This is report number 51 of a potential 240 as I document my journey to a $10M net worth – only 189 reports to go! As we sprint towards our goal of paying the mortgage off by July of this year, I’ve been thinking about how this report ought to evolve. The obvious change will be to remove the section that tracks our progress towards paying off the mortgage. I’m not sure what to replace it with. Maybe I don’t replace it with anything and the report just gets a tad smaller. I welcome your thoughts in the comments below.

It’s hard to fathom that Q1 is already in the rearview mirror. Where does the time go?

Without the benefit of a calendar, I would have a hard time telling you what I did this past quarter. As I look back on the calendar the events that stand out are as follows:

(1) Mountain Trip – At the beginning of the month we took Baby GYFG up to Big Bear for his first snow trip. He is a little too young to understand the concept of snow but it was a fun milestone nonetheless. We stayed at a the cabin of a family friend with my in-laws for the weekend where we enjoyed good food, great company, and plenty of time reading by the fire (we are all readers).

(2) Hosted Friends – We had friends over the second and third weekends in March. As we live and die by our calendars, these were dates booked months ago to ensure we continue to see friends, even if it is only every couple of months.

(3) Santa Barbara – During the fourth weekend of the month we headed to Santa Barbara to visit my Aunt and Uncle who just settled into their new house there. We enjoyed their incredible ocean view and went on an amazing hike. The theme for the weekend turned out to be “cheese.” Unintentionally, every dish we ate had cheese (homemade lasagna & quiche were the two standout stars). Before heading home we also had the opportunity to meet up with The Money Commando and his family for a lunchtime BBQ. We spent three hours together and if we didn’t have to drive could have hung around for much longer – good peeps! (Believe it or not we only spent something like five minutes talking about personal finance.)

(4) Met Hailey – During the last weekend of the month (yes, there were five weekends in March) we got to meet the newest addition to our friends’ family. Hailey is two and a half months old. She looked so tiny next to Baby GYFG, who is now five months old. It really put into perspective how much our little man has grown.

The only other thing of note that happened in March is that I officially started the new business (consulting) I had been alluding to the past couple of months. For now, it is just a side hustle but we already have two paying clients with a total gross revenue of $69,000 combined. That is not all revenue I will get to keep as I am contracting a good amount of the work out. My initial estimate is that I will net about 30-40% on client engagements and will only be doing about 10% of the actual work. More details to come as the money starts flowing in.

