Quadrant you know that there is a big difference between being an “S” (Self-Employed) and being a “B” (Business Owner). I’m currently straddling both quadrants, trying my hardest to make the final leap into the “B” quadrant.

Ideally, you want all of your income to come from the “B” and “I” quadrant – at least that’s my goal. In order to fully transition from the “S” to the “B” quadrant, I have to continue investing in the “system” (people, technology, training, and SOPs) that will allow the business to run without me. That important to me for two reasons:

(1) Time Freedom – in the “S” quadrant you are still trading time for dollars. You may have gained some leverage by hiring people to work for you but at this stage, the business could not survive long without you working in it vs. on it. It’s not an easy transition and a lot of companies fail to make the full transition.

(2) Valuation – it’s really hard to sell a business that is heavily reliant on the owner if you can sell it at all. If I can’t get the business to a place where it isn’t “the Dom show” it won’t be worth much to someone else. Since I started this business with the intention of an exit, this is a very critical transition to make in order to achieve my valuation goals.

I want to dive into valuation a little deeper this month. I know I’ve noted that my net worth is probably overstated due to the value of my business, but I’m sure some of you are scratching your head wondering how I determine the value of the business. First, I need to warn you that any value I share is really an estimate based on an assumption of what I think we could potentially get, based on my experience with M&As in the Corporate world.

Prior to leaving the comforts of fulltime employment, I had the opportunity to be involved with about a dozen M&A transactions over my career. There were two main methods we used for determining the value of a company we were interested in acquiring:

Multiple of EBITDA – For those not familiar with the term, EBITDA stands for Earnings Before Interest, Tax, Depreciation, and Amortization. This is the method I have the most experience with and is the method in which I value my own business. In the transactions I’ve been involved with, we regularly were willing to pay 4-7X EBITDA. We were looking for companies with $5M to $20M a year in revenue, with minimum EBITDA margins of 25% to 50%. There are certain characteristics that were required to get the high end of the range. With this method, the buyer is willing to pay you x times your EBITDA (typically on a TTM basis).

Multiple of Revenue – This method is strictly a multiple of revenue. I’m not a fan of this one as it doesn’t contemplate the quality (i.e., profitability) of that revenue.

I’ve personally been valuing my company based on the multiple of EBITDA methodology using an assumption/target of 5X.

Our TTM EBITDA at the end of September was $506,606 implying a $2,533,012 valuation based on my assumed 5X multiple. That being said, there is no guarantee that I can get a 5X multiple, and right now I couldn’t command that because there is still too much dependent on me. I think the sweet spot (once I extract myself from the day to day) is $10M in topline with a $3.5M to $5M bottom line (we are currently running a 41% EBITDA margin). This would place the value of my company at $17.5M to $25M with a 5X multiple.

Closing Thoughts

I feel like I’m on the last leg of an ultra-marathon and the finish line (vacation + beach house) is so close I can see finally see it up ahead. I’m looking forward to no email, no phone, really no communication on anything work/business-related for the first full week of November. Mrs. GYFG is looking forward to the same. It will take us a couple of days to really relax and come down from the grind.

Fortitudine Vincimus — “by endurance we conquer.”

– Gen Y Finance Guy

2 Responses

“Fun is important.” – Barney Ross, Expendables 3

Fun is coming to the family GYFG soon, you can endure!

One question regarding business/value…not prying and please delete the question if it might impact in the wrong way…is the possibility for selling a percentage (or all) of the business back to your prior company still an option? Just thinking of ways you can remove some risk, receive a present benefit that might help with future real estate acquisition/domicile, and allow you to consult with more time for fam and self-care, if you know what I mean and I think you do.;-)

Hey JayCeezy – you never have to filter your questions with me.

I think it is still an option but it has become a little more complicated now that my former employer is also a client (a fairly large one).

That said, we only become interesting to them as an acquisition if we are doing at least $5M in topline.

Dom