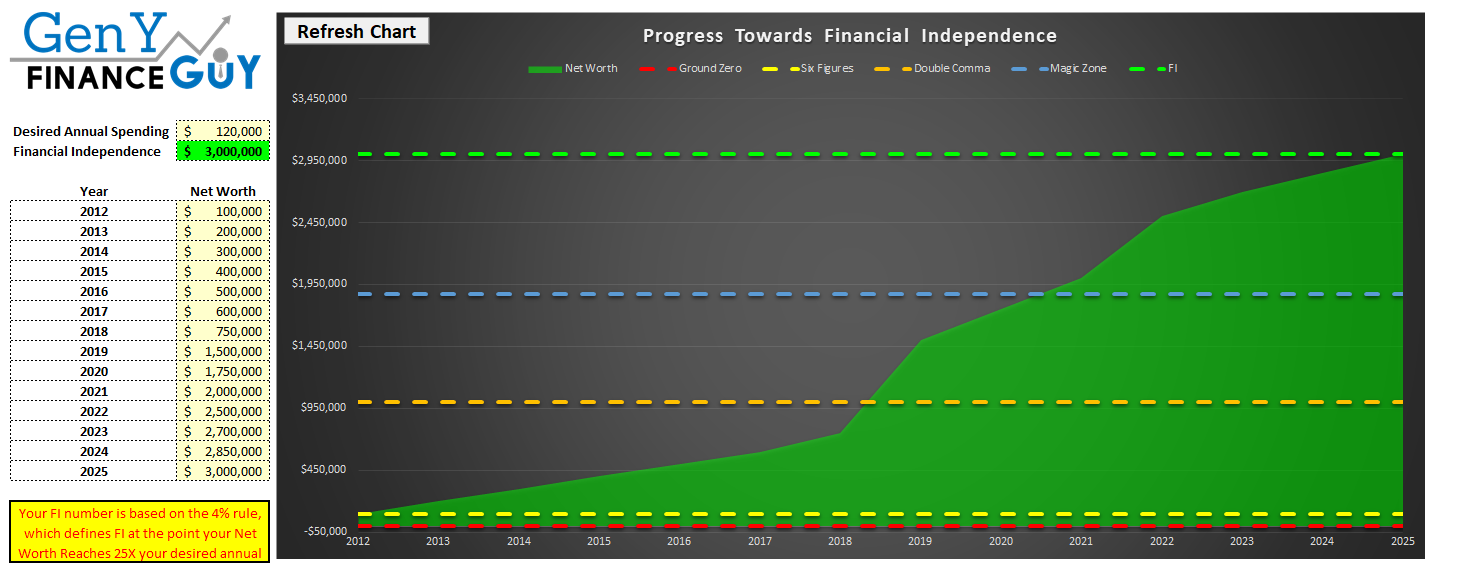

In March we officially hit 11% completion on the path to a $10M net worth.

With that, let’s dive into the nuts and bolts.

If you’re a regular reader and only want to read the new content, feel free to just skip the intro below, and head to Net Worth. If you are new or haven’t read many of these reports, I encourage you to take two minutes to read the intro below, which does change periodically.

Why I Share These Monthly Reports

Mission Statement: To Humanize Finance, Build Wealth, and Reach Financial Freedom.

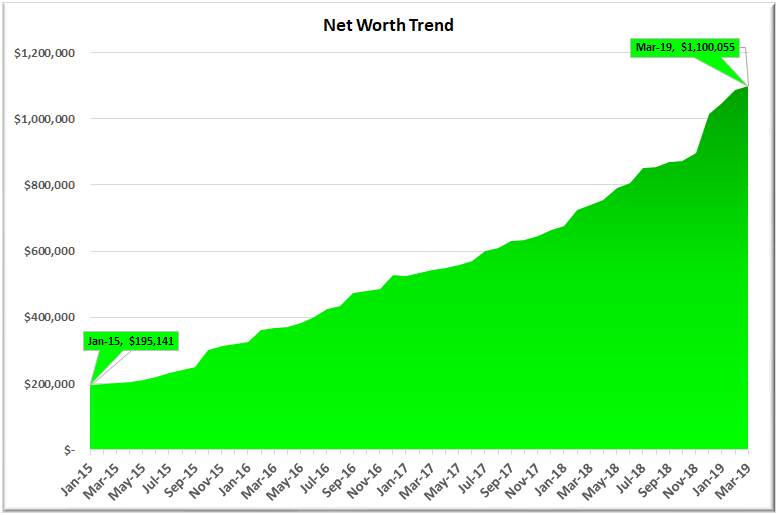

For those of you new around this corner of the internet, these monthly reports are about full transparency. And, they are just as much for me as they are for you. It was a hard decision to make all of my financial details public, but it has proved to be a very motivating one. The process I go through every month to produce these reports has been enlightening and life-changing. I published my first “income and net worth report” for January of 2015 when our net worth was only $195,141, and our gross income was on pace to hit $178,000 that year.

A little over four years later, our net worth currently clocks in at $1,100,055 with a gross income over the trailing twelve months of $453,875 (peaked at $475,914 in January 2019).

- That’s a 5.6X increase in net worth due to a compound annual growth rate of nearly 50% for the past four years.

- At the same time, income has increased 2.6X, which translates to a compound annual growth rate of roughly 27%.

Honestly, I don’t think the GYFG household would have experienced these kinds of results without the existence of this blog and the accountability it brings. Knowing that I will share our results with you readers every month keeps me very focused and intentional with all things related to our financial well being. For that, I THANK YOU for taking the time to read and interact with me on this blog.

Above and beyond this benefit to my own household, my sincere hope is that my policy of full transparency will inspire you to take the helm of your own financial ship and be intentional with its direction. I truly believe that anyone can reach financial freedom if he or she is willing to do things differently than the pack. If you’re after average results, then you’ve landed on the wrong site. There’s nothing wrong with average, but the kind of results I preach are EXTRAORDINARY. Sure, the “get rich slow” method is proven, but there is an alternative, which is to “get rich fast.” Look, I have no interest in living like a starving college student until I am old and brittle to only then have the means to check off bucket-list items when my body might no longer be physically capable of doing them. And I don’t want that for you either!

Here at GYFG, we approach the pursuit of FINANCIAL FREEDOM with an abundance mindset, so you won’t hear me telling you to cut out those $5 lattes. Choose to spend on what is meaningful to you. I spend a lot, but I also strategically earn a lot, save a lot and invest a lot.

I hope these reports inspire and move you to action. Don’t take a passive role in your finances and hope for the best. Keep this famous Jim Rohn quote in mind:

“If you don’t plan your future, somebody else will. And you know what they have planned for you? NOT MUCH!”

You must be intentional with your finances if you ever want a fighting chance to make it to financial freedom. But it does not have to take 40-50 years of slaving away for The Man before you have the option to retire. I think 10-20 years is all you need, with the most aggressive folks probably able to reach financial freedom in 10 years or less. A high income paired with a high savings rate are two of the vital components of a good recipe for the 10-year track.

I know I don’t have to publish my juicy details every month, but it’s important to me that you know that I put my money where my mouth is (not so many people giving financial advice actually do this). I publish all of my financial details not to brag, but instead to show you what is working as well as what’s not working. Sometimes finance can get pretty dense, and I think real life examples and numbers can help slice through the complexities (and BS). Personally, I have always enjoyed the financial reports put out by other bloggers around the blogosphere, so I have always intended to share my own.

You can find all my previous reports on the Financial Stats page.

Net Worth

Our net worth was up $13,179 or 1.2% vs. February. I was stoked to get over $1.1M and mark another notch off our progress to $10M at 11% complete. Year to date our net worth is up $87,191 or 8.6% vs. December 2018. And if you look year over year our net worth is up $361,338 or 48.9% vs. March 2018. The music continues to play and the party continues…

March Net Worth $1,100,055 (up $87,191 or +8.6% for 2019)

- Previous month: $1,086,876

- Difference: +$13,179

Net Worth Break Down (MoM):

The majority of the gain in net worth this month was driven by debt pay-down on the mortgage, which was funded from my year-end bonus that was paid out this month.

The Real Estate ($597,143) category increased from 49% to 54%. This category includes the equity in our primary residence ($423,896), our investment in the Rich Uncles commercial REIT ($68,227), and our hard money loans through the PeerStreet ($105,021) platform. I have been taking capital as it’s freed up from our after-tax PeerStreet account and using it to fund Rich Uncles as we work the RU account value up to $100,000 (which is why the PeerStreet value hasn’t been changing much MoM).

The Real Estate ($597,143) category increased from 49% to 54%. This category includes the equity in our primary residence ($423,896), our investment in the Rich Uncles commercial REIT ($68,227), and our hard money loans through the PeerStreet ($105,021) platform. I have been taking capital as it’s freed up from our after-tax PeerStreet account and using it to fund Rich Uncles as we work the RU account value up to $100,000 (which is why the PeerStreet value hasn’t been changing much MoM).

Net Cash ($36,595) remained flat at 3%. We actually have $47,032 in cash but net cash is only $36,595 after you adjust for our current credit card balance of $10,437, which we pay in full every month based on the statement due date. I started traveling again in January, so this will fluctuate a lot more going forward.

The Business ($234,962) category decreased from 22% to 21%. This represents the ownership I have in the private company that I work for. This is an illiquid investment that only gets an update to its value one time per year. I net the company stock asset value of $446,962 against the company stock loan of -$212,000 to arrive at the $234,962.

Life Settlements ($85,446) remained flat at 8%. We currently have investments in seven policies at $10,000 each. They are accreting in value by about $1,000 per month. For anyone that is familiar with options, I liken the fixed return of life settlements to the theta of a short option. In this case, the accreted value is like the theta decay of an option you’ve sold. In more simple terms, with this fixed return you are amortizing (realizing) that value with the passing of time.

The Stocks ($140,909) category decreased from 17% to 13% and represents the cumulative value of our brokerage accounts (all retirement accounts) that are invested in stocks. However, this is not all of our retirement money, as the majority of our PeerStreet investments are made through a self-directed IRA (worth about $80,000 and are counted in the Real Estate category of the pie chart). I know this isn’t going to be popular with the PF crowd but we took a $50,000 loan against my 401K and applied it against the mortgage to ensure we hit our goal of a July 2019 payoff. We were up 13% YTD after the market had its best quarter in some time. That paired with the fact that stocks are once again near all-time-highs with the yield curve inverted made us a bit nervous about the outlook for stocks over the next 18-months.

The Cars ($5,000) category remained flat at 1%. This is the last month that cars will show up in our net worth total! I had previously kept this as a part of our net worth in order to make sure we were not sinking too much of our net worth into the machines that get us from point A to point B. I did mention that we recently bought a Suburban and financed the entire amount and will likely keep it financed for the foreseeable future. In total cars make up less than 1% of our net worth and our net worth has grown to a value that makes the value of our cars immaterial to our overall wealth.

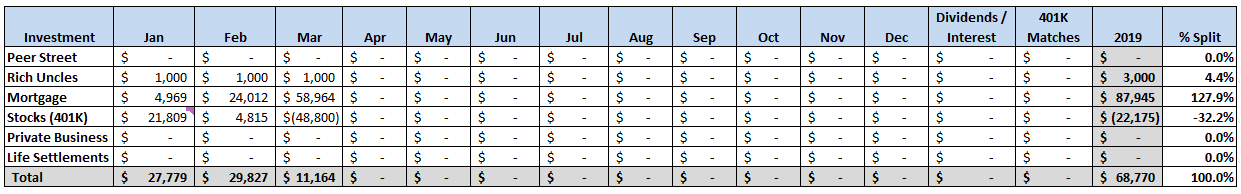

Total Capital Deployed in 2019:

I anticipate deploying about $182,000 in new capital this year (of which 38% has already been deployed). Although healthy, this is down significantly from the $414,692 that we were able to deploy in 2018. Going forward I expect there to be a lot more month-to-month variability in the capital deployed. About 65% of the total deployed this year will go towards putting the mortgage to bed this year (we only have $40,000 remaining on the mortgage).

You can see that I deducted the $50,000 from the stocks category due to the 401K loan that I took to apply against the mortgage. I know it’s not a popular move but it makes sense to us given our goal of paying off the mortgage and the current environment. Based on our cash flow we can have the 401K loan paid back by the end of 2019, but the speed at which we pay it back will depend on what the market does. It’s technically a five-year loan but I seriously doubt we will take that long to pay it off. In the meantime, we will be paying ourselves interest at a rate of 6.5%.

Gross Income

Income for the month of March was $26,324 vs. $59,020 in February. On a cumulative basis, we have earned $112,866 through March of 2019. We are currently behind where we were at this time last year when Q1 income was $134,737. A big driver here is a slowdown in real estate, which has translated to no commissions for Mrs. GYFG (accounted for $5,000 to $8,000 a month in compensation last year). This could be another warning sign of an eventual recession – only time will tell.

In the second chart above, I also track our income on a trailing twelve months, and as expected the TTM dipped further to $453,875. That now puts us $22,039 off pace of the all-time high of $475,914 set in January 2019.

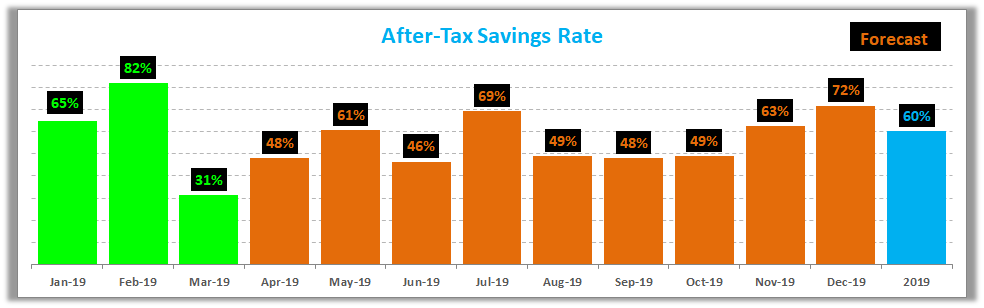

Savings Rate

Below is how we actually did vs. our goal of saving 50% of our after-tax income. In the chart below, the green bars represent our actual savings rate for the month, the orange bars are what we anticipate based on our 2019 budget, and the blue bar is the projected savings rate for all of 2019.

March is a little misleading in that it is artificially low due to the timing of some reimbursements in travel expenses for work. At the end of March, I had almost $3,000 in expenses that hit the GYFG P&L and no offsetting reimbursement. Accordingly, I expect April to be higher than the 48% shown below.

Do you want to calculate your own savings rate? I’ve made it super easy for you with the savings rate calculator included in the free GYFG FI Toolkit that you can download instantly by clicking the link below. Here’s a peek below. Did I mention it’s free? You have nothing to lose and everything to gain, Freedom Fighter!!!

Speaking of savings rate, go check out my post where I mathematically prove the importance of your savings rate as a higher priority in achieving financial independence than your compound return! If you’re trying to build wealth quickly, then you have to read this post.

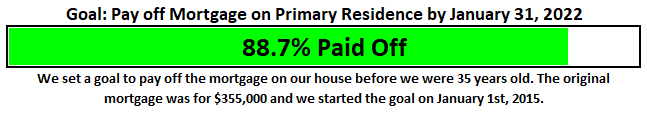

Mortgage Early Payoff Goal

After several refinances, our mortgage is a 3/1 ARM at 2.25% and we currently owe $40,000. We had originally set a goal to pay it off in seven years and three months but recently accelerated that timeline by a few years. In the progress bar below you will notice that we were originally working towards a goal completion date of 1/31/2022, but are now aiming to have this goal completed by 7/31/19.

For the past few years, I have been writing about the desire to avoid concentration risk and ensure diversification, and therefore not rush to pay off our mortgage. But in June 2018 we decided to go after this goal hard and fast. Why the change of heart? The first major driver is the fact that our income has grown far faster than we had ever imagined in our wildest dreams. Based on the 20-year plan I shared on the blog back in 2015, our income wasn’t projected to hit current levels until 2031 – that puts us 11 years ahead of schedule.

Secondly, prior to the 2018 tax reform, the tax benefit we received from being able to deduct the interest and property taxes was already minimal. And now, under the new reform, there is zero tax benefit (due to SALT limit and the increased standard deduction to $24,000 for a married couple which is greater than our itemized deductions). I still don’t understand how anyone could be dogmatic about keeping a mortgage for the tax deduction, which is worthless under the new tax reform for most households across the USA.

Moreover, why would you spend a dollar on interest to get thirty cents back? Why not pay zero interest and keep 70 cents out of each dollar that you don’t have to pay towards interest? Our lightbulb moment came when we realized that we could get this pay-off accomplished in about a year, which became very motivating once Baby GYFG arrived. This gives us a very strong financial foundation from which to spring into our next phase of life, and wealth-building.

This acceleration means that the equity value in our home will be growing rapidly over the next six months, as will the percentage of our net worth concentration tied up in this asset. It currently makes up 38.5% of our net worth (up from 33.5% last month), and I anticipate it will make up as much as 35-45% of our net worth between now and July of 2019.

LESS THAN FOUR MONTHS TO GO!!!

The original philosophy of this plan to pay off the mortgage was to accomplish this goal while avoiding any austerity to our lifestyle. I coined it the “pay more tomorrow” plan. In keeping with the GYFG emphasis on the income side of our financial equation, I projected that we could easily increase our income (after tax) by at least $9,600/year and dedicate that additional income to fund the goal effortlessly. This has proved to be not only true but also very conservative. To date, we have paid down the mortgage by $315,000 in four years (and three months). It’s crazy to think that we will be mortgage-free a little less than five years from setting this goal.

This goal is now 88.7% complete (vs. 75.7% in February)!

Closing Thoughts

Is this real life?

Things have been so good for so long that it’s hard to imagine what struggle is like. Don’t get me wrong, I’ve had plenty of struggle in my life. I did grow up poor, on welfare, and with drug addicted parents, after all. I don’t ever want to forget where I came from or fail to realize how incredibly lucky we are to be in our current financial position. I remember the hard times, to be sure, but life is so good now, all that seems very far back in the rear view mirror.

As mentioned last month, I plan to leave autopilot on until the mortgage is paid off before becoming a bit more active in managing our personal finances. I will admit that I have been dabbling in a little due diligence on the rental real estate front. To that end, I’ve created a financial model to evaluate potential investments and starting talking to a seasoned real estate investor (who is also an agent).

I did start waking up at 5 AM again in March. I decided to start working out in the morning, a habit I had abandoned the past couple of years while recovering from my back injury (and prioritizing work over working out). I’ve mostly been swimming in the morning and it’s such a great way to start the day.

I hope you had a magnificent March, too!

– Gen Y Finance Guy

12 Responses

So you are borrowing pre-tax money and repaying with post tax money to pay back a low interest rate loan? Could you help me understand your thinking around that strategy or am I misunderstanding the product?

Black Raven,

You understand the mechanics as described. The loan itself is a wash, its the interest that is paid back with post-tax money and will be taxed again at ordinary income rates some day.

The interest is to me and over the duration of this loan, will be immaterial to the overall big picture. I have always viewed a paid off mortgage as a bond substitute and so this is more like a rebalancing move in the short term.

If stocks were not at all time highs I would not have taken this loan.

When you say the loan is a wash, isn’t a 401k contribution pre-tax money, so your AGI is lower when you pay taxes for the year, and then you pay back that loan with post tax dollars, meaning it costs you 1.25-1.30x your initially invested amount (making a simple assumption on your tax rate at 25-30%) just to get that money back into your account? Additionally, you are taxed again when you withdraw the money in retirement.

And why do stocks at all time highs have an impact on whether or not you take a loan against your portfolio? Are you arguing that you want to buy back shares at a lower cost when you repay the loan (assuming they fall between now and then)? But, again, would have to be a 25-30% decline just to break even, right?

And what is the purpose of a short term rebalance if you just repay the loan with future cash flow and end up in the same position, just slightly later than in this scenario?

Just trying to understand an alternative view point on this.

Nevermind, answered my own question on the loan, simply the fact that you are swapping one post-tax repayment for the other. Understand the argument on the strategy now, very interesting if the market does indeed correct.

Fun back and forth on the interest rate arb strategy here.

Dom, good luck with the new consulting gig!

Another excellent month. Keep it moving.

Thanks, Church!

Hey Black Raven,

Yes, you are correct, I’m swapping one post-tax repayment (mortgage) with another (401K loan). The loan has a 60-month term, and if we were to hold the loan for that term the interest is around $8,500. This is the amount that is double taxed.

I don’t know if the market will correct or not but the good news is that I have a mechanism to deploy capital slower or faster depending on what the market does. My grandfather always said that a bird in the hand was worth two in the bush. Since stocks were up so much, we thought it was a good opportunity to ensure that our house was paid off vs. the uncertainty of what the market might do in the short term especially in light of the possibility that my wife decided to stay at home later this year.

Worst case, the market doesn’t correct and we miss out on a little upside. The freed up cash flow we will have going forward will be $100K+ a year that we will no longer be throwing at the mortgage.

“Children are like f*rts…people only enjoy their own!” – James Mullinger

Kidding, Dom! For some reason, that joke popped into my mind and I couldn’t hold it in.

Congrats on already showing Baby GYFG the networking ropes with Baby Hailey. Alpha Generation already on the move. Also liking the consulting side-gig, that is a significant revenue stream! Swimming is so great, especially for men’s bodies. Mrs. GYFG will be appreciating your hard work come summertime and jacuzzi-season.

LOL!

The consulting business is exceeding all my expectations. I plan to write a post on this but I turned down the opportunity to take a seven-figure investment to grow the very business I decided to start on my own. If I were to have taken the investment I would have given up 80%+ of the upside and under tremendous pressure to grow rapidly, which would have severely eaten into the family life I have so aggressively carved out.

I decided that the business was built around my relationships and expertise, so, why not keep 100% and just grow it slowly and into a lifestyle business. At some point I plan to exit the company I currently work for and this is a great opportunity to set up the next act. Since writing this post my consulting income has grown to $180K. I have actually had to turn down a few jobs due to lack of resources and not wanting to work 100 hour weeks. This has taken a lot of restraint on my part. More to come as this develops and unfolds.

I think this business has the potential to be a seven-figure lifestyle business.

Dom

Ouch on taking a loan from your 401K to pay off the mortgage and a return ouch on paying back that loan. Certainly, not a wash.

Expecting a market crash?

An example of what happens when we get obsessed by our goals. We can lose our minds and common sense. Best to talk it over with many people, advisors before making decisions like this to keep oneself going off the deep end.

Carving goals in stone can be fraught with danger. Be flexible and wise to allow oneself to move goals maybe comes with age.

Enjoy marking off the goal.

Impressive feat to be so close in paying off your mortgage. I plan to re-finance the mortgage on my primary home given the low mortgage rate to a 30 year loan. I guess that means I will need to continue to pay my mortgage for the next 30 years if I stick to the schedule.

Hopefully, the good times will continue although some of the Wall Street talking heads are forecasting a recession in 2020.

Nice job on already achieving a 6 figure revenue stream from your consulting business in such a short period of time. I am interested in your future post about the consulting business.

It was great to meet you, Mrs. GYFG, and Baby GYFG. We’d love to have you over again the next time you’re in town. And next time I’ll skip breakfast so I can try to keep up with you on crushing the trip-tip!